Policy brief: Back to the future — Nebraska under a spending cap

Nebraska’s schools would be much poorer, its roads bumpier and its property taxes significantly higher if the state had to live for the past three decades under the kind of rigid spending limits that have been discussed around the state of late.

In 1998 and again in 2006, Nebraskans overwhelmingly voted to reject state spending lids that would have led to significant cuts to education and increased property taxes. Around the same time, our neighbors in Colorado passed spending limits, only to later suspend them after they led to damaging cuts to education and roads.

The idea of spending lids has resurfaced in Nebraska lately as the state considers changes to its tax code.

To get a clearer picture of the consequences of such a move, we looked back at what would have happened had state spending growth been limited to 3 percent[1] over the past 30 years. Our research shows that – as was the case in Colorado — such a measure would have forced dramatic cuts to K-12 funding and other key services, as well as requiring significantly higher property taxes.

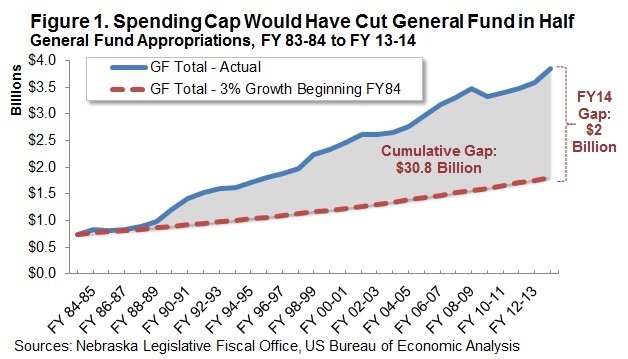

Spending would not have kept up with economy

In the past 30 years, Nebraska’s economy has grown about 5.2 percent annually and the cost of providing services increased by about the same amount.

If spending growth had been capped at 3 percent during this period, state spending would not have kept up with the economy, and the amount of money the state had to fund essential services would have continuously lagged.

That would have created an ever-widening gap between the money needed and the money available to support schools, roads and other vital services.

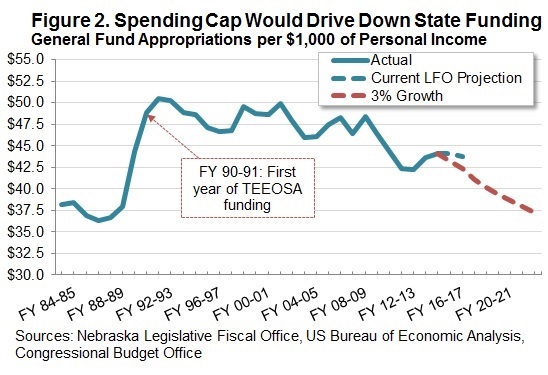

General Fund would be cut in half

Capping spending growth at 3 percent during the past 30 years would have slashed the state’s General Fund, which supports services Nebraskans need, by more than 50 percent. (Figure 1). That means the fund would be $2 billion smaller than it is now. To put that number in perspective, it is more than the state’s K-12 and higher education budgets combined. [2]

A massive hit to K-12 funding

Under a spending lid, the state’s fiscal year 2014 budget for K-12 education – a key component of Nebraska’s strong economy — would be $696 million – or 61 percent – less than what it actually is.[3]

Over the entire 30 years, K-12 funding would have been reduced by $11 billion and the state wouldn’t have had enough money to create the current school funding formula that aims to provide equitable education opportunities for our state’s children while keeping property taxes down.

Replacing the lost state education funds with local property taxes would have required a 19 percent average increase in Nebraskans’ property taxes.[4]

Roads funds would have been depleted

The spending cap would have cut FY14 funding for roads and other infrastructure by $368 million[5] — a 35 percent reduction in funds used to maintain the roads and infrastructure Nebraskans use to go to work and school and that businesses use to transport their products and services.

Colorado business leaders were among the key voices in efforts to suspend that state’s spending lids and lack of roads funding was a main reason.

A 3 percent spending cap beginning with the next budget in FY16 would mean spending as a share of the economy – which has already been cut nearly 10 percent since FY09 — would plunge quickly in future years. (Figure 2)[6]

From now to FY23, spending as a share of the economy would have to be cut another 14.7 percent, about $566 million in today’s dollars.

The potential effects of spending limits remain the same as when Nebraska voters rejected them twice previously. Lawmakers’ hands would be tied in terms of providing funds for services vital to our state and its economy. Services would have to be cut or local taxes like property taxes increased to make up for insufficient state revenue.

And this squeeze would get perpetually tighter as the economy grows and spending fails to keep up. This means Nebraskans would likely experience continuous cuts to services and increases in property taxes.

Download a printable PDF of this analysis.

[1] Some local organizations have recently talked of limiting spending growth to 3 percent annually.

[2] FY14 General Fund appropriations are $1.1 billion for K-12 Education and $665 million for Higher Education.

[3] Based on a 3 percent growth scenario applied to General Fund K-12 appropriations beginning FY84.

[4] This estimate is based on 2012 rather than 2014 because 2012 is the most current year of property tax data available (Department of Revenue Property Assessment Division). The 2012 K-12 funding shortfall would have been $601 million.

[5] Includes General Fund and Cash Fund spending, mostly the Department of Roads and also Capital Construction, Public Service Commission, Aeronautics, and Motor Vehicles.

[6] Figure 1 shows raw dollar amounts with no adjustments for inflation, population, or economic growth. Figure 2 shows appropriations per $1,000 of Nebraska personal income to put spending into perspective relative to the Nebraska economy.