Policy brief – Amid budget woes, plan calls for tax cuts for the wealthy

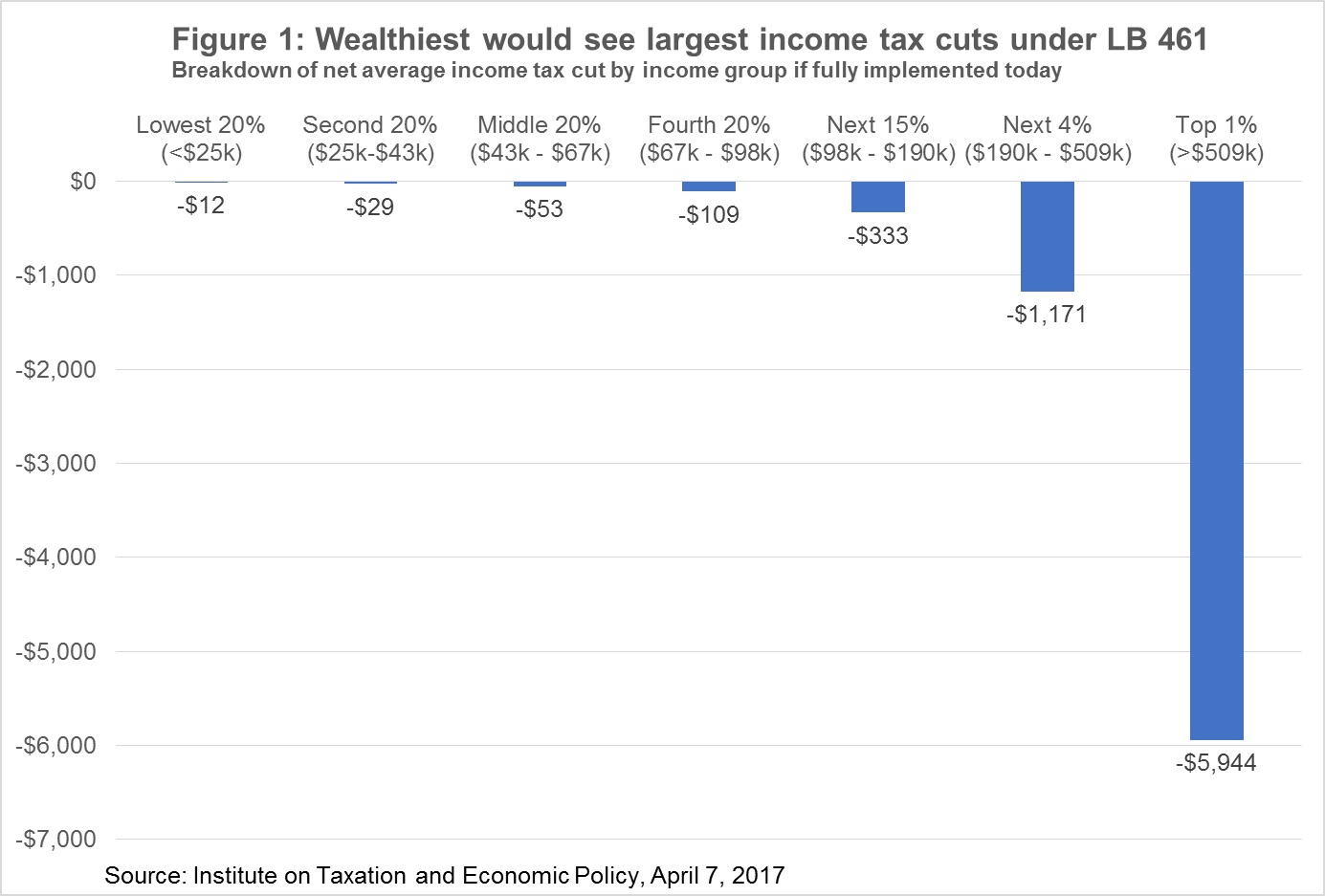

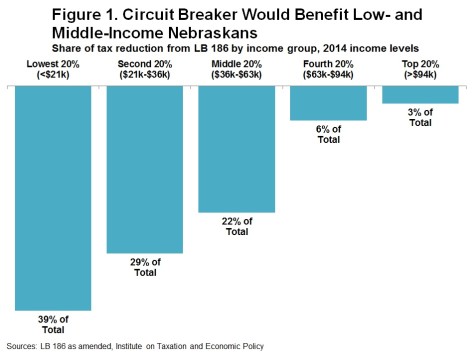

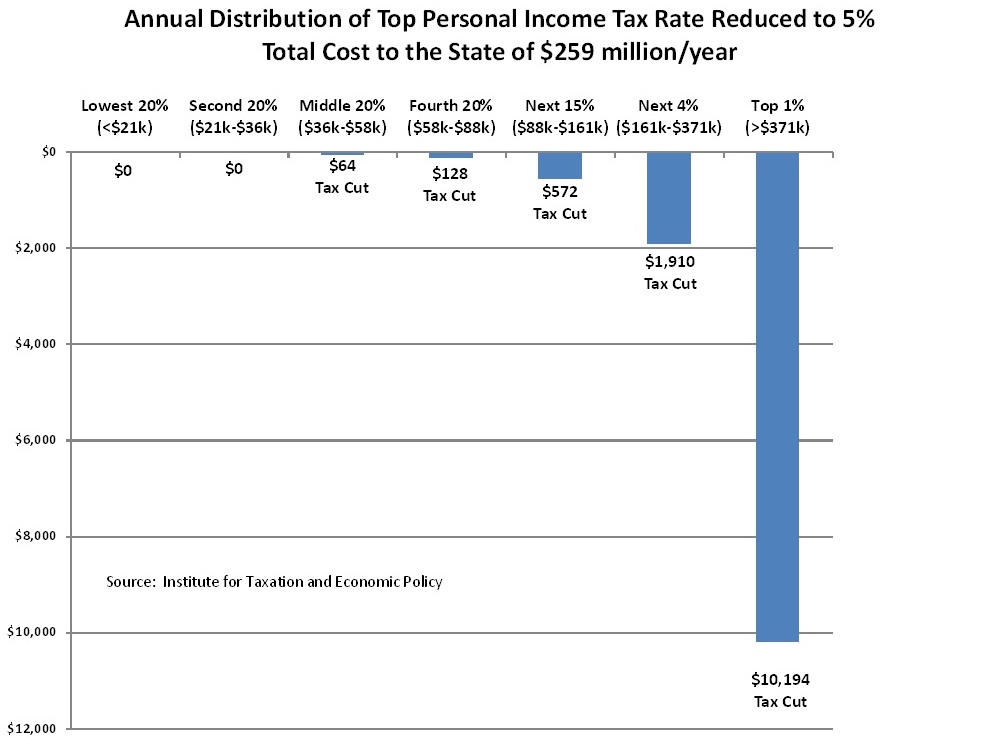

LB 461, the tax-cut package put forth by the Revenue Committee, is first and foremost an income tax cut for wealthy Nebraskans and the proposal does little to truly address property tax relief.