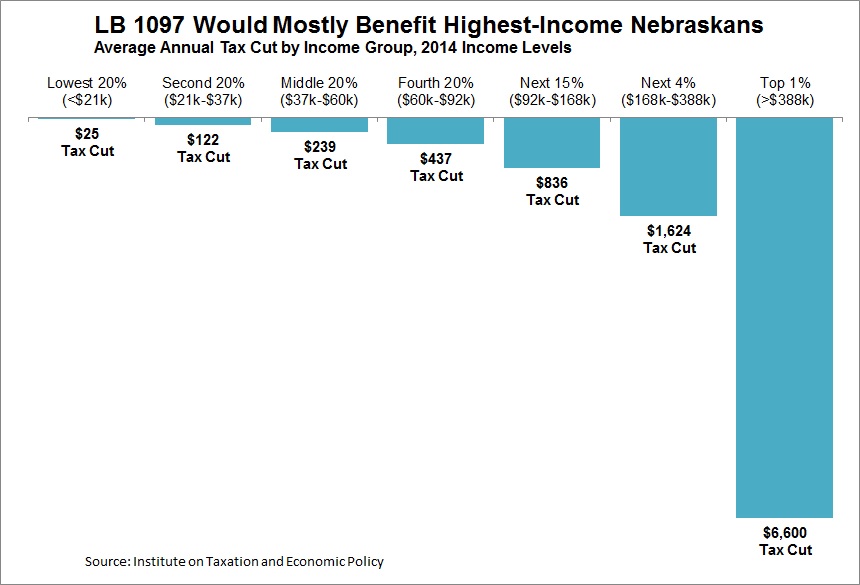

Data show middle class benefit of LB 1097 paltry compared to higher earners

While some proponents of LB 1097 – a bill to cut Nebraska’s income taxes – talk about the bill’s benefit to the state’s middle class, a look at the data shows by far the biggest beneficiaries of the cut would be the state’s highest earners. (See chart below or download a printable pdf.)

Preliminary estimates by the Institute on Taxation and Economic Policy (ITEP) show about 61 percent of the tax cut would go to the top 20 percent of earners – those who earn more than $92,000 – while just 7 percent would go to the bottom 40 percent of Nebraska earners – those who earn less than $37,000. [1]

About 31 percent of the benefit of LB 1097 will go to the top 5 percent of Nebraska earners, those who earn more than $168,00 annually. The greatest benefit of the cuts would be reserved for the state’s top 1 percent of earners – those who earn more than $388,000 annually. Nearly 16 percent of the overall tax cut will go to these earners. That means an average taxpayer in this group would receive an annual tax cut of about $6,600 – or about $550 a month.

Meanwhile in the middle of the income spectrum – Nebraskans who earn between $37,000 and $60,000 – would receive average tax cuts of about $239 a year – or about $20 a month.

View a complete OpenSky analysis of LB 1097 and LB 721 – which are both bills before the Legislature that would cut Nebraska’s income taxes. The Legislature’s Revenue Committee will hold hearings on the bills on Thursday at 1:30 p.m. in the State Capitol, Room 1524.

NET Nebraska will stream the hearings and OpenSky will provide updates on our Twitter page.

[1] Estimates produced by the Institute on Taxation and Economic Policy upon request from OpenSky Policy Institute.