Policy brief: Gas tax and transportation funding in Nebraska

This afternoon the Legislature is scheduled to debate LB 610. The bill would increase Nebraska’s gas tax – the largest source of state revenue for transportation funding – by 6 cents, phased in by increasing 1.5 cents each year for four years.

The Department of Roads would get one-third of the increased revenue and cities and counties would each get one-third. For the Department of Roads, LB 610 would generate an additional $2.1 million in revenue in FY15-16 and $8.5 million in FY16-17. For cities and counties, the bill would generate $4.2 million in new revenue in FY15-16 and $16.9 million in FY16-17. The total new revenue from the increase would grow to more than $75 million by FY 19-20.

Gas tax losing effectiveness

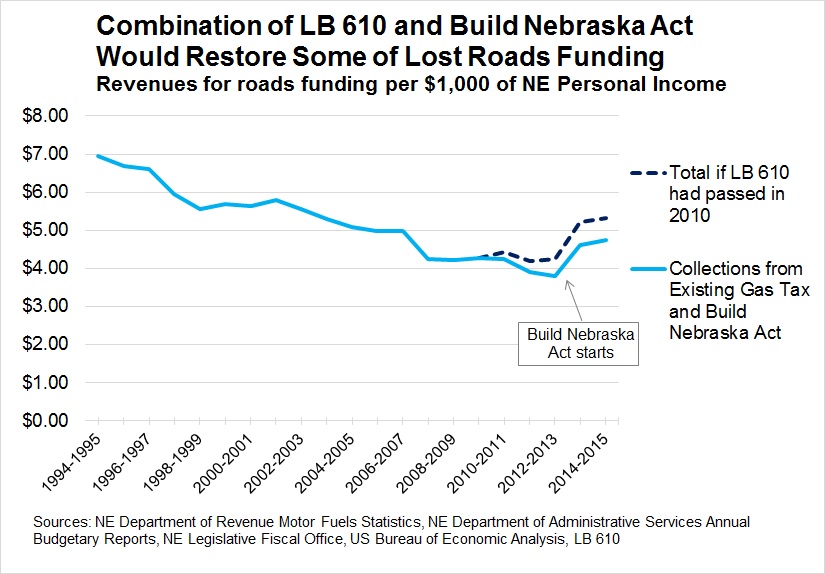

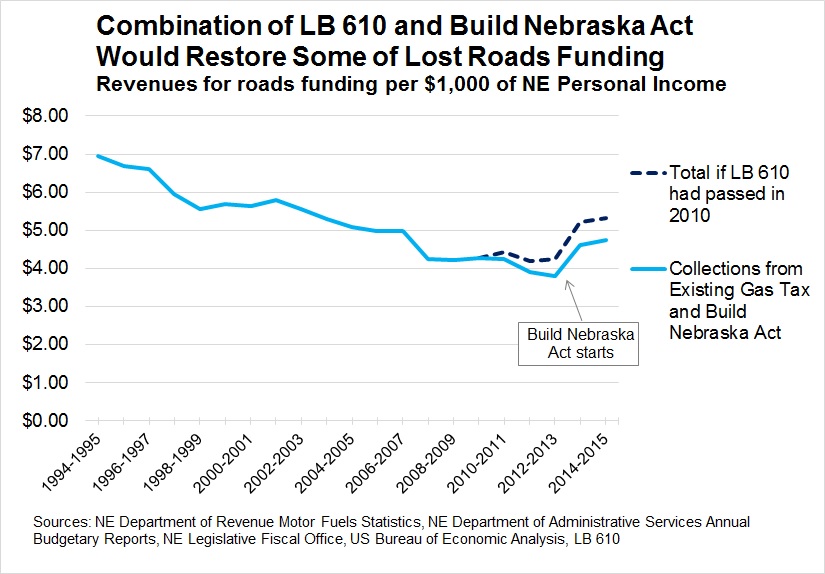

According to the Nebraska Department of Roads, Nebraska’s gas tax rate currently is 26th in the country and is below the national average. Our research shows Nebraska’s gas tax has lost buying power over the last decade, as a share of personal income (see graph). Part of the reason for this is that the gas tax rate hasn’t kept up with inflation. Another reason is that Americans drive less and use more fuel efficient cars than they have in the past.

Building and maintaining a high quality transportation network is critical to economic growth and vitality in our state. Having drivers who use our roads and bridges pay for their maintenance through the gas tax is considered good fiscal policy by a diverse group of analysts. For example:

- In 2011, the Institute on Taxation & Economic Policy (ITEP) published “Building a Better Gas Tax” in which they recommended that states looking to modernize their gas tax increase gas tax rates, restructure state gas taxes so that their rates rise automatically with inflation and create or enhance targeted tax credits for low-income families to offset the impact of gas tax reform.

- The Tax Foundation in 2014 published “Gas Taxes and User Fees Pay for Only Half of State and Local Road Spending” and wrote: “The lion’s share of transportation funding should come from user fees and user taxes such as the gas tax. Subsidizing road spending from general revenues creates pressure to increase income or sales taxes, which can be unfair to non-users…”

- Tax Policy Center published “Reforming Gas Taxes” in 2014 and wrote: “Since Americans started driving less and purchasing more fuel-efficient cars, demand for gas has declined, and states with unchanged gas tax rates have seen revenues plummet. If states want gas taxes to remain a steady source of revenue, they have to change tax rates.”

Serious roads issues need to be addressed

While Nebraska does well on some measures of transportation infrastructure quality, including ranking No. 2 nationally on overall performance of the state highway system and No. 1 for rural interstate pavement condition, recent reports have shown that we are falling behind on others. For example, a recent TRIP report found that Nebraska ranked No. 7 in the country for the highest percentage of rural bridges rated as structurally deficient. Furthermore, the Legislature’s Transportation and Telecommunications Committee released a report in December that found counties do not have adequate resources for needed bridge repairs. The report recommended that policy makers provide greater financial resources to counties specifically for bridge repairs.

We support Nebraska making smart investments in our transportation infrastructure and having those who are the greatest users of that infrastructure fund these investments. Furthermore, raising the gas tax to help fund critical transportation needs as opposed to using existing general fund dollars will prevent the state from having to reduce revenue for schools and other services to pay for transportation costs.

The Legislature may also want to consider strengthening the sustainability of this revenue source by tying the fixed portion of the gas tax to some measure of cost growth and reducing the regressivity through a targeted low-income tax credit as recommended by ITEP.

LB 610 is scheduled to be debated this afternoon at 1:30 p.m. NET Nebraska will broadcast the debate on NET 2 and stream the discussion online. OpenSky will provide updates on our Twitter page.