Policy brief: Income tax cut bills would decimate state budget, lead to cuts, property tax hikes

A pair of bills to cut income taxes would blow holes in the state budget, aren’t aimed at the middle class and are not likely to grow the economy. Furthermore, the bills — LB 1097 and LB 721 — likely would lead to higher property taxes and cuts to investments in schools and other key services.

An overview

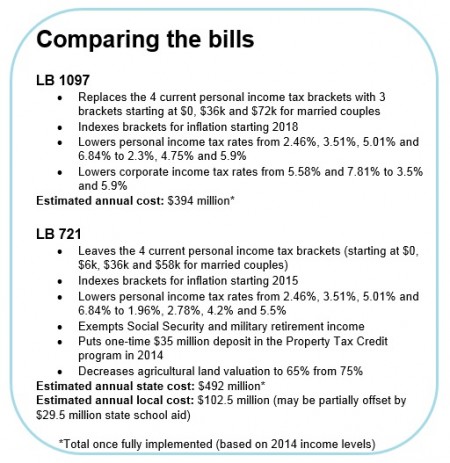

Both LB 1097 and LB 721 would cut income taxes by changing the tax brackets and lowering personal income tax rates, phased in over three to four years.

In addition to the income tax cuts, LB 721 also increases the property tax credit by $35 million in 2014 and reduces the valuation of agricultural land from 75 percent of market value to 65 percent.

Both bills cost hundreds of millions of dollars and grow increasingly expensive as they are phased in, pushing the largest costs to coming years and leaving it to future policymakers to raise taxes or cut services to address the resulting funding shortfalls.

Correlation between tax cuts and economic growth negligible

The measures have been proposed in the name of economic growth, but academic research fails to find a conclusive link between income tax cuts and economic growth.[1]

Furthermore, since Kansas enacted significant income tax cuts in 2012 under the promise of economic growth, the state has trailed four of its five neighbors – including Nebraska – in job growth.[2]

School cuts and higher property taxes likely unavoidable

The revenue loss in both bills equates to more than 10 percent of the general fund and almost certainly would force state funding cuts to K-12 schools and higher education, which likely means property tax increases and cuts in the classroom. This would particularly be the case under LB 721, which calls for lowering agricultural land valuations to 65 percent from 75 percent – a measure likely to lead to increased property taxes for most Nebraskans. [3]

LB 1097: The Details

Based on preliminary estimates by the Institute on Taxation and Economic Policy (ITEP), LB 1097 would cost the state $394 million annually once fully implemented.[4] The budget problems created by this bill would equal nearly ten percent of the General Fund and more than a third of what Nebraska invests in K-12 education. About 61 percent of the tax cut would go to the top 20 percent of earners – those who earn more than $92,000 — while just 7 percent would go to the bottom 40 percent of Nebraska earners — those who earn less than $37,000.[5]

And while Nebraskans would face the consequences of this bill as they suffer cuts to vital services, more than $100 million of the benefits of this bill would go to the federal government and non-Nebraska residents who own stock in Nebraska companies or earn income from Nebraska sources.[6]

LB 721: The Details

Based on preliminary ITEP estimates, LB721 will cost the state a total of $492 million once fully implemented, the largest portion of that cost coming from the income tax cuts called for in the bill, which would cost the state $462.5 million annually.[7] The cost of the income tax cuts is equivalent to 11.4 percent of the General Fund, or more than 40 percent of the state’s investment in K-12 education.

About 64 percent of the income tax cut would go to the top 20 percent of earners – those who earn more than $92,000 — while less than five percent of the tax cut would go to the bottom 40 percent of Nebraska earners — those who earn less than $37,000.

In addition to the income tax cuts, the lowering of agricultural land valuations would create a $102.5 million annual shortfall for school districts and other localities and likely lead to property tax increases for the vast majority of Nebraskans. This change also would cost the state $29.5 million in additional state aid to K-12 schools. If this state aid increase is fully funded by the state, it would partially offset the shortfall for schools.

LB 721 would send nearly $92 million to the federal government and non-Nebraska residents who own stock in Nebraska companies or earn income from Nebraska sources.[8] And the bill would cost an additional $35 million in the first year to increase the state’s property tax credit program.

Conclusion

Both bills would make higher property taxes and cuts to services like education and public safety unavoidable while failing to boost the economy. The bills also will deplete revenues needed to help lower property taxes, which Nebraskans have made clear is their primary concern regarding taxes.

Download a printable PDF of this analysis.

[1] Dr. McGuire: Research shows no conclusive link between taxes, economic growth, https://www.openskypolicy.org/dr-mcguire-research-shows-no-conclusive-link-between-taxes-economic-growth

[2] US Bureau of Labor Statistics

[3] OpenSky analysis of reducing agricultural land valuations to 65 percent, https://www.openskypolicy.org/higher-property-taxes-for-most-if-nebraska-lowers-agricultural-land-valuations

[4] The ITEP cost estimates reflect the cost of the bills as fully implemented based on 2014 income levels, and are therefore likely to be conservative compared to the actual cost of the bills when they are fully implemented in 2017 or 2018.

[5] Estimates produced by the Institute on Taxation and Economic Policy upon request from OpenSky Policy Institute.

[6] This includes $45 million in revenue to the federal government. Nebraskans can write off our state income taxes in their federal tax returns. Under the tax rate cut, we would have less to write off, which means the federal government would get money that would otherwise stay here. $61 million of the cut would go to out-of-state shareholders in Nebraska companies and to non-Nebraskans who earn income from Nebraska sources.

[7] Institute on Taxation and Economic Policy and LB 75 Fiscal Note. See also footnote 4 above.

[8] This includes $58 million in revenue to the federal government. $34 million of the cut would go to out-of-state shareholders in Nebraska companies and to non-Nebraskans who earn income from Nebraska sources.