Feeling the Squeeze – The Negative Effects of Eliminating Nebraska’s Inheritance Tax

If Nebraska lawmakers follow through on a proposal to eliminate the state’s inheritance tax, many counties will find it hard to keep roads safe and support businesses, and property tax increases will be highly likely in many counties, according to a report from OpenSky Policy Institute.

If counties replaced all of the lost inheritance tax revenue with higher property taxes, the average tax rate would increase by 7 percent, according to the report, “Feeling the Squeeze”. Counties are likely to consider other options, such as cutting services or tapping reserves, to make up some of this revenue loss.

“The loss of inheritance tax revenue would leave most counties with an impossible choice: slash services, deplete reserves, or raise property taxes,” said OpenSky Executive Director Renee Fry. “For many counties raising property taxes will be a last resort, but still an unavoidable option. Until the elimination of the inheritance tax can be studied in the larger context of tax reform, the better choice for preserving Nebraska’s future is to keep the inheritance tax, a proven source of funds to meet important needs.”

Click here to download a copy of the Feeling the Squeeze. To be the first to hear about OpenSky’s work, click here to join our email list.

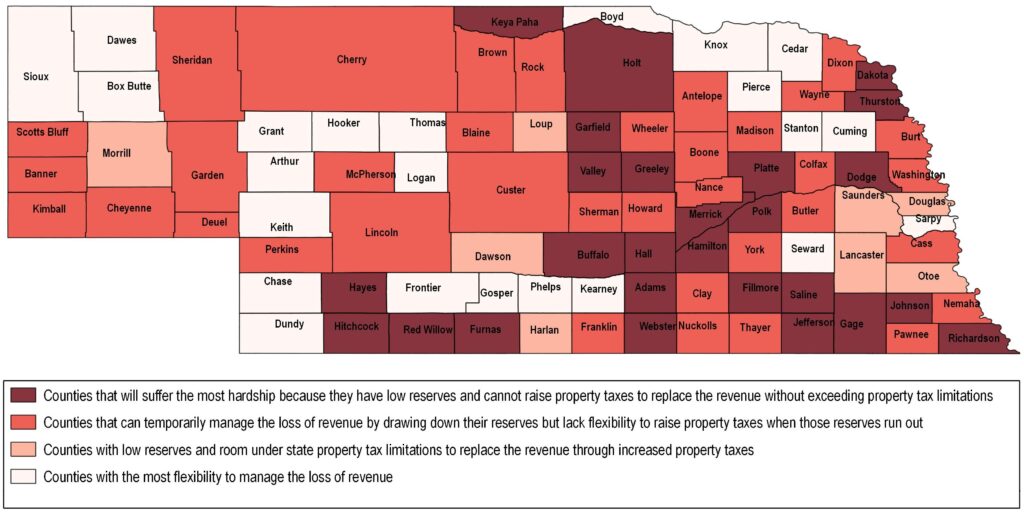

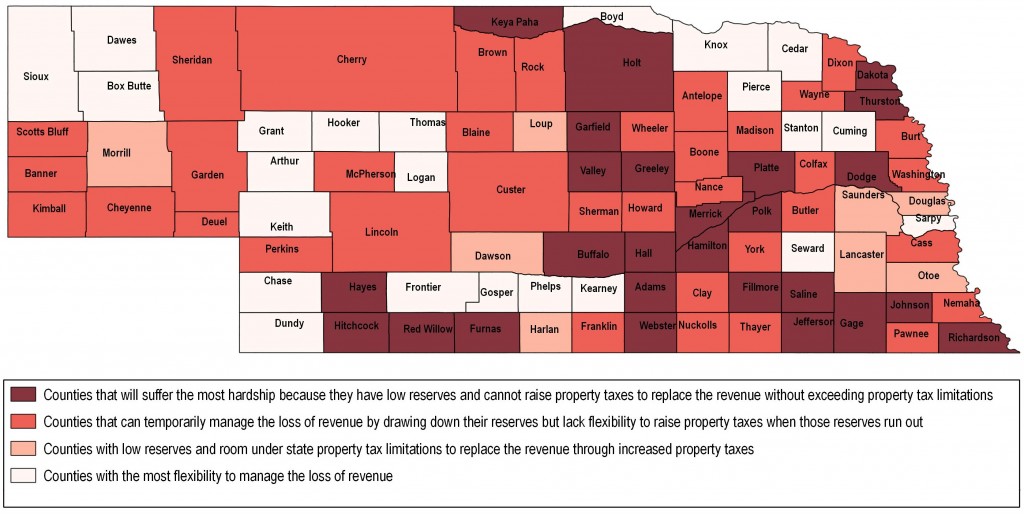

Nebraska’s counties fall into four broad categories in their ability to manage the loss of inheritance tax revenues:

Counties that will suffer the most hardship because they have low reserves and cannot raise property taxes without exceeding property tax limitations.

These counties, roughly 26 in all, are the most likely to slash services or ask local taxpayers to vote to raise property taxes beyond existing limitations. On average, they have less than two years worth of reserve funding, though many have less than that.

These counties are Adams, Buffalo, Dakota, Dodge, Fillmore, Furnas, Gage, Garfield, Greeley, Hall, Hamilton, Hayes, Hitchcock, Holt, Jefferson, Johnson, Keya Paha, Merrick, Platte, Polk, Red Willow, Richardson, Saline, Thurston, Valley, and Webster.

Counties that can temporarily manage the loss of revenue by using their reserves but lack flexibility to raise property taxes when those reserves run out.

These 36 counties could potentially replace inheritance tax revenues by tapping their reserves for at least three years, but would then be in the same pinch as the counties in the previous category.

Moreover, the apparently large reserves in many of these counties may be an illusion; for example if the money is being saved for a badly needed project that cannot be ignored.

The counties in this category are Antelope, Banner, Blaine, Boone, Brown, Butler, Burt, Cass, Cherry, Cheyenne, Clay, Colfax, Custer, Deuel, Dixon, Franklin, Garden, Howard, Kimball, Lincoln, Madison, McPherson, Nance, Nemaha, Nuckolls, Pawnee, Perkins, Rock, Scotts Bluff, Sheridan, Sherman, Thayer, Washington, Wayne, Wheeler, and York.

Counties with low reserves and room under state property tax limitations to replace the revenue through increased property taxes.

These eight counties would have to cut services or raise property taxes, since they do not have sufficient reserves to cover the loss of the inheritance tax revenue.

The counties in this category are Dawson, Douglas, Harlan, Lancaster, Loup, Morrill, Otoe and Saunders.

Counties with the most flexibility to manage the loss of revenue.

Approximately 23 counties have larger reserves and would not be constrained by state limitations if they have to make up the lost revenue by raising property taxes. But these counties may have large reserves because they are saving for important projects, and unexpected expenses could arise at any time, putting them on less solid ground than they are now. Gradual property tax increases and service reductions will be inevitable in these counties as well.

These counties are Arthur, Box Butte, Boyd, Cedar, Chase, Cuming, Dawes, Dundy, Frontier, Gosper, Grant, Hooker, Kearney, Keith, Knox, Logan, Phelps, Pierce, Sarpy, Seward, Sioux, Stanton, and Thomas.

OpenSky Policy Institute is a non-partisan, data-driven think tank focused on tax and budget policy in Nebraska. Our mission is to improve opportunities for every Nebraskan by providing impartial and precise research, analysis, education, and leadership.