Many Commonly Taxed Services Not Taxed in Nebraska

A 2009 study estimated that Nebraska could gain nearly $500 million in sales tax revenue each year by expanding the sales tax base to all “feasibly taxable” services, defined as “all household purchases of services other than health care, housing, education, legal, banking, public transit, insurance, and funeral services.”

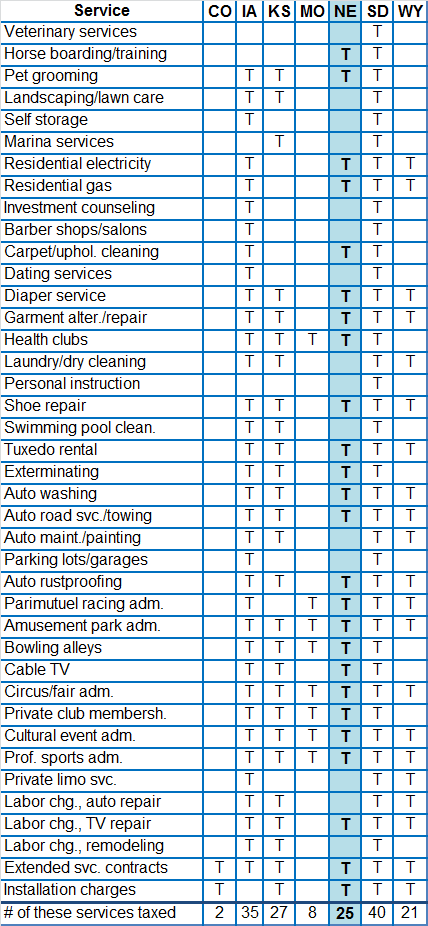

There are 168 services taxed in at least one state. The table below focuses on 40 commonly taxed household services and whether or not they are taxed in Nebraska and our neighboring states (T = taxed). Nebraska taxes more of these services than Colorado, Missouri, and Wyoming, but less of them than Iowa, Kansas, and South Dakota. Click here to return to Chapter 5 – Evaluating Nebraska’s Tax System.

(Note: the original table was based on 2007 data from the Federation of Tax Administrators, and thus included remodeling labor as a taxable service in Nebraska. Contractor labor charges on real property are not taxable in Nebraska since October 2007. See Nebraska Department of Revenue, Information for Construction Contractors.)

Source: Mazerov, Expanding Sales Taxation of Services: Options and Issues (Center on Budget and Policy Priorities: July 2009)