Policy brief – Federal tax plans no boon for middle-class Nebraskans

The tax plans being considered by Congress would offer big tax breaks to large corporations and the very wealthy, provide modest benefit to middle- and low-income Nebraskans and, in fact, cause many Nebraskans to pay more taxes, Institute on Taxation and Economic Policy (ITEP) analyses show.

House and Senate plans both heavily skew toward wealthy taxpayers

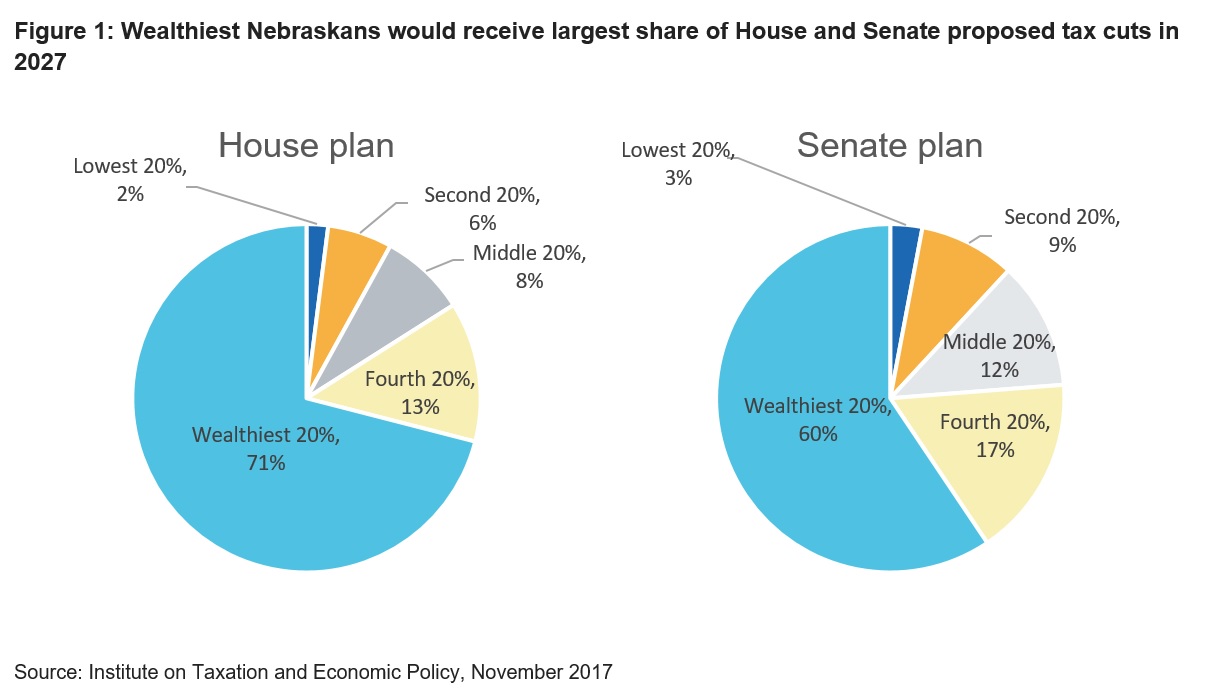

Analyses of the House[1] and Senate[2] tax plans show they both overwhelmingly favor high income taxpayers (See figure 1[3]). This is primarily because significant cuts to corporate income and pass-through business taxes will accumulate to wealthier taxpayers, as well as proposed changes to the estate tax. ITEP analysis of the House plan finds that the top 20 percent of taxpayers in Nebraska — those with incomes greater than $106,870 — would receive 61 percent of the tax benefits in 2018. By 2027, this group would receive 71 percent of the tax benefits under the House plan. ITEP finds that the Senate plan also predominantly benefits the wealthy with 62 percent of the tax cuts going to the wealthiest 20 percent in 2019[4] and 60 percent in 2027.

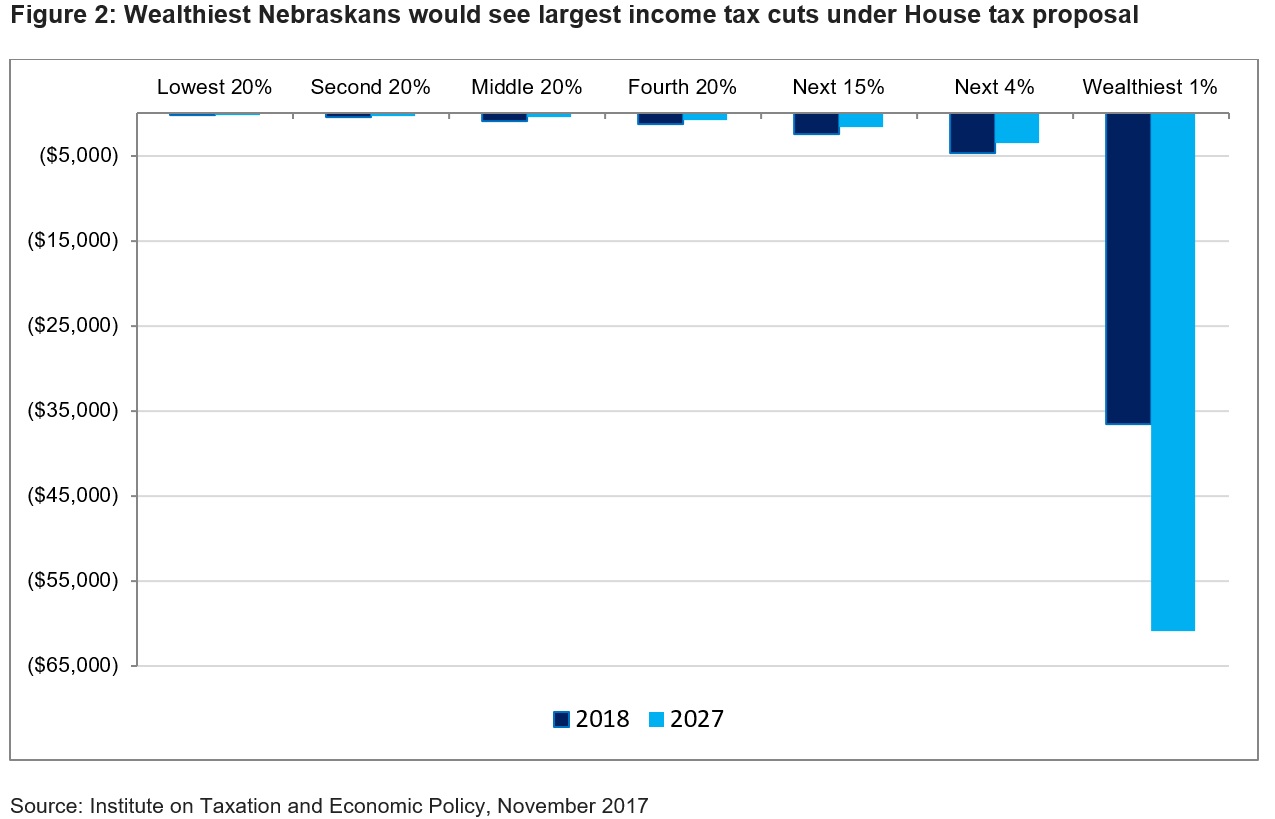

Under the House bill, in 2018, the middle 20 percent of Nebraska taxpayers would get an average tax cut of $920, whereas the top 1 percent of Nebraskans would get an average tax cut of $36,580. By 2027, the middle 20 percent of Nebraskans would get a tax cut of just $460, whereas the top 1 percent’s average tax cut would grow to $60,860. This is because some of the middle class tax cut is front-loaded in the early years with provisions phasing out or growing more slowly over time.[5] This contributes to the value of the tax cuts declining over time for all but the top one percent of taxpayers. (See figure 2)

Under the Senate bill, in 2019, the middle 20 percent of Nebraska taxpayers would get an average tax cut of $760, whereas the top 1 percent of Nebraskans would get an average tax cut of $34,860. By 2027, the middle 20 percent of Nebraskans would get a slightly larger tax cut of $880 on average, whereas the top 1 percent’s average tax cut would jump to $44,780.

Many Nebraskans would pay more in federal and state taxes

ITEP analyses show many Nebraskans would experience federal tax increases under the plans. Under the House plan, 6 percent more than 50,000 tax filers[6] — would pay more in federal taxes in 2018 and that number would grow to 15 percent more than 130,000 tax filers — in 2027. Under the Senate plan, the percentage of all Nebraska taxpayers who face tax increases would be 9 percent more than 80,000 filers — in 2019 and 2027.

The ITEP analyses do not examine the federal tax plan effect on state taxes and therefore don’t reflect that the changes could lead many Nebraskans to pay more in state taxes, too. This would occur because many Nebraskans’ taxable incomes would increase after deductions and credits are eliminated, thereby increasing what they owe in state taxes. This would likely increase the number of Nebraskans who will have a net tax increase should either plan pass.

Tax cuts will necessitate cuts to key services

The tax plans also will lead to cuts to key services that middle-class Nebraskans need. While crafting Senate and House budget resolutions, lawmakers spelled out plans to pay for tax cuts through budget cuts including:[7]

- More than $1 trillion from Medicaid over the next ten years;

- Nearly $500 billion from Medicare over the next decade;

- $400 million from the Social Security Administration budget in 2018 alone;

- Large cuts to the nation’s primary food assistance program, SNAP; and

- Cuts to housing assistance.

Furthermore, while funding for elementary and secondary education adjusted for inflation is 13 percent lower than it was in 2010, the Senate budget resolution calls for 2018 inflation-adjusted education funding to be 20 percent lower than it was in 2010.

In addition to the impact federal tax changes could have on individual Nebraskans, they could also automatically affect the amount of tax revenue the state of Nebraska collects by influencing state-level taxes, which are coupled with the federal tax code. Depending on the credits and deductions that are changed, the state could experience significant decreases or increases in revenue. It also is important to keep in mind that a significant portion — approximately 30 percent — of the state budget is paid for with federal dollars. To the extent that federal budget cuts are made to pay for these tax changes, reduced federal funding could potentially force state-level budget cuts.

Conclusion

The tax plans currently being considered by Congress provide modest benefits for middle- and low-income Nebraskans and up to 15 percent of Nebraska taxpayers would actually pay more in taxes under the plans. Furthermore, when the cuts to key programs and services that would follow from reduced federal revenue are factored in, many middle- and low-income Nebraskans would likely be worse off under the tax plans that lawmakers are currently considering.

Download a printable PDF of this analysis.

[1] Institute on Taxation and Economic Policy, “How the House Tax Proposal Would Affect Nebraska Residents’ Federal Taxes,” downloaded from https://itep.org/housetaxplanne/ on Nov. 14, 2017.

[2] Institute on Taxation and Economic Policy, “How the Senate Tax Bill Would Affect Nebraska Residents’ Federal Taxes,” downloaded from https://itep.org/senatetaxplanne/ on Nov. 14, 2017.

[3] ITEP income quintiles for 2027: Lowest 20% – Less than $34,480; Second 20% – $34,480 to $57,390; Middle 20% – $57,390 to $89,770; Fourth 20% – $89,770 to $136,640; Wealthiest 20% – $136,640 and above. Â

[4] ITEP analysis uses 2019 as the first year of full implementation to incorporate the distributional impact of the corporate tax cut, which is delayed one year in the Senate plan.

[5] For example, the new $300 child tax credit for adults in the household expires at the end of 2022, and the increased standard deduction is indexed to a more slow-growing measure of inflation (chained CPI). In contrast, the estate tax sees an increase in the exemption amount in the initial years but is fully repealed in 2023.

[6] OpenSky calculation based on Internal Revenue Service data, downloaded from https://www.irs.gov/statistics/soi-tax-stats-historic-table-2 on Nov. 14, 2017.

[7] Center on Budget and Policy Priorities, “Republican Plans to Cut Taxes Now, Cut Programs Later Would Leave Most Elderly People Worse Off,” downloaded from https://www.cbpp.org/research/federal-budget/republican-plans-to-cut-taxes-now-cut-programs-later-would-leave-most on Oct. 18, 2017.