Policy brief: Income tax bills good for wealthy and non-residents

LB 452 and LB 380 would provide large income tax cuts to wealthy Nebraskans and do little-to-nothing for the middle-class or small businesses. Furthermore, under LB 452, many low- and middle-income Nebraskans and many C-corporations would actually pay more in overall taxes. Both bills also would deplete the state of revenue at a time when a report by the U.S. Government Accountability Offices shows we could be entering a long run of budget shortfalls.[1] The loss of revenue would prevent the state from addressing truly pressing issues, such as our high reliance on property taxes to fund K-12 education and other local services.

Forty percent of Nebraskans would see tax increases under LB 452

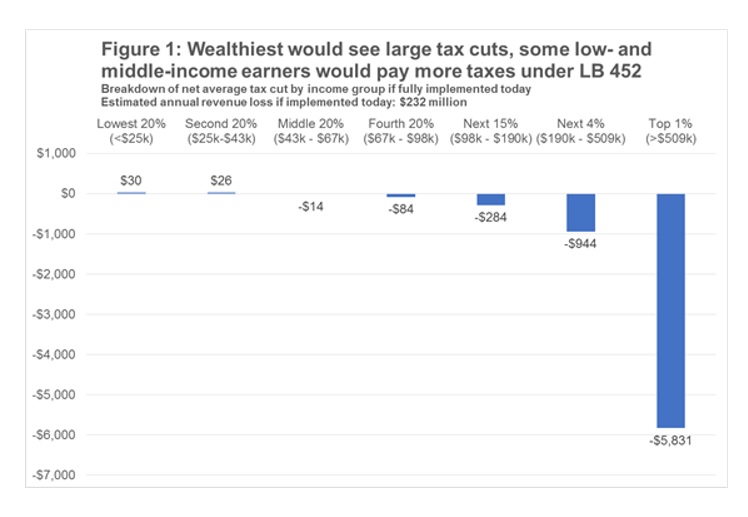

Low- and middle-income earners pay more of their incomes in sales taxes than income taxes. This is reflected in Institute on Taxation and Economic Policy (ITEP) data that show LB 452 – which includes a sales tax expansion — would raise taxes on average for the 40 percent of Nebraskans who earn less than $43,000. (Figure 1) The next 20 percent of Nebraska earners who make between $43,000 and $67,000 would see average annual tax cuts of $14 while the wealthiest 1 percent of Nebraskans, those who make more than $509,000 annually, would receive average tax cuts of about $5,831.

LB 452’s tax changes

Beginning in 2018, LB 452 would immediately:

- Expand the sales tax to more services, including auto repair and haircuts. A portion of the revenue collected in this sales tax expansion will go to roads instead of the General Fund due to the Build Nebraska Act;[2]

- Collapse the bottom two personal income tax brackets. The brackets now apply a 2.46 percent rate to the first $6,170 of taxable income and a 3.51 percent rate to taxable income between $6,170 and $37,030 for married taxpayers filing jointly. In LB 452, they would become one bracket with a 3.1 percent tax rate on taxable income up to $38,060;[3]

- Eliminate the state’s bottom corporate income tax rate, which currently applies a 5.58 percent rate to the first $100,000 of taxable corporate income;

- Cut the top personal income tax rate from 6.84 percent to 6.73 percent with another automatic cut kicking in in 2019 that would drop the rate to 6.62 percent;

- Cut the top corporate income tax rate from 7.81 percent to 7.58 percent with another automatic cut in 2019 that would reduce the rate to 7.35 percent; and

- Eliminate the personal exemption credit for high earners, which would nominally reduce their tax savings.

In the ensuing years, the bill would reduce the top personal and corporate income tax rates to 5.99 percent incrementally using triggered tax cuts that would be enacted when revenue projections reach certain levels.

Most Nebraska C-corporations would see tax increases

In 2012, 90 percent of C-corps with Nebraska taxable income had less than $100,000 in taxable income. Under LB 452, these businesses would see tax increases as their income that previously was taxed at 5.58 percent would be taxed at higher rates.

About 43 percent LB 452 tax cut would leave the state

If fully implemented today, LB 452 would annually reduce revenue by $232 million. About $99 million – or about 43 percent — of the total income tax cuts would leave the state each year as the federal government would collect about $38 million more from Nebraskans who would have less state tax to write off on federal tax returns and another $61 million would go to non-residents who own stock in multi-state companies that do business in Nebraska. Because the sales tax expansion and elimination of the personal income credit for high earners are eliminated immediately and the income tax rate cuts are gradual, ITEP data show LB 452 will cause an initial revenue increase in the first year but would reduce increasingly large amounts of revenue in later years.

Revenue triggers are not sound tax policy

Revenue triggers like those proposed in LB 452 set tax cuts on autopilot based on arbitrary levels and don’t allow lawmakers to respond to state needs. In 2016, a tax cut trigger in Oklahoma caused an income tax cut just as oil prices plummeted. This contributed to a budget crisis in which nearly one third of the state’s school districts moved to four-day school weeks.[4] LB 452’s triggers are based on projected revenue growth – not actual revenue growth. If the triggers proposed in LB 452 had been in place in Nebraska since 2001, several tax cuts would have been implemented, including personal and corporate income tax cuts during the recession of the early 2000’s and “The Great Recession” and another personal income tax cut last year that would have significantly increased our present budget shortfall.

LB 380 provides largest cut to wealthy, does little to nothing for middle-class

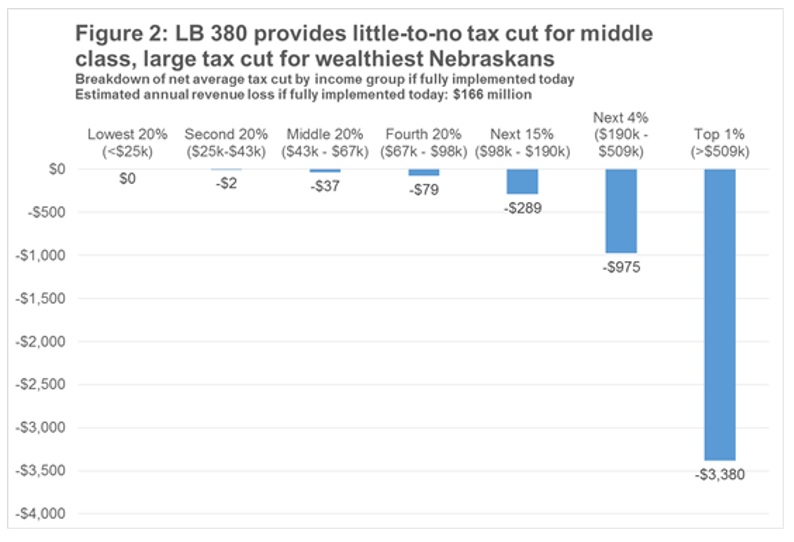

LB 380 would reduce the state’s top personal income tax rate from 6.84 percent to 5.99 percent upon implementation and offset some revenue loss by phasing down credits and deductions taxpayers can use. Under LB 380, the wealthiest 1 percent of Nebraskans, who earn more than $509,000, would receive average tax cuts of about $3,380 a year; middle-income earners who make between $43,000 and $67,000 would receive about $37 annually on average; and the lowest-earning taxpayers who earn less than $25,000 would, on average, receive no tax reductions. (Figure 2)

LB 380 revenue loss would be significant

If fully implemented today, LB 380 would annually reduce revenue by $166 million annually with $41 million – or about 25 percent of the tax cut — leaving the state. The federal government would collect about $29 million more from Nebraskans and another $12 million would go to non-residents.

Bills not likely to help small businesses, attract new businesses, grow economy

Neither LB 452 nor LB 380 would do much to help small businesses. The average small business subject to the individual income tax has $27,484 in taxable income.[5] Such a business would receive no tax cut under these bills. Cutting income taxes also is unlikely to help the state attract new businesses as site selector data show companies are more concerned with infrastructure and other factors than with state taxes.[6] The revenue losses created by these bills would, however, hinder investments in infrastructure, schools, public safety and other services businesses care about. In their research of the effect of tax cut and budget cuts on economies, Wichita State University professors Arwiphawee Srithongrung and Ken Kriz found the negative effects of funding cuts typically significantly outweigh any positive economic impact of tax cuts.[7]

Conclusion

In the face of a $1.2 billion budget shortfall that could linger for several years, it makes little fiscal sense to implement risky measures that reduce revenue further with little chance of economic reward. That both bills would give large tax cuts to wealthy Nebraskans, provide little tax savings for low- and middle-income residents, and in the case of LB 452, raise taxes on many residents, strengthens the case for lawmakers to reject both proposals.

Download a printable PDF of this analysis.

[1] U.S. Government Accountability Office, “State and Local Governments Fiscal Outlook, 2016 Update,” downloaded from http://www.gao.gov/assets/690/681506.pdf on Dec. 21, 2016.

[2] (LB 84, 2011)

[3] Calculated based on the inflation adjustments made between the baseline thresholds in 77-2715.03 and the 2017 tax rate and bracket schedule. Downloaded from http://www.revenue.nebraska.gov/tax/16forms/f_1040nes_2017.pdf on Feb. 14, 2017. Page 6.

[4] CBSNews.com, “Okla. schools make tough cuts amid oil slump, budget cuts,” downloaded from http://www.cbsnews.com/news/schools-forced-to-shorten-school-week-amid-oil-slump-budget-cuts/ on Jan. 31, 2017.

[5] Office of Tax Analysis, U.S. Department of Treasury, “Methodology to Identify Small Businesses and Their Owners, November 2016,” downloaded from https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/TP4-Tables.xlsx on Feb. 2, 2017. Tables 2014-4 & 2014-6.

[6] Area Development, “29th Annual Survey of Corporate Executives: A Realignment of Location Priorities,” downloaded from http://www.areadevelopment.com/Corporate-Consultants-Survey-Results/Q1-2015/annual-corporate-executive-business-expansion-survey-287775.shtml on Feb. 13, 2017.

[7] Arwiphawee Srithongrung and Ken Kriz, “The Impact of Subnational Fiscal Policies on Economic Growth: A Dynamic Analysis Approach,” downloaded from http://onlinelibrary.wiley.com/doi/10.1002/pam.21784/abstract on Feb. 12, 2017.