Policy brief — Infrastructure is important, so is a strong cash reserve

On the Legislature’s agenda today are the Appropriations Committee budget recommendations as well as LB 960, a measure to create a transportation infrastructure bank. Strong transportation infrastructure is vital to a state’s economic health. However, a proposed $50 million cash reserve withdrawal to fund the transportation infrastructure bank, along with other proposed withdrawals in the Appropriations Committee’s budget recommendations, would take the state’s rainy day fund below recommended levels and leave Nebraska vulnerable to cuts and tax increases when the economy takes a downturn.

Proposed withdrawals effect on the cash reserve

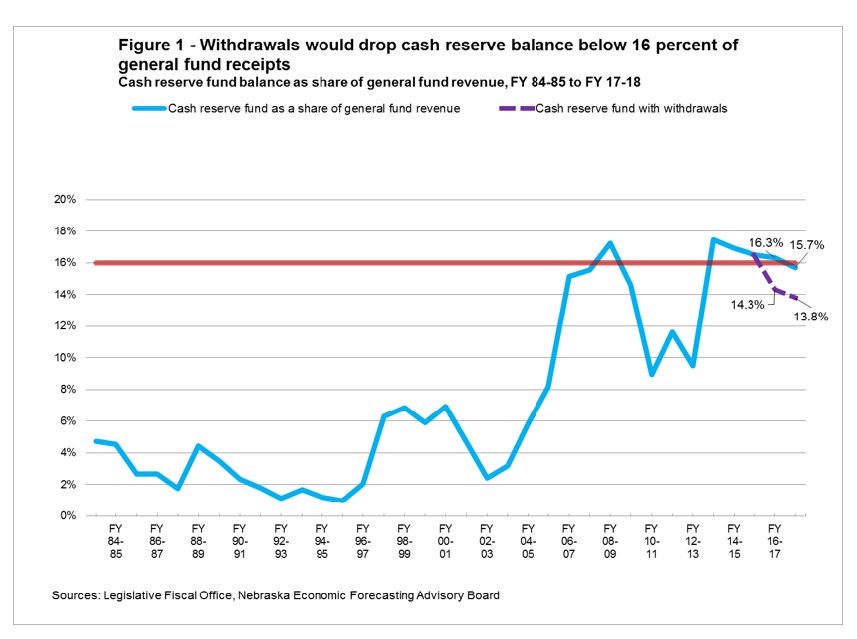

The Legislative Fiscal Office finds a balance of 16 percent of general fund receipts would help protect against revenue forecasting errors.[1] Similarly, the Government Finance Officers Association recommends that cash reserve balances be equal to at least 16.7 percent of annual general fund appropriations. The current proposed cash reserve withdrawals would decrease the rainy day fund’s balance down to 14.3 percent of general fund revenue for FY16-17 and the balance would be projected to be at 13.8 percent for FY17-18. Without the withdrawals, the cash reserve balance would be 16.3 percent of general fund revenues in FY 16-17, and would be projected to be at 15.7 percent in FY 17-18. (Figure 1)

Strong cash reserve, stimulus funds key to weathering “Great Recession”

Nebraska’s cash reserve at the end of FY08-09 was $578 million — about 17 percent of the general fund revenue. However, the state spent $986 million[2] — equivalent to 29 percent of general fund revenue — in federal stimulus, cash reserve and other one-time money to get through the recession. And even then, the state still was forced to make cuts to schools and other services.

Low cash reserve led to painful choices in early 2000s

Lawmakers didn’t have the benefit of federal stimulus funds when a recession hit in the early 2000s. They also had a small cash reserve of about $110 million — smaller than 5 percent of the general fund. Faced with a $759 million budget shortfall, [3] legislators were forced to increase sales and income tax rates,[4] raise other taxes and also make painful cuts to K-12 education, the university system, county property tax relief and other services.

Transportation investments, cash reserve both vital to fiscal health

Targeted investments in transportation infrastructure are among the most powerful investments states can make to promote long-term economic growth. A strong cash reserve, however, also is essential to our state’s fiscal health, as it will help prevent major cuts to our schools, roads and other key services when the economy takes a downturn. This is particularly important considering a federal stimulus package is unlikely to occur the next time we enter a recession.

Download a printable PDF of this analysis.

[1] State of Nebraska Biennial Budget, FY 15-16/16-17, Pages 20-21. http://nebraskalegislature.gov/pdf/reports/fiscal/2015budget.pdf

[2] State of Nebraska Biennial Budget, FY 15-16/16-17, Page 21. http://nebraskalegislature.gov/pdf/reports/fiscal/2015budget.pdf

[3] State of Nebraska Biennial Budget, FY 03-04, Page, 3.

http://nebraskalegislature.gov/pdf/reports/fiscal/2003budget_0910.pdf

[4] Nebraska Legislature, Taxes in Nebraska; http://www.legislature.ne.gov/app_rev/source/chrono_salestax.htm#2002