“Real Taxpayers of Nebraska” and cutting the top income tax rate

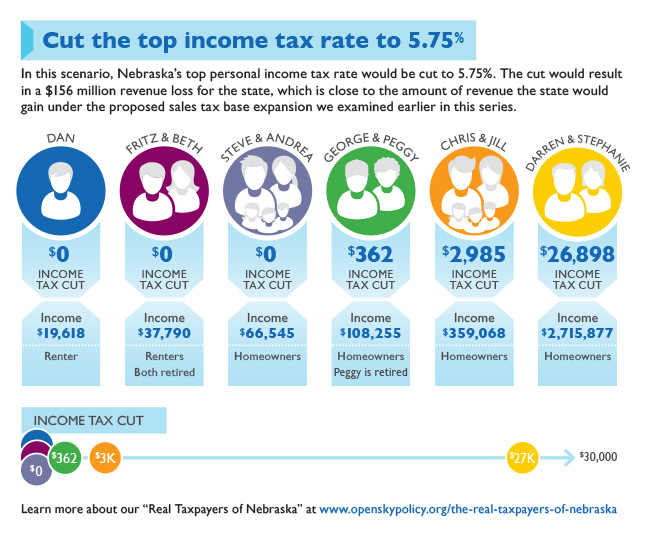

In this “Real Taxpayers” infographic, we examine what cutting Nebraska’s top personal income tax rate to 5.75% would mean for our tax payers.

The cut would result in a $156 million revenue loss for the state, which is close to the amount of revenue the state would gain under the sales tax base expansion we examined earlier in this series.

We recommended that the state not cut its top income tax rate as income tax cuts have little-to-no economic benefit, do little to benefit the middle class and likely would hurt the state in the long run by draining resources from schools, health care and other building blocks of a strong economy. Look at the infographic below to see what cutting the top income tax rate to 5.75 percent would mean for our taxpayers.

Download a printable PDF of this infographic.

Download a printable PDF of this infographic.

Previous infographics

Click the links below to view our previous tax change infographics about: