“Real Taxpayers of Nebraska” and expanding the sales tax

Over the next several days, we will look at five different tax change scenarios and how they would affect our six “Real Taxpayers of Nebraska.”

These infographics are meant to show the tax cuts and increases actual Nebraskans would experience under individual measures. However, we expect that any actual changes to the state’s tax code would be a combination of several proposals and unlikely to be a full implementation of any single measure.

Based on this analysis, we recommend that the state enact a combination of changes that include increased state aid to local governments, taxation of more services and targeted property tax assistance through circuit breakers. However, to ensure that we don’t raise taxes on the middle class and are able to address property taxes in a meaningful way, we also recommend looking at other revenue-raising options such as reforming income tax credits and deductions.

Most importantly, we believe this analysis illustrates the challenge committee members have before them, and we applaud them for their efforts.

First up – Sales tax expansion

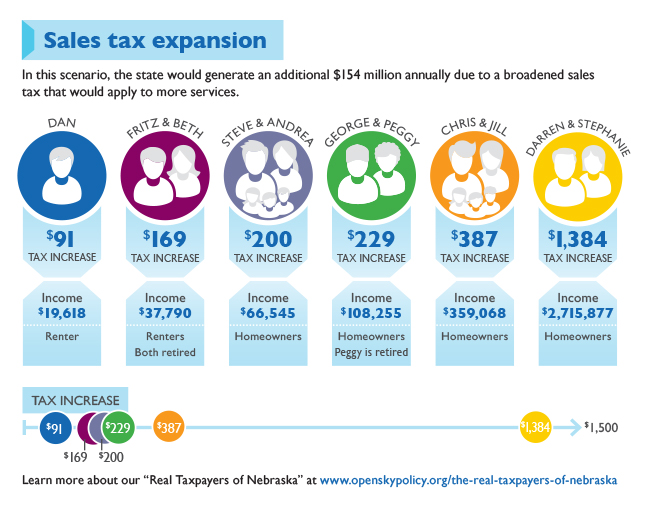

In our first infographic, we will examine the effects of expanding the state’s sales tax to include about$150 million in services, a moderate expansion and one of the few revenue-raising options under consideration by the Tax Modernization Committee.

The rest of the scenarios in our infographics would reduce revenue. We have set up each scenario to cost about $150 million to offset the revenue generated by the sales tax expansion.

The infographic below will show what expanding the sales tax would mean to our “Real Taxpayers.”

Download a printable PDF of this infographic.

What’s ahead

In the coming days, we also will see how our taxpayers would be affected by:

- Increasing state aid to local governments. We recommended the state increase aid to local governments like school districts to help lower property taxes and improve education equity.

- Enacting a “property-tax circuit breaker.” We recommended the state enact a circuit breaker as it is a targeted form of property tax assistance and is the only option we reviewed that was able to extend property tax assistance to renters.

- Increasing the state’s property tax credit. We recommended the state use a more targeted form of property tax assistance like a circuit breaker.

- Cutting the top income tax rate to 5.75 percent. We recommended that the state not lower income rates as this wouldn’t spur economic growth but would make our tax code significantly more regressive.