“Real Taxpayers of Nebraska” and property tax circuit breakers

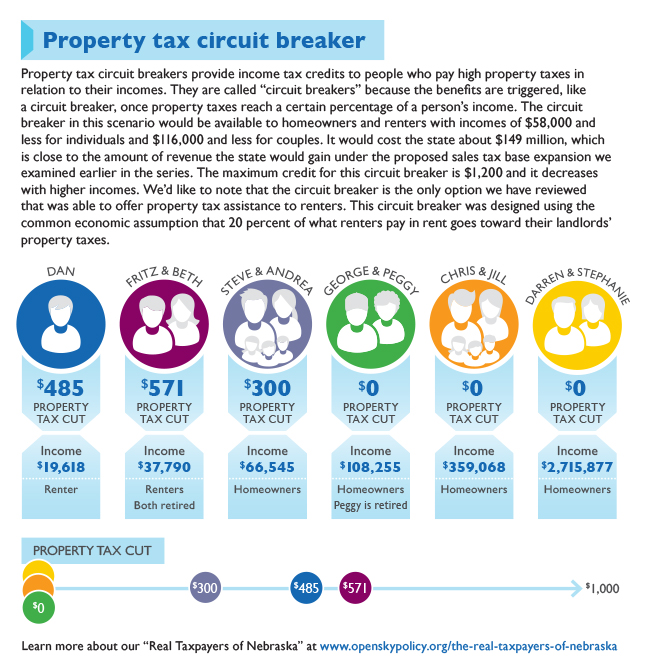

Today’s “Real Taxpayer” infographic shows how taxpayers would be impacted should the state enact a property tax circuit breaker. Property tax circuit breakers provide income tax credits to people who pay high property taxes in relation to their incomes.

They are called “circuit breakers” because the benefits are triggered, like a circuit breaker, once property taxes reach a certain percentage of a person’s income. This particular circuit breaker is intended to serve as an illustration of what a circuit breaker can look like, but they can be designed with or without caps, with various income limits and various triggers.

The circuit breaker in our infographic would be available to homeowners and renters with incomes of $58,000 and less for individuals and $116,000 and less for couples.

It would cost the state about $149 million, which is close to the amount of revenue the state would gain under the proposed sales tax base expansion we examined earlier in the series. The maximum credit for this circuit breaker is $1,200 and it decreases with higher incomes. This circuit breaker was designed using the common economic assumption that 20 percent of what renters pay in rent goes toward their landlords’ property taxes.

We recommended the state enact a property tax circuit breaker as it can help provide targeted property tax assistance to those who really need it. Circuit breakers also are the only option under consideration by the Tax Modernization Committee that would offer property tax assistance to renters.

Download a printable PDF of this infographic.

Other infographics

In case you missed it earlier, this week we published this infographic that examines a sales tax expansion that taxes about $150 million in additional services and this infographic that looks at what would happen should the state provide about $150 million in additional aid to local governments.

In the coming days, we also will release infographics that show how our taxpayers would be affected by:

- Increasing the state’s property tax credit; and

- Cutting the top income tax rate to 5.75 percent.

In our recent analysis of the tax change options presented by the Tax Modernization Committee, we recommended that the state not increase its property tax credit and rather use a circuit breaker to provide targeted property tax assistance. We also recommended that the state not cut its income tax rates as research shows this would not spur economic growth but would make our tax code significantly more regressive.