“Real Taxpayers of Nebraska” and increasing the property tax credit

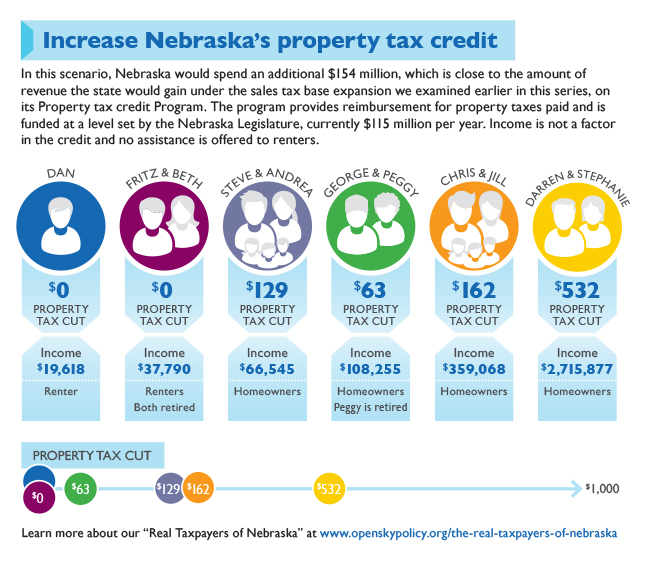

In this “Real Taxpayers of Nebraska” infographic, we examine what would happen should the state bolster its Property Tax Credit by $154 million, which is close to the amount of revenue the state would gain under the sales tax base expansion we examined earlier in this series.

The program provides reimbursement for property taxes paid and is funded at a level set by the Nebraska Legislature, currently $115 million per year. Income is not a factor in the credit and no assistance is offered to renters.

We recommended that the state not increase its property tax credit and rather use a circuit breaker, such as the one we examined earlier, to provide targeted property tax assistance. Look below to see how an increased Property Tax Credit would affect our taypayers.

Download a printable PDF of this graphic.

Other infographics

In case you missed them earlier, here’s a list of the infographics we have published in the past few days that focus on tax change options put forth by the Legislature’s Tax Modernization Committee:

Our next infographic will examine what it would mean to our “Real Taxpayers of Nebraska” if the state were to cut its top income tax rate to 5.75 percent. We recommended that the state not cut its income tax rates as research shows this would not spur economic growth but would make our tax code significantly more regressive.