“Revenue neutral” claims raise an eyebrow

Download a printable PDF of this report.

Department of Revenue estimates shed significant doubt on claims that LB 405 and LB 406 would be revenue neutral for Nebraska’s budget.

The bills call for cuts and reductions to the state’s income tax in favor of increased sales taxes. Eliminated sales tax exemptions will replace revenue lost in the income tax cuts, proponents of the bills said.

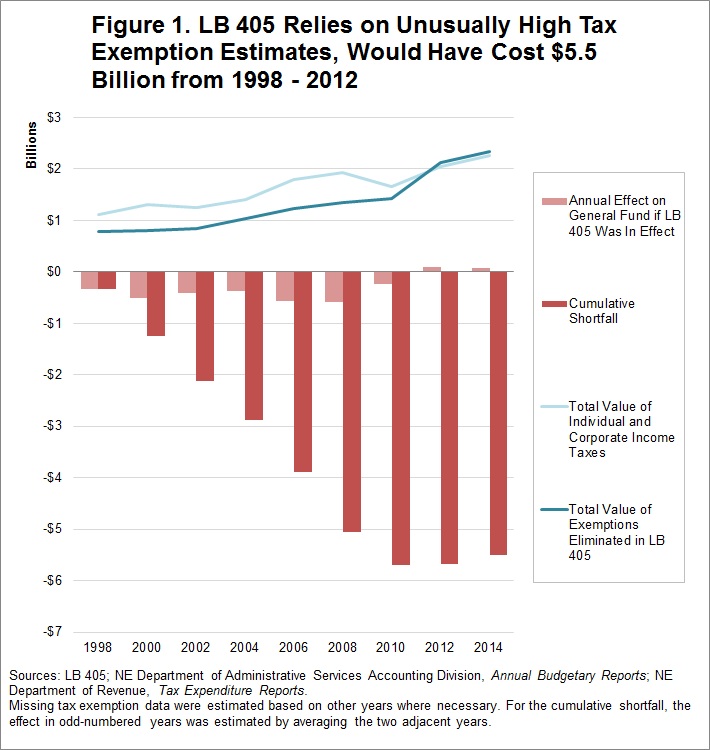

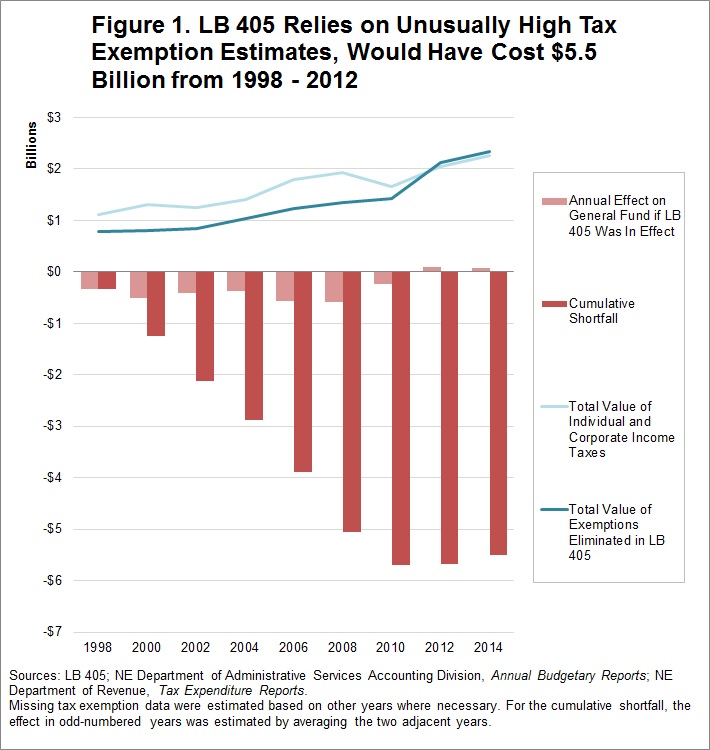

They point to estimates made in 2012 on the value of the sales tax exemptions. The 2012 estimates are considerably higher than they had been in any previous year. (Figure 1)

A different take

Previous estimates of the value of those exemptions tell a drastically different story.

They show that from 1998 to 2010, the potential revenue from eliminating those exemptions would be less than income tax revenues by an average of $426 million a year. That’s a $5.5 billion total shortfall in that time period.

Just one year of a shortfall that size would have essentially wiped out the state’s “rainy day” fund, which is designed to help Nebraska weather disasters and emergencies.

An unbalanced shift

The shift from income taxes to more sales taxes would upset the balance needed to adequately support schools, health care and other services vital to Nebraska.

Productive state tax systems are frequently described as “three-legged stools,” which are balanced by income, sales and property taxes. Each tax has strengths and weaknesses and together, they help the state maintain a steady revenue stream.

Some states with unusual mineral wealth or strong tourism can use those revenue streams to replace one of the legs on the stool. Nebraska is not one of those states.

Sales tax lags

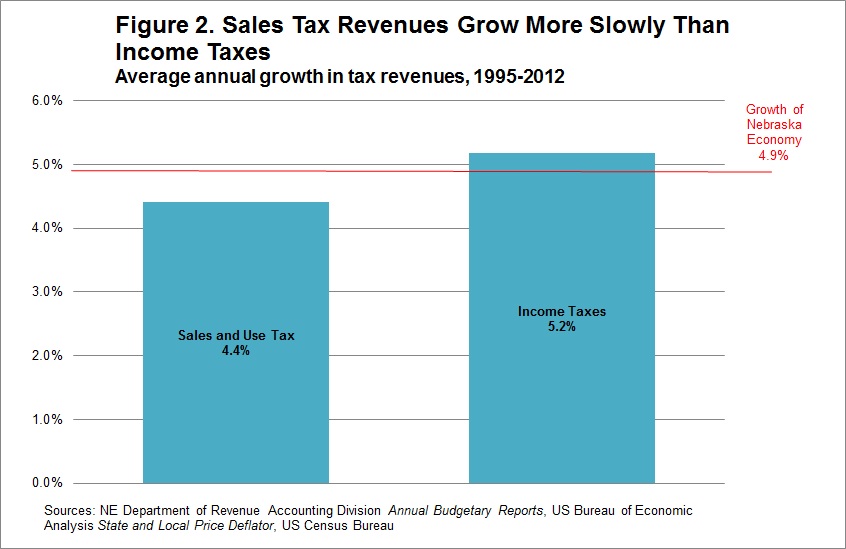

That the state sales tax has failed to keep up with the modern economy also should concern Nebraskans. (Figure 2)

Americans now spend more on services than things but most services aren’t taxed. The sales tax reliance likely will add to the existing long-term gap between the revenue the state takes in and the money necessary to meet public needs.

Compounding factors

This scenario would be further exacerbated as the tax shift also would add new fees on nursing homes, hospital stays, prescription drugs and medical equipment. More expensive health care means higher Medicaid costs and thus less money for education and other state priorities.

Higher sales taxes also would create a $109 million annual windfall for road funds because a portion of the sales tax is dedicated to that purpose. That’s good for the Department of Roads but it means another large cut for services and investments supported by the general fund.

Furthermore, eliminated income taxes also would mean that the nearly $900 million in tax credits presently owed to businesses under the state’s incentive programs would come entirely out of sales tax revenues.

Revenue neutral

The bottom line is the shift likely would not create a revenue neutral budget, as proponents of LB 405 and LB 406 claim.

In fact, it probably would widen the gap between the state’s revenue and the funds needed to invest in education and other building blocks of a strong economy.

To prevent this, any major shift in Nebraska’s tax policies should follow a comprehensive examination of the state’s overall tax code.

The stakes for Nebraska are simply too high for a hasty gamble on estimates and an unbalanced tax system.