Tax cuts account for nearly half of potential new costs, projected spending still below pre-recession levels

As of Monday, lawmakers have bills on the floor that would cost the state $414,640,410 through the next biennium if passed. Of that total, $166,266,922, or 40 percent, are for tax cuts.

Gov. Dave Heineman has asked lawmakers to increase funds for the state’s property tax credit program from $140 million to $205 million. This would increase total tax cuts for the session from $166 million to $231 million, which would be about 56 percent of the total cost of the advanced bills.

Based on the latest revenue projections, all of these bills passing would lead to nearly a $176 million shortfall in FY17. If none of the bills pass, Nebraska would have a balance of $179 million.

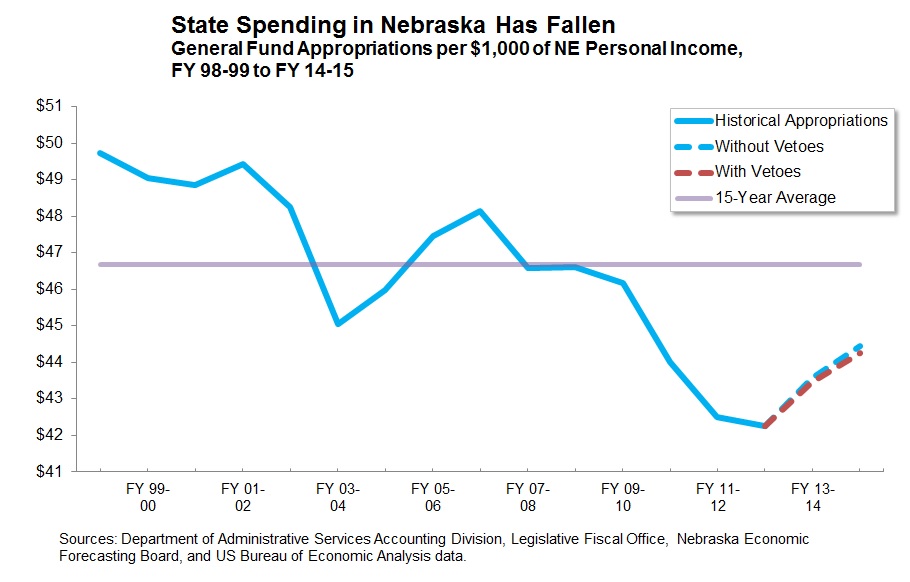

While there has been talk of late about increases in state spending, data show that if all bills – including the budget bills – pass, state spending as a share of the economy still would remain below pre-recession levels.

Spending growth has averaged less than two percent per year in the last five years as the state cut services and deferred maintenance in the Great Recession and its aftermath. The average has been 5.6 percent annually over the past 30 years.

It is not uncommon for spending growth to be above average coming off recessions. The Legislature and Governor enacted a budget last year that would restore some of the cut funding by allowing spending growth to average 6.1 percent per year in FY14 and FY15. If all bills now under consideration pass, spending growth would average 7 percent for the biennium but if the $65 million in vetoes proposed recently by the governor are maintained, that growth would be 6.8 percent.

The governor’s vetoes include cutting $10 million in support of the state’s Behavioral Health Aid program, $11.7 million for heating and air conditioning upgrades in the State Capitol and $10 million from the state’s job training program.

With or without the vetoes, spending as a share of the economy will remain below historic averages. Furthermore, some of this year’s proposed growth is temporary as spending growth is expected to drop back below average – to 4.5 percent and 4.1 percent – for FY 16 and FY 17.