Policy brief: Typical family pays less tax in Nebraska than in most similar states

Middle-income Nebraskans pay relatively low taxes compared to their counterparts in eight nearby states with similar economies and tax structures.

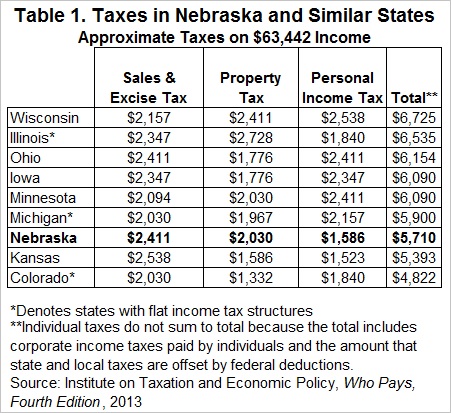

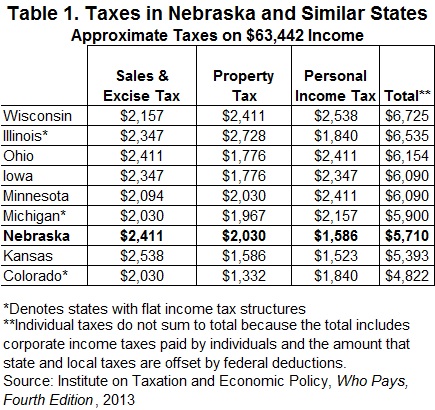

A family earning the median family income in Nebraska ($63,442) would pay less in taxes than a similar family in all but two of these states – Colorado and Kansas. (Table 1) The other comparable states are Iowa, Illinois, Ohio, Wisconsin, Minnesota and Michigan.

Such a middle-income family in Nebraska is likely to pay higher sales and property taxes, but their income tax would be lower than that paid by similar families in all these states but Kansas.

The comparable states were selected because they have the three major taxes – on income, sales and property – that Nebraska has and they don’t rely heavily on revenue from gambling or natural resources like oil.

Tax differences between these states are small

On average, only $238 separates each of these states from the one above or below it in terms of how much a middle-class family pays in taxes — less than one-half of one percent of that family’s income.

Many factors affect tax comparisons

Simply looking at top tax rates does not tell the full story when it comes to comparing state taxes. Other features of a state’s tax code, such as what is and isn’t taxed, matter just as much.

For example, Nebraska’s top personal income tax rate is higher than five of the comparable states but because of other tax code features including deductions, credits and local income taxes, a middle-income family in Nebraska would pay less in state and local income taxes than a similar family in all comparable states except for Kansas.

Similarly, some states have more exemptions from their sales taxes than others, and some make more extensive use of local sales taxes. Nebraska’s 5.5 percent state sales tax rate is lower than all but two of these states, but a middle-income family here pays more in overall sales taxes than it would pay in any of these other states except Kansas. That’s because Nebraska has fewer exemptions and higher local sales taxes than some of these other states.

This analysis of taxes paid by middle-income families also reinforces the fact that Nebraska’s taxes overall are moderate compared to the rest of the nation, as we explored in previous work.[1]

Download a printable PDF of this analysis.

Methodology Note

States for this analysis were chosen based on proximity to Nebraska and similarity to Nebraska’s economy and tax structure. Nebraska’s neighboring states and other states in the Midwest region as defined by the US Census Bureau constituted the initial pool. States lacking one of the three major taxes (SD, WY), states in the top ten for reliance on gambling revenues (IN, MO, SD),[2] and states in the top ten for severance taxes on natural resources like coal, oil and natural gas (ND, WY) were omitted. States with strong gambling and oil revenues were excluded since such states can rely less on taxes to support their state services and therefore don’t provide a fair comparison to Nebraska, which doesn’t have strong oil or gambling revenues.

Data from the Institute on Taxation and Economic Policy (ITEP)[3] on the percentage of income paid in taxes at particular income levels were used to calculate the taxes a Nebraska median-income family would pay. These figures are approximate, as the percentages produced by ITEP are averages for income groups.

[1] OpenSky Policy Institute, “Nebraska Taxes at a Glance” (2013), https://www.openskypolicy.org/nebraska-taxes-at-a-glance.

[2] http://www.rockinst.org/pdf/government_finance/2011-06-23-Back_in_the_Black.pdf

[3] Institute on Taxation and Economic Policy, Who Pays, Fourth Edition, 2013.