Policy brief – Adjusting to federal tax changes

Today, the Legislature’s Revenue Committee will hold hearings on LB 1090 and LB 1048 — bills that would adjust Nebraska’s tax code to compensate for the effects of recently passed federal tax changes. The Department of Revenue estimates that without any adjustments to the state tax code, Nebraska would expect to see more than a $200 million increase in state revenue and taxpayers would be faced with state tax increases.[1]

What the bills change

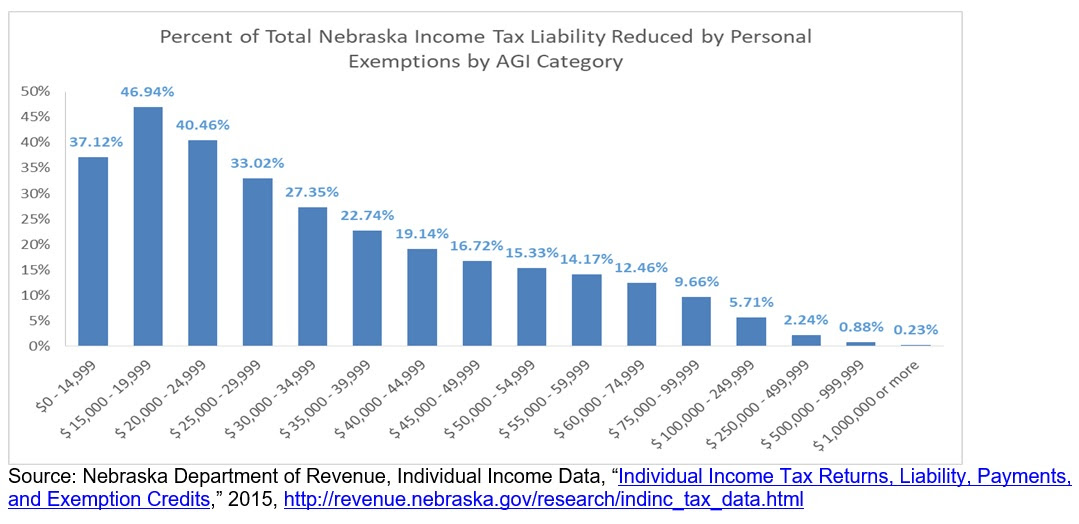

Nebraska taxpayers currently receive a non-refundable personal exemption credit for themselves and their dependents against their income taxes. In 2018, the credit is equal to $134 per person. For a family of four, this would be worth $536. Department of Revenue data show the credit particularly helps low- and middle-income Nebraskans (See chart below). The credit would be effectively eliminated by the federal tax changes if the state takes no action to adjust its tax code. The elimination of this credit makes up the bulk of the state tax increases anticipated by the Nebraska Department of Revenue.[2] Both LB 1090 and LB 1048 attempt to prevent increasing state income taxes on Nebraskans by preserving the personal exemption credit. LB 1090 preserves the credit for all taxpayers while LB 1048 only preserves it for individuals with a federal adjusted gross income of less than $100,000 and married couples with incomes less than $200,000. LB 1090 also would increase Nebraska’s standard deduction and would retain our current inflation calculation method rather than chained CPI adopted under federal law, which grows more slowly. Because of these differences, LB 1090 would reduce more revenue than LB 1048.

LB 1048 leaves cushion should impact of federal tax changes miss projections

There is tremendous uncertainty and many questions about the impact of the recent federal tax changes. For example, it is hard to tell the rate at which people will continue to itemize. Will businesses change their filing status from S-corps to C-corps? How will corporate taxpayer behavior change? The federal tax changes have altered the fiscal tax policy landscape so considerably, that it is hard to predict how everything will ultimately shake out. For all of these reasons and more, it is a difficult job for the Department of Revenue to estimate the total fiscal impact on the state of Nebraska. Along with preventing many Nebraskans — particularly low- and middle-income residents — from seeing state tax increases because of the federal changes, LB 1048 also is intended to give the state some revenue cushion should the impact of federal tax changes differ from projections. LB 1090, on the other hand, is intended to be revenue neutral with the federal tax changes, which significantly reduces the margin of error for the projections. If the projections do not perfectly predict the revenue impact of the federal changes, lawmakers will need to increase other revenues such as sales taxes and fees, or continue to make cuts to key state services like education.

Conclusion

Both bills would prevent most Nebraskans from receiving state tax increases because of federal tax cuts. LB 1048, however, is a more prudent path for lawmakers to take as it prevents low- and middle-income residents from paying more state taxes and also would give the state some cushion if the impact of federal tax reform differs from projections. Given the revenue struggles we have, we recommend lawmakers take the more cautious approach to adjusting to federal tax changes set forth in LB 1048.

Download a printable PDF of this analysis.