As Tax Day approaches, we’re reminded of how our collective tax dollars contribute to a stronger Nebraska.

Good schools, safe communities, modern infrastructure and a great quality of life are all things that make our state better, and a strong tax system provides the foundation to make those things possible.

The benefits extend not only to working families and seniors, but also to business owners who understand how an educated workforce with access to affordable, quality housing is good for the bottom line.

But those investments, all part of the state’s $5.2 billion annual budget, don’t come free. At the state level, Nebraska collects income and sales and use taxes. Income taxes are collected from individuals and from corporations. That’s why for everyone to thrive, Nebraskans agree that individual and corporate taxpayers need to pay their fair share.

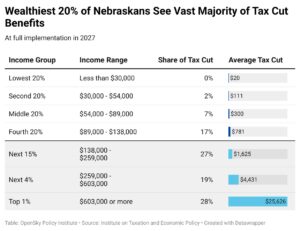

Last year, Nebraska passed the largest tax cut in the state’s history, a package that included personal and corporate income tax reductions and enhanced property tax credits. By full implementation in 2027, the impact on state revenue could approach $1 billion a year.

Estimates put the impact of the proposed income cuts on state revenues at $3.9 billion over the next six years.

On Tax Day, as we think about the things we benefit from when we pay our taxes, we can also see what’s at risk – teachers and textbooks, affordable homes and health care – for Nebraska’s families, workers and communities.