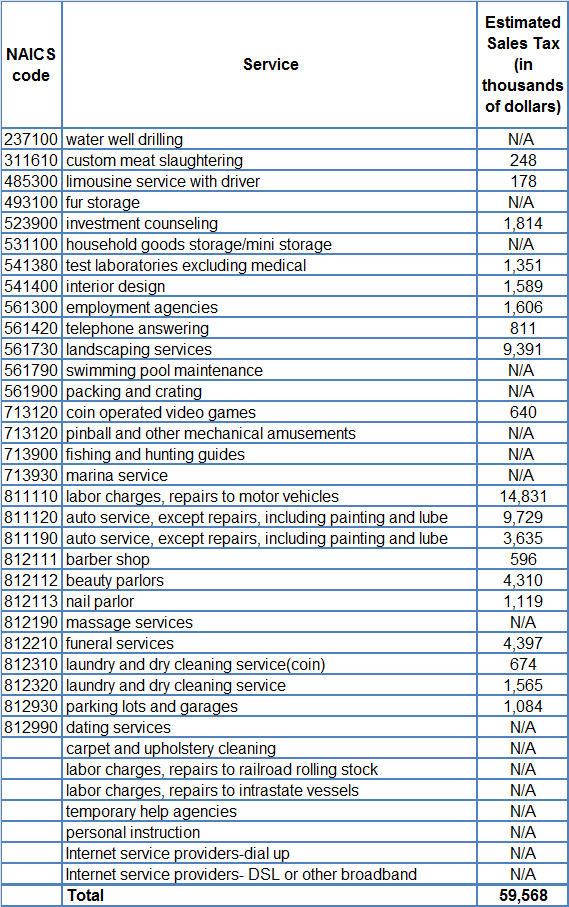

Estimate of Revenue Losses from Specific Untaxed Services

The table below was produced by the Committee on Revenue in 2009. Out of the 168 services that are taxed in at least one state, the Committee focused on approximately 30 services that are taxed in at least two of Nebraska’s neighboring states, and provided estimates for FY 10-11 revenue losses for 19 of them. These 19 exemptions alone total nearly $60 million in lost revenue each year. Click here to return to Chapter 5 – Evaluating Nebraska’s Tax System.

Source: Lock, Memo Re: LR161, LR166, & LR 97 (Committee on Revenue: December 2009), downloaded from http://nlc1.nlc.state.ne.us/epubs/L3770/B042-2009.pdf on March 18, 2013