Today is Tax Day, the day when your income taxes are due. But today is also a reminder that those taxes pay for so many of the things that make our communities strong, from Chadron to Falls City and everywhere in between.

From safe streets to quality schools and efforts to keep health care affordable, the investment of those tax dollars touches each of our lives every day of the year.

But in building a more equitable society and an economy that works for everyone, those taxes should be fair. When everyone pays their fair share, we can tackle the housing crisis so that everyone can have a safe place to call home and keep amazing teachers at work in the classroom helping to educate our kids.

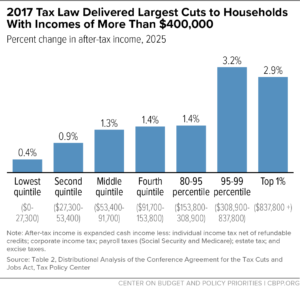

At the federal level, a high-stakes debate is shaping up ahead of the scheduled expiration of the 2017 Tax Cuts and Jobs Act, tax reform that overwhelmingly benefited the wealthiest taxpayers and eroded revenue available to fund programs that benefit all Americans.

And if you paid $1 in federal taxes, you paid more than what 23 corporations paid between 2018-2022 despite being profitable every single year. And 109 corporations paid zero federal tax in at least one of the five years.

Poll after poll shows that voters from both parties are tired of tax cuts that favor the wealthy and tax avoidance by corporations. And everyone paying their fair share will be necessary to invest in programs supporting a rapidly growing population of Americans age 65 and older and in areas such as child poverty, where the U.S. rate exceeds most other developed countries.

Much the same is true at the state and local level, where a tax policy that benefits all Nebraskans is essential to a thriving state where families can grow and businesses can prosper. Tax revenues in rural areas contribute to building and maintaining vital infrastructure and funding schools that are the heartbeat of small communities.

But in Nebraska, state and local taxes are upside-down, levying the lowest effective tax rates on the highest-income households. This is due to a heavy reliance on sales and excise taxes, where middle- and low-income taxpayers pay more on what they buy than on what they earn, as well as property taxes.

Policymakers have choices when it comes to our tax code, and as a nonpartisan policy research institute, OpenSky’s focus is on educating policymakers and everyday Nebraskans of the impact of tax and budget policy decisions.

April 15 may be the day that your taxes are due, but decisions made everyday have an impact on all of those things important to thriving communities and a tax system where everyone pays their fair share.