General Government

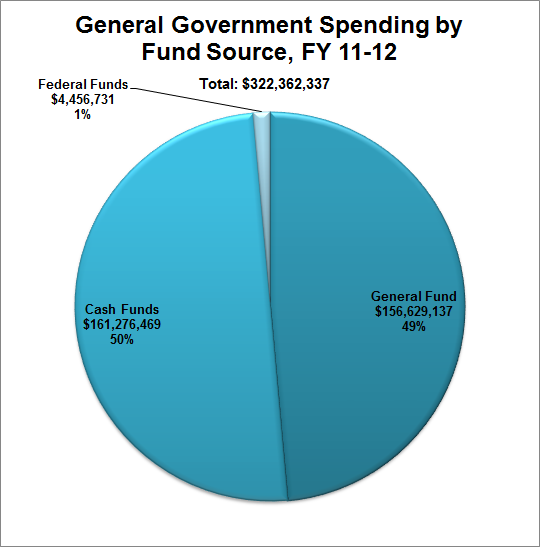

General Government: This category is mostly the Department of Revenue, whose largest expenditure is payments to certain elderly and disabled homeowners through the Homestead Exemption program. Also included are the Retirement Board, Legislative Council, Department of Administrative Services, and the offices of the Auditor, Governor, Lt. Governor, Treasurer, Secretary of State, etc. (full list below).

Most of the Cash Funds spending in this category is made up of the Property Tax Credit Act, which is funded by transfers from the General Fund to the Property Tax Credit Cash Fund. Another example is the Home Energy Improvement Program, an energy conservation effort funded by a portion of sales taxes paid to public power districts.

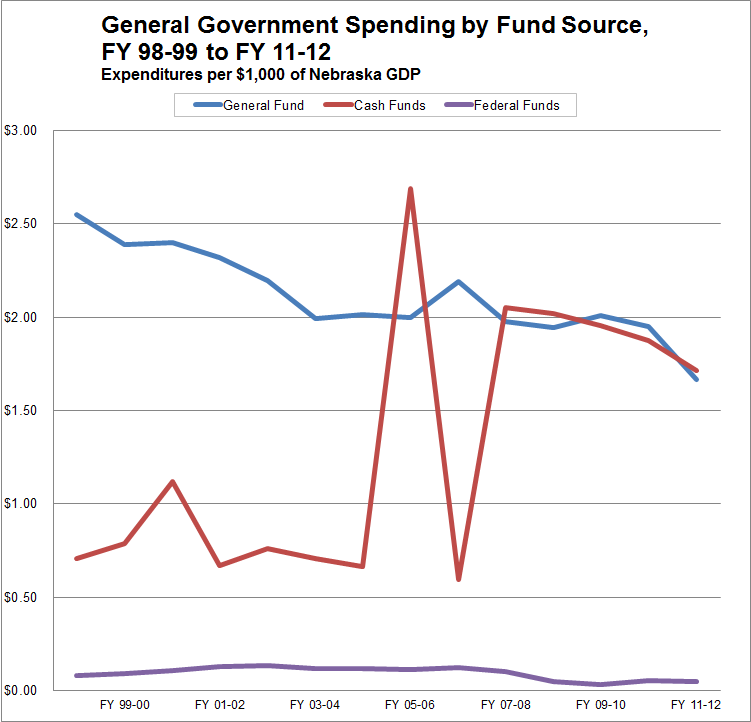

(Note: The erratic behavoir of the Cash Funds line is due to a one-time spike in State Treasurer Cash Fund appropriations in FY 05-06 and the creation of the Property Tax Credit, administered by the Department of Revenue, in 2007.)

Full list of agencies included:

- Account/Disclosure

- Admin Services (DAS)

- Athletic Commissioner

- Constitutional Revision Comm.

- Governor/PRO/Energy

- Investment Council

- Legislative Council

- Lt. Governor

- Power Review Board

- Property Assess/Tax

- Retirement Board

- Revenue

- Secretary of State

- UCC Filing Council

- State Auditor

- State Building Comm.

- State Treasurer

- Tax Equal/Review Comm

- Rounding Adjustments

(Note: Some agencies listed may have been eliminated or merged, but are included in the category in previous years.)

Sources for graph data: Department of Administrative Services Accounting Division, Legislative Fiscal Office, and US Bureau of Economic Analysis