A few bills proposed by the state Legislature this session would change how the state helps school districts manage the costs of providing special education services to students, whose needs can be significant and with costs that can be challenging for schools to manage. We thought it would be helpful to walk through how special education funding works right now.

Where the funding comes from

Nebraska public schools are required to provide a free education for all students, some of whom – 16% in 2020-21 – require special education services. Those services are funded at the local, state and federal levels, although to very different degrees.

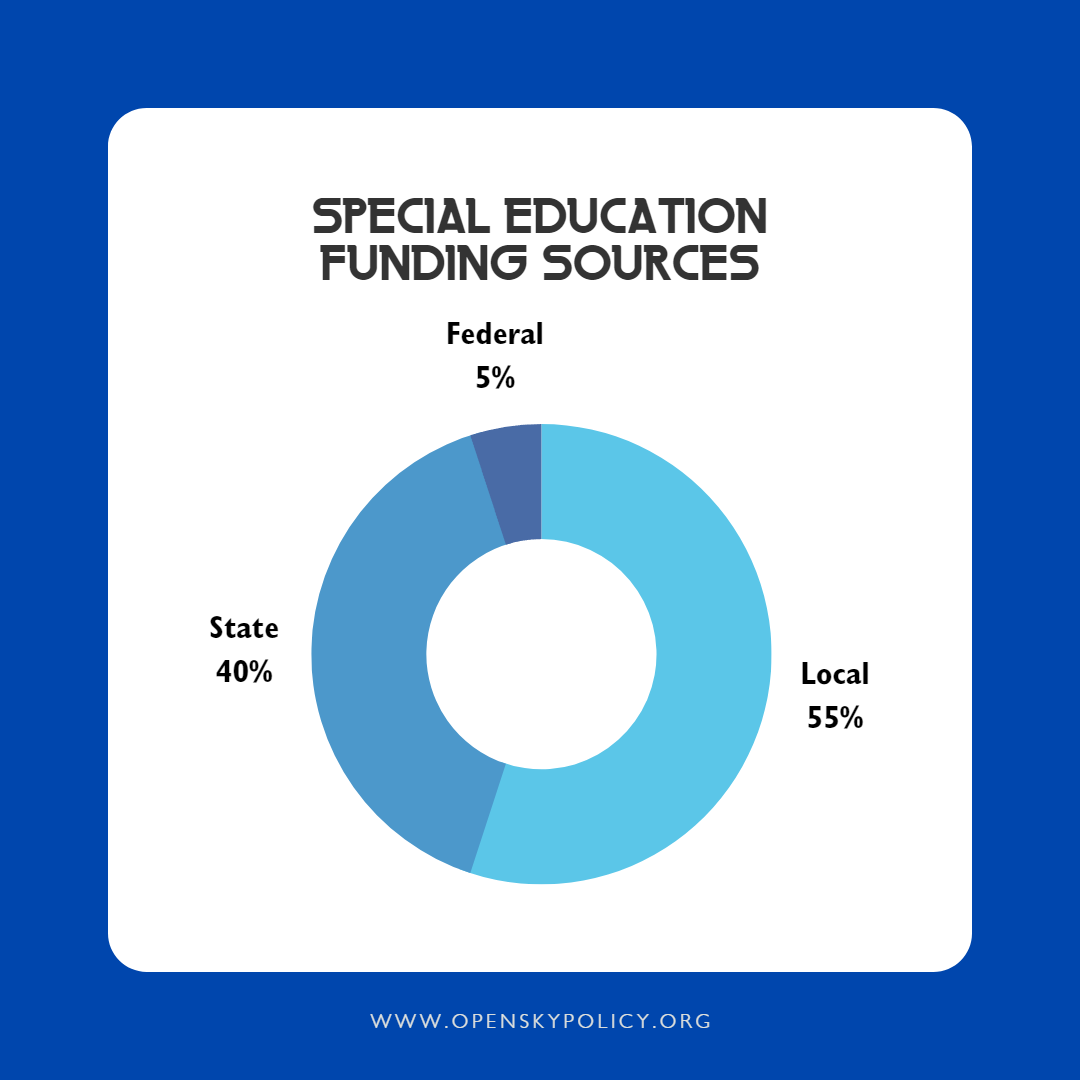

According to the Nebraska Department of Education, Nebraska schools spent $570 million on special education services in 2020-21. Of that, 55% was paid by local funds, 40% by state funds and 5% by federal funds.

Federal funds

Federal funding comes primarily from the Individuals with Disabilities Act (IDEA) and is intended to cover the excess costs of meeting the needs of students with disabilities. While IDEA authorizes federal funding of up to 40% of average per-pupil spending nationwide, the federal government has never met that level.

Under IDEA, federal funds are not intended to pay for all special education services, so school districts who accept IDEA funding have to agree that the funds will be used to supplement, and not replace, state and local funds. To do that, they must comply with a maintenance of effort (MOE) requirement. The MOE requirement ensures school districts continue to spend state and local funds at the same levels from year to year instead of limiting services to those they can afford using only federal dollars.

In practice, this means schools need to budget at least the same amount of state and local funds as they actually spent on special education services the prior year. Any school district that fails to meet the MOE requirement risks losing eligibility to receive IDEA funds in the future and may have to repay funds to the U.S. Department of Education.

State funds

State funds, however, are also limited, currently capped at 10% of what was spent the prior year. This explains why local funding for special education was 55% of total spending in 2020-21, since local school districts shoulder most of the cost of providing special education services. These costs can sometimes be unexpected to the school, such as when a student requiring significant support moves into a district.

In this legislative session, there are several proposals to increase the state’s share of these costs, likely in part because the state is considering how to manage its current budget surplus. However, an important element to consider is whether the funds will be considered a “resource” within the state’s education funding formula, called TEEOSA (the Tax Equity & Educational Opportunities Support Act). The state uses TEEOSA to try to even out funding between districts with high property values, and thus significant local resources from which to draw funding, and those with low property values and fewer resources.

Equalization formula

The basic calculation in TEEOSA is needs – resources = equalization aid. Needs are what it costs the school district to educate all of its students and resources are the revenue sources, such as taxable property, that it can tap to pay those costs. Equalization aid is funding distributed by the state to help make up the difference between the needs of a district and its resources.

Right now, state special education costs are considered a need and special education reimbursements are considered a resource, so for most school districts, they cancel each other out within the formula. However, for equalized districts that may have special education costs greater than 10% of what they spent the prior year, the excess will be considered a need and the state will pick up more of the cost than it would otherwise.

Critical investment

Special education is a critical and significant investment the state makes in the well-being of Nebraska students and it’s important that we be thoughtful about how best to help school districts fund these vital services.