It’s tax season, and many of us are trying to figure out what we owe. The Nebraska Legislature is also looking into that question. A few bills introduced in the Legislature – including one up for debate this week – would provide tax credits for charitable donations to certain organizations. However, taxpayers already get a tax benefit for the exact same donations through a tax deduction, although smaller than what has been proposed in legislation.

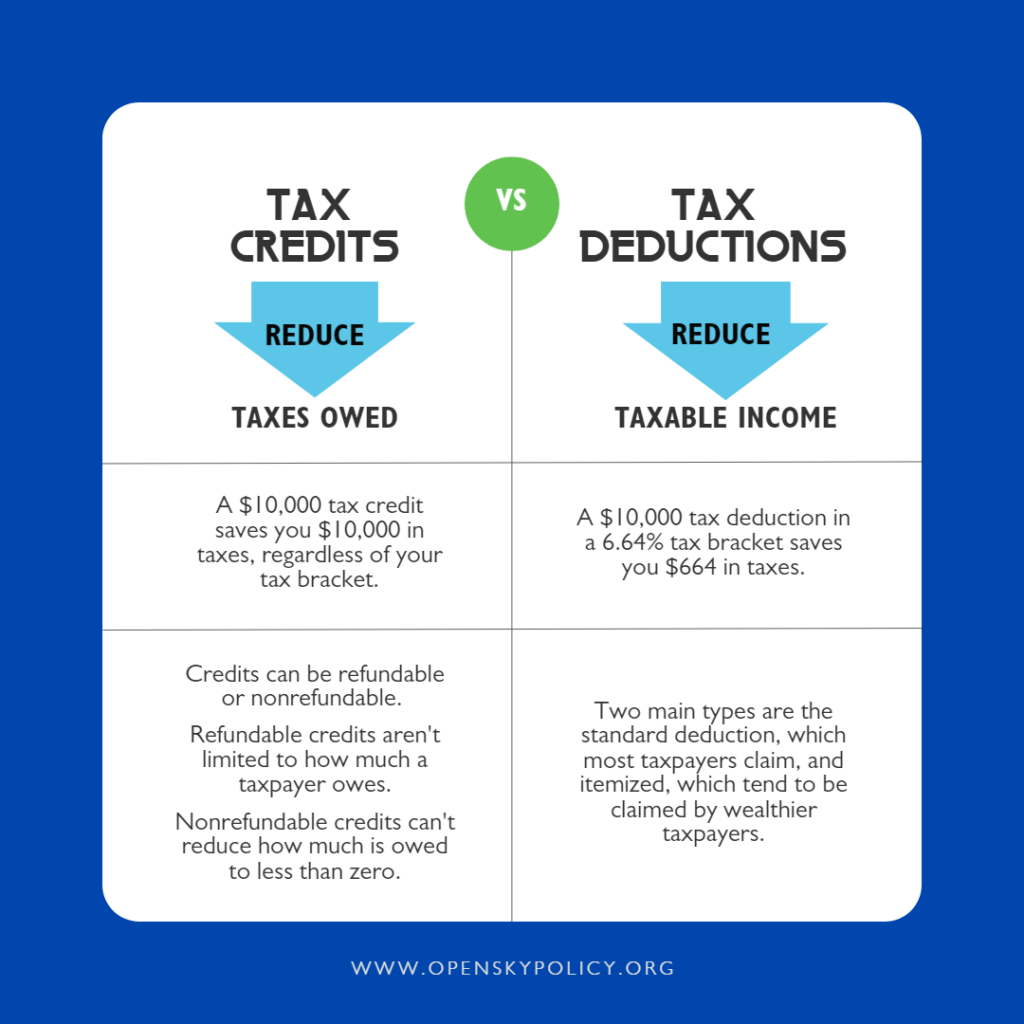

Deductions reduce how much of a taxpayer’s income can be taxed. Credits, on the other hand, reduce how much in taxes a taxpayer owes.

For example, a $10,000 income tax deduction means you can take $10,000 off your income before you calculate how much you owe in taxes, also known as your tax liability. A $10,000 income tax credit, however, is subtracted after you’ve already calculated how much you owe.

If it’s a refundable credit and you owe less in taxes than you received in the credit, the government must refund, or return to you, the difference. A non-refundable credit won’t get you a refund, but it can sometimes be carried forward to allow you to claim the credit in future years, assuming you have the tax liability at that point.

Because deductions reduce the income on which the income tax rate is applied, they can only save you as much as the highest tax rate multiplied by your deduction amount. In Nebraska, the top individual income tax rate is 6.64%, so a $1,000 deduction could be worth at most $66.40.

Credits are applied after the amount you owe in taxes has been calculated. If a taxpayer owes $1,000 in taxes and has a $1,000 credit, the amount they owe becomes $0.

Bill would give greater tax benefits for donations to private schools than for public

LB 753, for example, would give a tax credit to any person or business entity that makes a donation to a scholarship granting organization (SGO), so long as they don’t also claim that donation as a deduction. That means someone who gives a $100,000 donation to an SGO and who has at least $200,000 in income tax liability could claim a tax credit equal to their full donation. Their income tax liability would be dropped to $100,000.

That same $100,000 donation to a public school foundation, however, would only allow the donor an income tax deduction, reducing the amount of income on which they’d pay taxes by at most $6,640. That deduction would thus be worth 15 times less than the same donation made to an SGO.

While both are ways to reduce how much a taxpayer owes – or, in the case of a refundable credit, is owed – there are big differences in how each one functions, especially with charitable donations.

Space available for OpenSky webinar on taxation and migration on March 7

Join us for a discussion with Professor Josie Schafer from the University of Nebraska – Omaha and Professor Cristobal Young of Cornell University at 12:15PM CT on March 7 on what drives interstate migration to and from Nebraska and how much taxes play a role in migration decisions.