LB294 – a proposed state-level child tax credit – will be the focus of a public hearing at the State Capitol on Wednesday, February 8, 2023. The proposal would provide tax credits to many Nebraska families with children. Similar credits at the federal level have been found to provide opportunities for hardworking families by reducing child poverty while creating better long-term outcomes for the entire economy.

Proposal targets hardworking families

The child tax credit proposal in Nebraska would provide families a refundable tax credit of up to $1,000 per child, with no limit on the number of children they can claim.

LB294 targets families earning up to $75,000 for single filers and $110,000 for married filers, allowing them to qualify for the maximum credit. There’s also a designation for those filing as head-of-household, allowing them to access the full credit so long as their incomes are below $92,500.

Importantly, LB294 doesn’t eliminate benefits for families above those income thresholds but instead provides a partial credit for single filers earning up to $95,000, head-of-household filers up to $122,500 and married filers up to $150,000.

Vast majority of Nebraska children would benefit

The credit is estimated to reach 478,000 children, or about 81% of all kids in the state. Similarly, 896,000 individuals are estimated to benefit from the credit, or about 46% of all Nebraskans.

Distributional analysis shows hardworking families hit with rising costs benefit most

With high inflation and rising interest rates hitting hardworking families in their wallets, the child tax credit proposal would give more Nebraska families an opportunity to continue contributing to the state economy. Research has found child tax credits help families afford food and rent while also reducing material hardship.

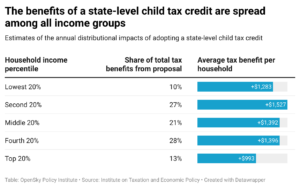

About 87% of the tax credits would flow to families making less than $125,000 per year, according to the Institute on Taxation and Economic Policy (ITEP). This stands in contrast to recent tax cuts enacted in 2022, as well as to proposals introduced in the current session. LB873 (2022) enacted a series of step-downs in Nebraska’s personal and corporate income tax rate, but both only apply to the top rate. Low-income Nebraskans will see very little benefit from the cuts, as ITEP estimates that 83% of LB873’s tax cuts will benefit just the top 20% of Nebraskans.

Further, the 80% of Nebraska families who make under $125,000 would receive an average credit of $1,400 from the child tax credit proposal. And while last year’s tax cuts provided minimal benefits to the opposite (lower) end of the income spectrum, the child tax credit would provide meaningful credits to families across the income spectrum, as the wealthiest 20% of families would also receive an average credit of just under $1,000. (See figure below.)

ITEP estimates the cost of the child tax credit at about $350 million, annually.

Federal credit proves a powerful tool

Created in 1997, the federal child tax credit reduces tax liability for parents and legal guardians and, for some, provides income support. Currently at $2,000 per child, the credit is partially-refundable and was increased under the 2017 Tax Cuts and Jobs Act. It’s set to expire after 2025 and, if not extended, will drop to $1,000 per child. The current credit extends benefits to higher-income families, as well, only starting to step down for married filers at incomes above $400,000.

The federal credit became well known during the pandemic, when an expanded version was enacted through the American Rescue Plan. Though temporary, the expanded credit’s benefits were far-reaching, with dramatic reductions in child poverty and hardship among families. Its success was due largely to its increased amount ($3,600 per child), full refundability and advance monthly payments (instead of waiting until families filed taxes to receive the benefits).

Other states’ child tax credits

In recent years, state-level child tax credits have gained traction, with nine states having already adopted the idea. Further, several states, including Arizona, Minnesota and Montana, are considering a state-level credit this year. These state-level credits are in addition to the federal child tax credit families receive.

Nebraska proposal would give more families opportunity to build “The Good Life”

LB294 presents an opportunity for Nebraska to enact a tax credit for hardworking families. Though the proposal would be independent of the federal child tax credit, it would build on its successes by giving families a better shot at being able to afford essentials like childcare and food, allowing them to contribute fully to the economy.

The child tax credit proposal could also help address systemic barriers that have made it difficult for low-income families – particularly low-income families of color – to build wealth. Income in Nebraska is highly concentrated at the top of the income distribution and is held mostly by white households, who comprise 84% of all filers in the state but control 90% of the income. That disparity grows as incomes increase, as white Nebraskans in the top 20% control 52% of all income in the state.

These disparities are the result of historic policy choices that have prevented Black, Indigenous and other Nebraskans of Color (BIPOC) from being able to save and pass forward wealth at the same rates as white residents. The child tax credit would help counteract some of the effects of those policies and allow families of color to invest in the necessities required to attain “The Good Life.”

Modeling indicates the child tax credit would have proportionately greater benefits for Black, Hispanic, Asian, and multi-racial Nebraskans. The outsize benefits are in large part due to the proposed credit’s full refundability and no limit on the number of children that can be claimed. For example, the average credit would reduce taxes for the bottom 80% of all Nebraskans by an estimated 0.79% relative to income. For Black and Hispanic Nebraskans, however, that average credit relative to income would be 1.02%, 1.35%, respectively. White and Asian Nebraskans in the bottom 80% would still receive a meaningful benefit at 0.72% and 0.76% of income, respectively.

The distribution of the credit provides insight into how it would be a powerful tool at starting to remediate some of the longstanding inequities BIPOC families face. Though there is still work to be done, the credit would be a meaningful step toward making “The Good Life” accessible to all.

Conclusion

Child tax credits are an efficient and effective tool in alleviating poverty, especially for children, at the federal level. Adding a state-level credit would better target resources to those families needing the funds the most and start to address wealth inequality, especially that experienced by Black and Hispanic Nebraskans.