The school revenue cap in LB 986 – a bill being debated by the Legislature – would cause significant revenue losses for large school districts with the highest needs, such as high percentages of students who live in poverty or who have Limited English Proficiency.

Furthermore, school districts that have worked to lower property tax levies in recent years would be constrained at lower levies under LB 986, which could prevent them from being able to address major needs that might arise, a move that is concerning when schools are struggling to retain qualified teachers and other staff.

Impact on large schools with growing needs

LB 986 would limit school district revenue growth, regardless of enrollment growth or other educational needs. While the bill contains several potential cap mechanisms, most of the caps would be too low to ever be implemented, which means school districts would mostly be subjected to a provision in the bill that limits growth in property tax asking to 2.5% over the previous year’s tax asking. The bill does allow districts to enact overrides to access more revenue but the override rate is lowest for large districts and OpenSky modeling shows that it often isn’t large enough to make up for the revenue loss that districts would endure.

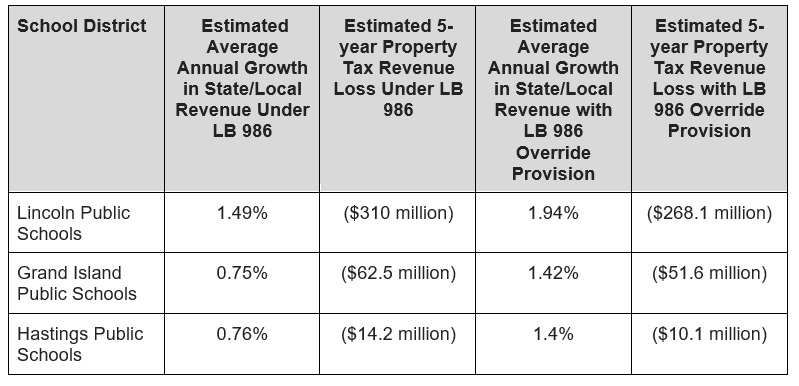

OpenSky analysis shows large districts with high needs are likely to see significant revenue losses under the 2.5% cap as well as under the override provision. The table below shows the impact on Lincoln Public Schools, Grand Island Public Schools and Hastings Public Schools had the 2.5% cap been in place between FY17 to FY 21.

LB 986 likely to hold school district’s state and local revenue growth below 2.5%

OpenSky analyzed how 20 school districts would have been impacted by LB 986 over the course of five years. None of the 20 districts would have experienced average growth in state and local revenue of 2.5% or greater. The average state and local growth in revenue was 1.53% with some districts seeing growth as low as 0.61%.

Districts could be crunched by previous efforts to keep taxes down

Many districts – particularly those in rural areas – have worked to keep property taxes down in recent years. LB 986 would force these schools to maintain these lower tax levels, which would make it hard for them to adjust to emerging needs without having to get an override vote of at least 60% of voters or 75% of the school board.

Blair Public Schools, for example, kept its property tax request from FY 2017 to FY 2021 at 1.6%. Had a 2.5% property tax asking cap been in place, however, Blair would have had $2.1 million less over that time because of fluctuations in state and local revenues. While Blair would have been able to gain $4.9 million under the override provision, some schools may find it difficult to override the revenue cap each year, which many may need to do to maintain the services they provide their students.

School spending is not the problem, low state support is

Nebraska’s public schools are already subject to tax and spending caps and adding further restrictions by way of LB 986 could harm funding at a time when schools are already struggling. Such caps also fail to get to the heart of Nebraska’s high reliance on property taxes – low state support of K-12 education and other local governments. Census Bureau data show Nebraska ranks 49th in the level of K-12 support that comes from the state and we rank 2nd in terms of reliance on property taxes to fund schools.

Rather than constraining funding, the 2013 Tax Modernization Committee recommended increasing state support to schools as the best way to ease property taxes in Nebraska. In this regard – LB 890 and LB 891 – which propose increased state dollars for K-12 education – present a better way to provide property tax relief.

First round debate on LB 986 will continue Wednesday morning. Nebraska Public Media will stream debate live.