Non-Nebraskans, corporations and wealthy residents would be big winners under the income tax cuts proposed in LB 938 and LB 939 – two bills before the Revenue Committee today.

Meanwhile, the bills – which would ratchet the state’s top corporate and personal income tax rates to 5.84% over four and three years respectively – offer most Nebraskans little tax savings while depleting revenue needed to fund services like schools, health care and public safety, which are the bedrocks of a strong economy.

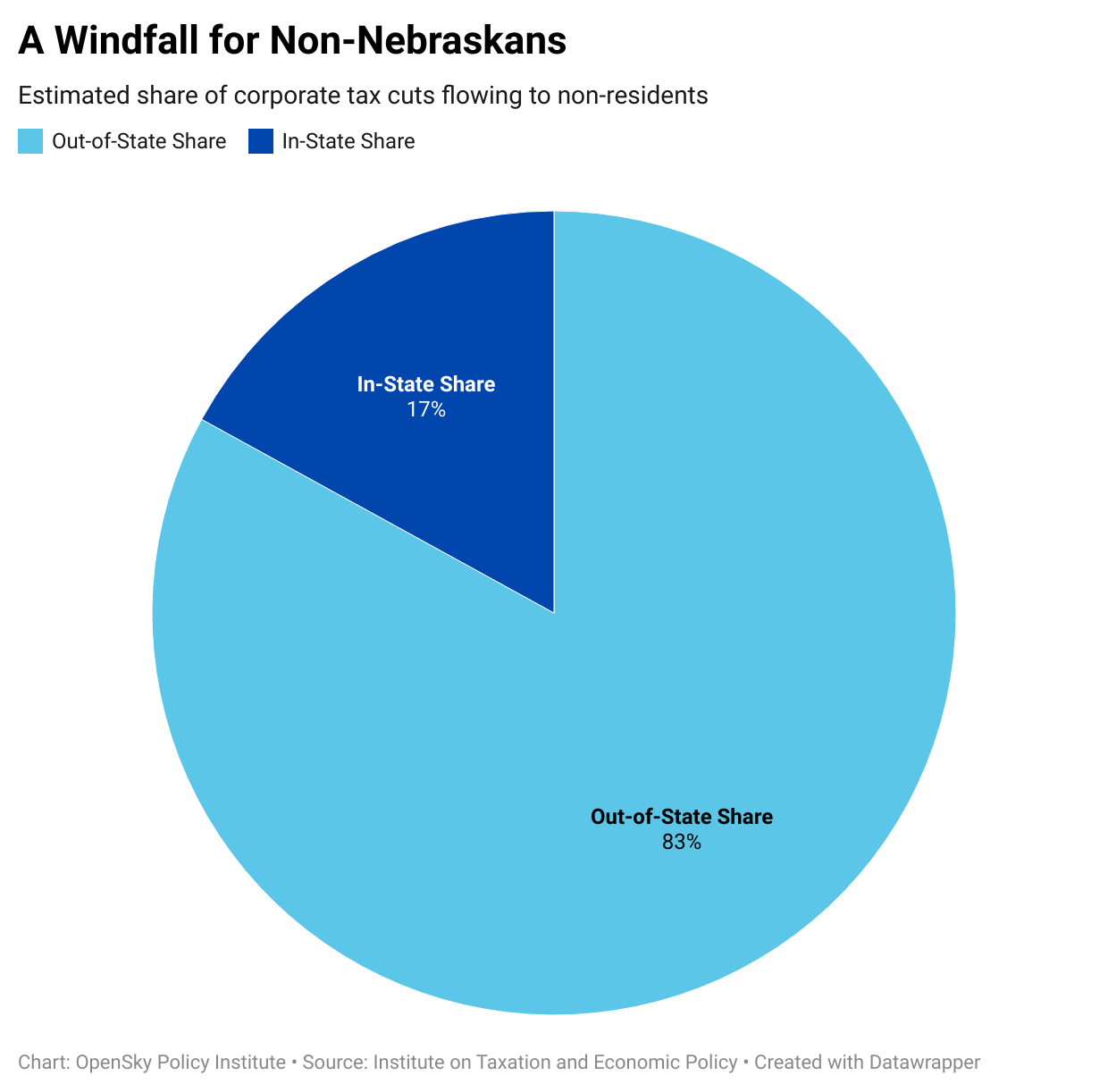

LB 938 ships its tax cut out of state

According to Institute on Taxation and Economic Policy (ITEP) analysis, at least 83% of LB 938’s corporate income tax cut would flow to out-of-state taxpayers. This me

Personal income tax cut for the wealthiest dwarfs the cut for average Nebraskans

About 84% of LB 939’s personal income tax cut would go to the highest-earning 20% of Nebraskans with about 29% of the tax cut going to Nebraskans with the highest 1% of incomes – those making $559,000 or more, the ITEP analysis shows. The average tax cut for 80% of Nebraskans who make less than $125,000 is less than $63 while the average tax cut for Nebraskans with the top 1% of incomes would be more than $8,900. This means the tax cut for the highest-income residents would be at least 142 times greater than the average tax cut the vast majority of Nebraskans would experience.

Rate parity wouldn’t guarantee level playing field for businesses

Presently Nebraska’s top corporate rate is 7.5% and the top personal income tax rate is 6.84%. LB 938 and LB 939 would bring the rates into alignment, establishing “rate parity.” Despite the claims of some proponents, this wouldn’t guarantee a level playing field between business types. There are, in effect, two business tax codes that apply to different types of businesses, causing each to pay taxes differently both at the federal and state levels. In the absence of federal changes, achieving parity at the state level would be extremely difficult.

Revenue losses would hinder key investments

In their research of the effect of tax cuts and budget cuts on economies, Wichita State University professors Arwiphawee Srithongrung and Ken Kriz found the negative effects of funding cuts typically significantly outweigh any positive economic impact of tax cuts.[2] The annual revenue reductions caused by the bills – $53 million and $363 million[3] respectively when fully implemented – would be significant and leave Nebraska vulnerable to major budget cuts, particularly when the federal relief dollars currently bolstering our economy stop flowing.

The hearings on LB 938 and LB 939 start at 1:30 p.m. in Room 1524 of the State Capitol. Nebraska Public Media will stream the hearings live.