Download a printable PDF of this analysis.

For numerous reasons, claims that reducing the personal income tax in Nebraska will promote economic growth are unsubstantiated.

Whether one looks at overall economic growth, employment levels or small-business job creation, data from across the United States show no clear relationship between personal income taxes and a state’s economic well-being.

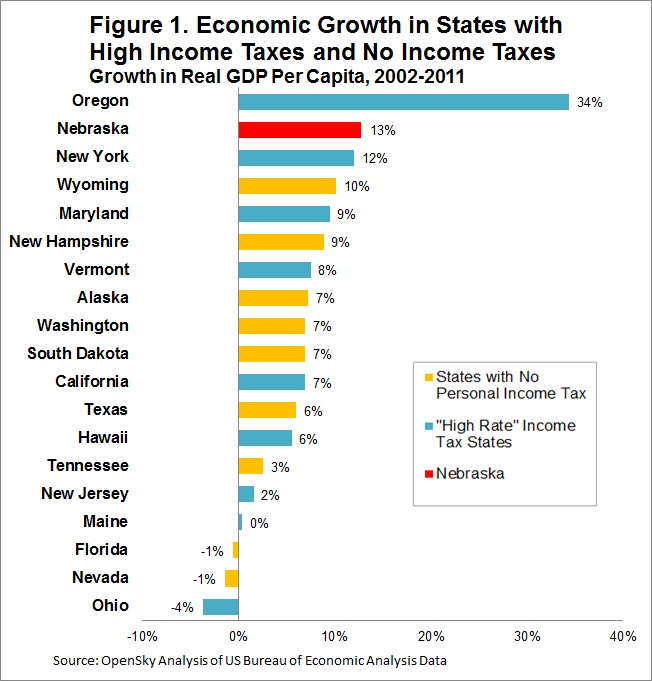

High income tax states perform just as well as no-income-tax states

Many of the states known to have relatively high income taxes have economically outperformed many of those that have no income tax at all. (Figure 1)

And Nebraska, which has individual and corporate income taxes, has seen its per capita GDP grow faster in the last decade than all of the states that have no income tax.

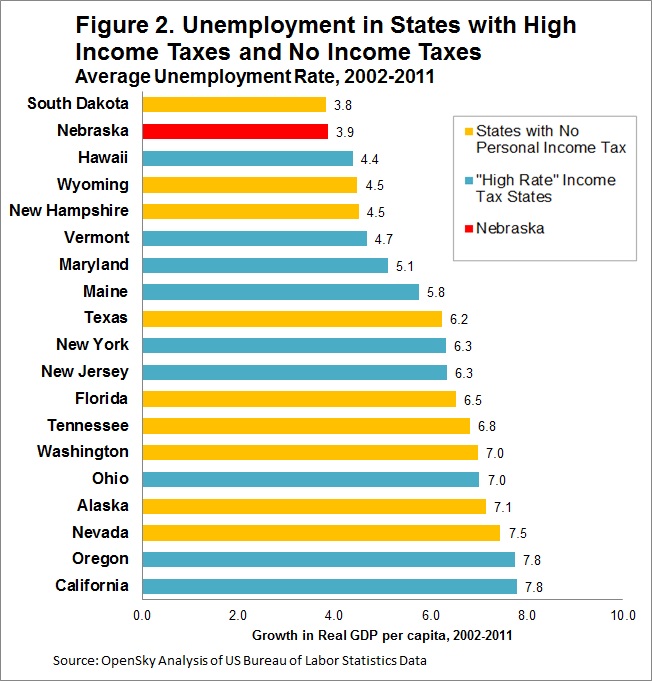

High taxes don’t correlate with unemployment

Research also shows there is no clear relationship between personal income taxes and unemployment. (Figure 2)

Many high-income-tax states have low unemployment and many states with no income tax have high unemployment.

And as is the case with GDP, Nebraska outperforms nearly all of the states without income taxes in unemployment, too.

In fact, a 2012 study of state economies and personal income taxes commissioned by the U.S. Small Business Administration found there is “no evidence of an economically significant effect of state tax portfolios on entrepreneurial activity.”[1]

Another study last year found no correlation between the location of businesses on Inc. magazine’s annual list of the 500 fastest-growing U.S. companies and the Tax Foundation’s State Business Tax Climate Index.[2]

No personal income tax=more hiring?

Because many business owners set up their companies so they pay individual income taxes rather than corporate income taxes, it is sometimes argued that eliminating the individual income tax will spur job creation.

But that is not really the case.

Nationwide, only 2.7 percent of personal income tax payers are owners of small businesses with employees other than the owners themselves.[3] Eighty-seven percent of small businesses make less than $50,000 in total income. The average small business subject to the individual income tax has $23,414 in taxable income.[4]

A business that size in Nebraska would pay less than $900 in income tax. That’s unlikely to be enough to offset the higher prices and sales taxes it would pay under the proposed tax shift, and even less likely to be enough to help it expand. In fact, the business is more likely to face a net tax increase.

So what does spur economic growth?

Businesses add jobs when they need more employees to meet the demand for their products. No business owner would hire more employees if his or her taxes were cut unless customer demand rose.

But the tax shift proposed in LB 405 would raise taxes on middle- and low-income families in Nebraska.[5] Those are the consumers most likely to spend their paychecks here in Nebraska and stimulate our economy. When the majority of the population has less money to spend, most businesses will suffer and it is highly likely that this will reduce rather than create jobs.

Protect the foundation

Nebraskans know what has driven the state’s economy and job creation over the years: investments in what really works, like high-quality schools, a skilled workforce, modern transportation systems, safe communities, and other building blocks of widespread prosperity.

The tax shift proposed in LB 405 would threaten Nebraska’s availability to make these crucial investments,[6] and it will create a tax shift that is highly likely to reduce funds available for education, health care, and other vital services.

Nebraska has a strong economic foundation because it invested wisely.

It’s a foundation that could significantly erode if Nebraska shifts away from the state income tax in the name of economic growth, and in the face of such strong evidence that doing so won’t work.

[1] Donald Bruce and John Deskins, “Can State Tax Policies Be Used to Promote Entrepreneurial Activity? Small Business Economics, 2012; http://www.springerlink.com/content/5q0721u362262340/.

[2] Yasuyuki Motoyama and Brian Danley, “An Analysis of the Geography of Entrepreneurship: Understanding the Geographic Trends of Inc. 500 Companies Over Thirty Years at the State and Metropolitan Levels,” Ewing Marion Kauffman Foundation, September 2012, p. 22.

[3] Matthew Knittel, Susan Nelson, Jason DeBacker, John Kitchen, James Pearce, and Richard Prisinzano, “Methodology to Identify Small Businesses and Their Owners,” Office of Tax Analysis, U.S. Department of Treasury, August 2011, Table 14; http://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/OTA-T2011-04-Small-Business-Methodology-Aug-8-2011.pdf.

[4] The Treasury study used a variety of criteria to remove from their analysis businesses those that consist of an individual providing employee-like services to a single company, people renting out a residence or farmland with no active management of the property, business entities used to enable multiple individuals to pool their assets for passive investment in other companies, and so on. They did not provide state-specific data and data are not available to replicate this analysis for only Nebraska businesses. Internal Revenue Service data for all Nebraska partnerships and s-corporations show an average net income of $44,960 in 2010. The Treasury data on small businesses of these types average $59,009 in 2007. There are many differences between those datasets, but these numbers suggest that Nebraska’s businesses may tend to be smaller than the national average.

[5] See our analysis of the distributional impact of LB 405 and LB 406 here: https://www.openskypolicy.org/80-percent-of-nebraskans-would-see-tax-increases-if-income-taxes-are-cut.

[6] This analysis can be found here: https://www.openskypolicy.org/revenue-neutral-claims-raise-an-eyebrow.