Policy brief: Bills would add needed oversight to Tax Increment Financing

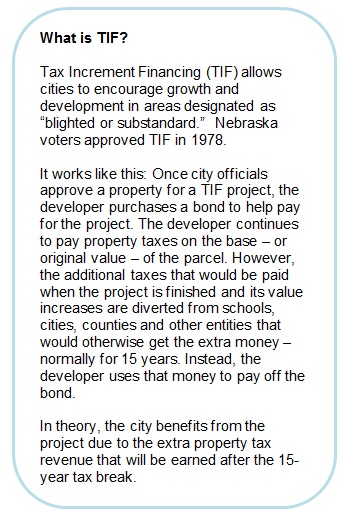

Increased oversight of Tax Increment Financing – or (TIF) – which is the focus of two bills before the Legislature – would help ensure the programs work as intended while not creating unintended consequences that affect school funding and property taxes.

TIF is meant to help cities revitalize blighted areas but some say the state needs to revamp TIF law to provide greater transparency, reduce disparity in application, and to provide a role for schools, counties and other entities in the process, as they have little say in how TIF is used, even though they lose millions of dollars in revenue each year from the tax breaks included in such projects.

The bills – LB 445 and LB 596 – would create auditing processes related to TIF projects.

Local governments lose money, have little say in process

Existing TIF projects reduce the value of property on the tax rolls statewide by some $2.6 billion. That translates into a loss of $55 million in property taxes by schools and other political subdivisions, such as cities and counties, natural resource districts and community colleges.[1]

Nebraskans end up paying about $22 million in additional income and sales taxes because the properties in TIF projects are taken off the tax rolls, triggering increases in state aid to school districts that see their ability to collect local revenue diminished.

The reason for this is that more state aid goes to districts with lower taxable property wealth, and TIF decreases districts’ taxable property wealth, which results in more state aid for districts that contain a TIF project and receive equalization aid.

TIF effect on the General Fund

For FY 15, K-12 property tax revenues will be reduced by about $30 million due to TIF, about $21.6 million of which will be offset by increased state aid, reducing total funding for K-12 by about $8 million. Of that total, non-equalized districts will lose $2.9 million.

For other local subdivisions such as counties, municipalities, community colleges, and natural resource districts, TIF projects reduce property tax revenues with no offsetting compensation from the state. In 2013, the losses for these subdivisions totaled about $25 million, including $7.6 million for county governments.

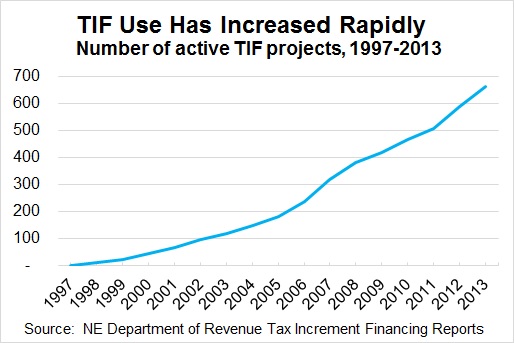

TIF use has increased dramatically, but oversight lags

The number and scope of TIF projects has increased dramatically. In 2003, there were 121 active TIF projects in Nebraska. That increased to 665 projects in 2013 (see chart).

However, cities use TIF with no oversight from the state or other jurisdictions affected by the projects. Furthermore, communities vary drastically in their application of TIF, despite the implications for taxpayers throughout the state. And while many local governments lose revenue because of TIF, they don’t have a seat at the table when decisions are made about TIF projects. All of this has led to citizen concern and projects that are not implemented according to best practices.

Conclusion

TIF audits – proposed in both LB 445 and LB 596 – can improve the transparency and accountability in the program. Additionally, LB 596 gives schools, counties and other local entities a say in these projects and creates a new TIF division that can help ensure TIF projects meet statutory requirements and are applied consistently across the state.

Download a printable PDF of this analysis.

[1] NE Department of Revenue TIF Data, http://www.revenue.nebraska.gov/PAD/research/tif_reports.html