EDITOR’S NOTE: As our state and nation continue to confront the COVID-19 pandemic, state fiscal and federal policies will play key roles in ensuring the physical and economic health of Nebraska and its residents. OpenSky Policy Institute staff will be continuously analyzing state and federal policies that impact Nebraskans during this national emergency. This analysis is part of that effort. You can access more of our pandemic-response policy analysis here. We also remind you that OpenSky staff are working remotely during the pandemic response. Remote contact information for staff members can be found here.

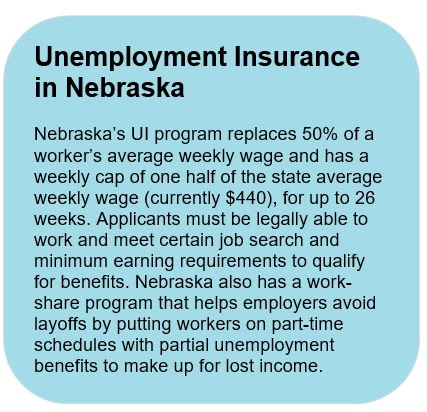

As the COVID-19 virus and efforts to contain it disrupt the workplace through layoffs, quarantines, and other dramatic upheavals, unemployment insurance (UI) can provide some temporary stability for workers who have their hours reduced or find themselves between jobs.

Program changes could help thousands of working families weather the COVID-19 crisis

Unemployment claims in Nebraska have skyrocketed, up to 15,668 initial claims for the week ending on March 21, which is more than five and a half times the previous high since the start of the 2018 fiscal year.[1] This mirrors national trends, as unemployment claims have risen by more than 3 million across the country. Even with moderate fiscal stimulus, early estimates suggest Nebraska could lose between 85,000[2] to 90,000 jobs by summer.[3] Changes to the UI program at both the state and the federal level can preserve the economic well-being of many working families, especially those living paycheck to paycheck.

Federal funds can help offset costs

Last week, the federal government provided $1 billion in emergency funding for state unemployment agencies, with half of the money contingent on states taking emergency steps to expand UI access. Congress has subsequently passed a $2 trillion stimulus package that established Pandemic Unemployment Assistance (PUA) through the end of 2020 for those not traditionally eligible for unemployment benefits (such as self-employed workers or independent contractors) unable to work as a direct result of the COVID-19 emergency, retroactive to January 27th. The package also provides an additional $600 per week of “Pandemic Employment Compensation” to recipients of UI or PUA for up to four months, 13 additional weeks of coverage for those who have exhausted their state benefits (26 weeks in Nebraska), and reimburses nonprofits, government agencies, and Indian tribes for half of their UI costs.[4] An in-depth summary of the UI provisions included in the Coronavirus Aid, Relief, and Economic Security (CARES) Act can be found here.

Nebraska has taken important steps to temporarily expand UI access

In line with federal recommendations, Nebraska has issued an executive order changing requirements for UI claims filed between March 22 and May 2, with an understanding that the timeframe could be extended if needed. The order waives the one-week wait time to start collecting benefits, waives the requirement that recipients be looking for and willing to work and waives charges incurred by employers whose team members are filing claims related to COVID-19, as unemployment benefits are typically paid using contributions from employers.[5] The order also directs the Commissioner of Labor to treat workers who are unpaid as a result of COVID-19 exposure or illness as being on a temporary layoff and attached to their employment, ensuring that they are able to qualify for UI.[6]

Nebraska could implement long-term policy changes to increase UI benefits and raise the state’s low recipiency rate

While the executive order immediately bolsters Nebraska’s UI system, the current crisis highlights the need for more comprehensive and permanent reform. At the end of last year, Nebraska had a UI recipiency rate of 10%, meaning that 90% of unemployed individuals in the state weren’t receiving any benefits. That rate is the second lowest in the country, ahead of only Mississippi.[7] Thirty states had a recipiency rate of 25% or greater.

Nebraska could look at permanently loosening restrictions to UI, including lowering weekly job search requirements. The current requirements begin at five job contacts and one application for suitable work per week and ramp up to five job contacts on at least four different days and two applications for suitable work per week,[8] which can be particularly onerous for rural Nebraskans to meet and maintain. Additionally, to collect UI in Nebraska, a person must have earned at least $4,135 in the base period (the first four of the previous five quarters) including at least $1,850 in one quarter and at least $800 in a different quarter.[9] This minimum earning requirement puts an additional burden on low-income workers; states that partially base their qualifications on hours worked generally have higher recipiency rates.[10]

In addition to lowering barriers to UI access, Nebraska should consider raising the wage replacement rate and maximum weekly benefit to reinforce the state’s support of its workforce. Nebraska’s replacement rate of 50% means that a 40-hour/week, minimum-wage worker (currently $9 per hour for non-tipped employees) would receive $180 per week in benefits; the equivalent of $9,360 per year. Because the current weekly cap of $440 equates to only $11 an hour, or $22,880 per year, the state should consider raising the maximum weekly benefit as well.

To help weather the COVID-19 crisis, Nebraska could take further steps to ensure that those in need can access UI benefits. An executive order in North Carolina directs the state’s Department of Commerce to “identify other state laws, regulations, and policies that may inhibit the fair and timely distribution of unemployment benefits [and with Gubernatorial permission] may interpret flexibly, waive, or modify [them].”[11] As a state with historically low UI coverage, Nebraska could benefit from a similar directive to identify and waive barriers to recipiency. It is also critical that UI benefits are not treated as income in determining eligibility for means-tested programs, such as Social Security Income (SSI) and the Supplemental Nutrition Assistance Program (SNAP), so that qualifying families can continue to receive benefits. Finally, Nebraska should consider extending UI benefits to its undocumented residents, who currently do not qualify for any benefits at the state or federal level yet face monumental financial challenges during this crisis.

Conclusion

While the average amount of benefit provided in Nebraska isn’t low compared to other states — we ranked 18th at the end of 2019[12] — these funds are often insufficient and are only reaching a select group of people. Taking permanent steps to reinforce the state’s support for our workforce and help unemployed Nebraskans access much-needed benefits will strengthen the state and help Nebraska weather future economic downturns.

Download a printable PDF of this analysis.