EDITOR’S NOTE: As our state and nation continue to confront the COVID-19 pandemic, state fiscal and federal policies will play key roles in ensuring the physical and economic health of Nebraska and its residents. OpenSky Policy Institute staff will be continuously analyzing state and federal policies that impact Nebraskans during this national emergency. This analysis is part of that effort. You can access more of our pandemic-response policy analysis here. We also remind you that OpenSky staff are working remotely during the pandemic response. Remote contact information for staff members can be found here.

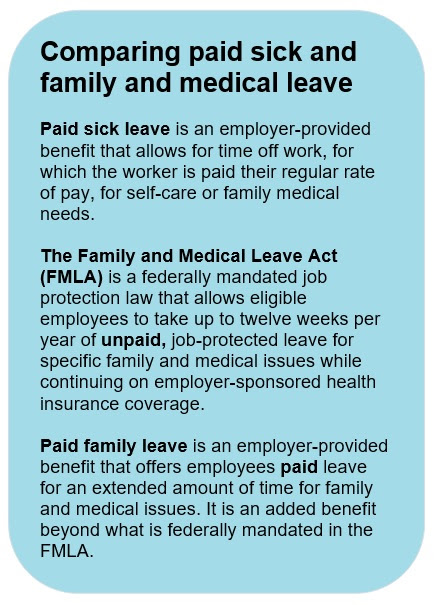

Paid sick and family and medical leave — particularly in an instance such as the COVID-19 pandemic — offer workers peace of mind by ensuring at least partial pay if they or their families fall ill. The extent to which the spread of the virus is successfully stopped will, in part, depend on ill workers staying home and studies have shown that paid leave provisions reduce transmission of viruses.[1]

Congress recently passed important changes regarding paid leave that will help many Nebraskans amid the COVID-19 pandemic. Federal and state leaders, however, can further mitigate the effects of the virus on Nebraskans by taking additional actions to extend paid leave benefits to more workers.

What Congress did

The Families First Coronavirus Response Act (FFCRA)[2] passed by Congress provides the following paid leave for all public employees and many private sector employees unable to work or telework because of specific instances arising from COVID-19:

- Two weeks (up to 80 hours) of paid sick leave at the employee’s regular rate of pay (up to $511/day) where the employee is unable to work because the employee is quarantined and/or experiencing COVID-19 symptoms and seeking a medical diagnosis; or

- Two weeks (up to 80 hours) of paid sick leave at two-thirds the employee’s regular rate of pay (up to $200/day) because the employee is unable to work because of a bona fide need to care for an individual subject to quarantine, or to care for a child whose school or child care provider is closed or unavailable; and

- Up to an additional 10 weeks of paid expanded family and medical leave (EFMLA) at two-thirds the employee’s regular rate of pay (up to $200/day) where an employee is unable to work due to a bona fide need for leave to care for a child whose school or child care provider is closed or unavailable for reasons related to COVID-19.[3]

Both FFCRA paid leave provisions, however, exclude employers that have more than 500 employees, and the Act allows the Department of Labor to exempt certain employees, including health care providers and emergency responders. Further, businesses with fewer than 50 employees may seek an exemption from the paid leave requirements if they would “jeopardize the viability of the business.”[4] The new law begins April 1, is not retroactive,[5] and sunsets on Dec. 31.[6]

FFCRA provisions contain some gaps for employees

While FRRCA is a huge step forward in acknowledging that families need paid leave during this time, the paid sick leave provision of up to two weeks of paid time off at their regular rate of pay (up to the cap) doesn’t necessarily reflect the realities of COVID-19, which can take up to 14 days to present symptoms after infection.[7] An employee subject to a 14-day quarantine who in turn presents symptoms will not have enough paid sick leave from the FFCRA to cover the entire span of their illness. Also, while those with extenuating circumstances have the ability to take time off to care for their children at home, FFCRA only guarantees they receive two-thirds of their full rate of pay, which could create hardships for those without much cushion in their budget. Furthermore, the FFCRA provisions related to paid family and medical leave do not cover family caregivers of the elderly or disabled when normal caregivers are unavailable because of the virus.

How FFCRA impacts employers

The paid leave provisions of the FFCRA provides employers federal reimbursement to help them cover some of the cost of the mandated paid leave benefits during the pandemic. This will help employers weather the economic fallout from the pandemic, which will help protect jobs. However, employers will only be reimbursed for the minimum benefits required- any sick leave beyond two weeks, for example, would be borne by the employer. Furthermore, this assistance does not address the loss in productivity many businesses and nonprofits will encounter as a result of employees being unable to work during the pandemic, although the CARES Act does provide some assistance that we will address in a future publication.

How employer costs are covered

Employers subject to the paid leave provisions of the FFCRA will be fully reimbursed by the federal government for the employee’s self-care at their regular rate of pay for up to two weeks of sick leave up to the cap of $511 per day (if caring for a sick family member or children whose school or child care provider is unavailable, it is reimbursed at two-thirds their regular rate of pay, up to $200 per day). Employers also will be reimbursed for two-thirds of the employee’s regular rate of pay for up to an additional ten weeks of paid EFMLA for childcare up to the cap of $200 per day beyond the two weeks of paid sick leave.

Employers will receive a refundable tax credit for all qualifying wages and health insurance coverage costs paid.[8] To access the tax credits, businesses can keep the funds they would normally remit to the IRS to pay payroll taxes.[9] If the payroll taxes kept are insufficient to cover the paid leave costs incurred, employers can obtain a refund.[10]

Paid leave in Nebraska and other states

Without robust paid leave policies — at the federal or state level — workers without paid leave are faced with a daunting situation: work while potentially ill and risk the spread of disease or stay home without pay and risk unemployment. Nebraska does not require paid sick leave for employees but 13 states plus Washington D.C. have enacted laws to require it.[11]

Furthermore, 81% of people working in the United States don’t have access to paid family leave through their employer[12] and only 8 states plus Washington D.C. require some form of paid family leave for employees.[13] Since the onset of the coronavirus pandemic, other states have begun to look at expanding paid leave benefits. For example:

- A New Jersey bill would provide paid leave for local government employees for COVID-19-related issues without having to utilize accumulated leave time.[14]

- An Ohio bill would require fourteen days of paid leave for employees subject to (or caring for a person in) quarantine or isolation and establish a grant program to compensate contract workers who cannot work during public health emergencies.[15]

- Colorado’s governor issued an executive order directing the Department of Personnel and Administration to publish emergency rules ensuring state workers subject to mandatory or voluntary quarantine or isolation have access to paid leave.[16]

Nebraska policymakers may consider enacting similar measures and also taking steps to ensure that all Nebraska workers receive paid sick and paid family and medical leave benefits. This will help protect Nebraska employers and workers during this crisis and beyond.

Conclusion

COVID-19 has highlighted the important role of paid leave policies in protecting workers and employers. The implementation of statewide policies requiring paid sick leave and paid family leave would help prevent Nebraskans from feeling they have to work even though they are sick, which would slow the spread of the virus and keep other workers and the public healthy. While the FFCRA helps address the acute shock felt by some workers because of COVID-19, state and federal leaders can take further steps to ensure all Nebraska workers have access to paid leave benefits that better protect the physical and economic well-being of our state, its residents and its businesses now and into the future.

Download a printable PDF of this analysis.