Policy brief – Federal tax changes and what they mean for Nebraska

The close relationship between state and federal fiscal policies means tax changes currently being considered at the federal level could have a profound impact on Nebraska. Potential effects of federal tax changes include dramatic revenue shifts and, if tax changes are paid for with federal funding reductions, cuts to services Nebraskans need.

As the U.S. Senate prepares to vote on its budget resolution this week — a key step in the advancement of tax changes — it’s important for state and federal policymakers to keep the connection between federal and state policies in mind, particularly as there is much uncertainty surrounding the details of tax changes currently being discussed.

Federal tax changes can drastically affect state revenues

Nebraska’s tax code more closely conforms to the federal tax code than most other states in that the state tax code links to many federal credits and deductions.[1] Therefore, changes to those federal credits and deductions that also are part of the state tax code would be automatically impacted and have significant ramifications for state revenues.

For example, if the federal deduction for state and local taxes is eliminated, Nebraskans who take that deduction would see their taxable income increase, which would increase what they pay in state taxes and thus increase state revenue. Conversely, a proposed deduction to allow companies to immediately deduct the cost of capital investments could shrink some companies’ taxable income, which would decrease what they pay in state taxes, and thus result in a revenue reduction for the state.

These and other changes could impact state revenue unless Nebraska lawmakers act to de-couple from the federal tax code. This has happened in the past when federal changes would have greatly affected state revenues. For example, Congress passed a number of tax changes between 2001 and 2003 that would have caused the state to lose about $416 million in revenue between FY02 and FY07. State lawmakers responded in 2002 and 2003 by passing legislation to offset most of these changes,[2] but even with these adjustments, the federal tax changes still resulted in an estimated loss of $84 million in state revenue between FY02 and FY07.[3]

Federal tax changes could significantly impact Nebraska’s budget

To the extent that the federal tax cuts would be offset by federal funding cuts, programs and services in our state budget that receive federal dollars could be cut significantly. Even if changes to the federal tax system result in a positive revenue impact at the state level, it is possible that the impact of federal funding cuts will more than offset any new revenue that is raised.

Also, if federal tax changes result in a reduction in state revenues, the Nebraska Legislature will be faced with difficult choices. Lawmakers either will need to make funding cuts to services like education and public safety or pass more of the cost of these services on to local taxpayers in the form of increased property taxes, assuming local governments have room under their property tax levies to increase rates. If local governments don’t have room under their levies, vital services will need to be cut.

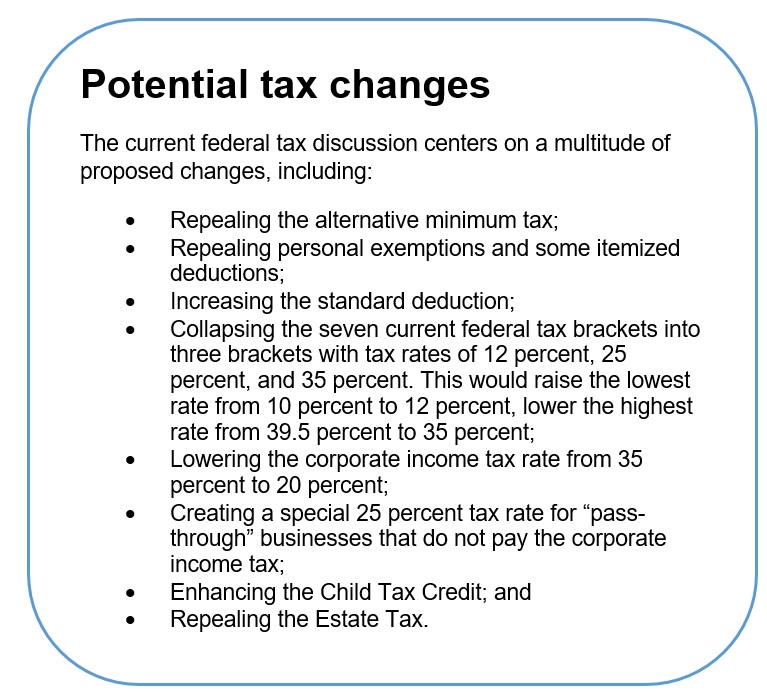

Wealthy taxpayers will save a lot, other effects for individual Nebraskans unclear

Initial analyses of the proposed federal tax changes find that the majority of the tax savings, including those focused on corporations and pass-through businesses, would go to very high income households.[4] The exact percentages vary based upon assumptions included in the analysis, but estimates show that between 53.3 percent[5} and 67.4 percent[6] of the tax benefits will go to the top 1 percent in 2018. The Tax Policy Center estimates that this percentage of tax benefits going to the top 1 percent will grow to 79.7 percent by 2027.

Other changes could potentially exacerbate issues for Nebraska taxpayers. For example, eliminating the federal deduction for state and local taxes, if enacted, could increase the stress of property taxes on Nebraska’s taxpayers. Additionally, the deduction for medical expenses could be eliminated, which could put additional pressure on Nebraskans with substantial health costs. A lack of specific details, however, makes it difficult at this time to understand the impact many of the proposed changes could have on actual taxpayers.

Conclusion

While significant uncertainty surrounds the federal tax discussion, what is clear is that federal tax changes could have major fiscal ramifications for Nebraska and its residents. Federal tax changes could put increased stress on our already strained state budget and lead to more cuts to education, health care and other services that Nebraskans need. Furthermore, some proposed changes could adversely affect individual taxpayers. With so much uncertainty and so many potential ramifications for our state and its budget, it is important for both federal and state policymakers to proceed cautiously and ensure they understand the full effects of any tax changes on the state and federal budget, as well as the individuals who rely on programs and services supported by tax revenues.

Download a printable PDF of this analysis.

_______________

[1] Pew Charitable Trusts, “Tax Code Connections: How Changes to Federal Policy Affect State Revenue,” downloaded from http://www.pewtrusts.org/~/media/assets/2016/02/fiscalfed_federaltaxpolicychangesreport_v6_web.pdf on Oct. 11, 2017.

[2] LB 1085 (2002), LB 596 (2003)

[3] OpenSky calculations based on analysis of the Nebraska Legislature’s 2002 Biennial budget and LB 1085 in and LB 596.

[4] Tax Policy Center, “Six Takeaways from the White House and Hill GOP’s ‘Big Six’ Tax Plan,” downloaded from http://www.taxpolicycenter.org/taxvox/six-takeaways-white-house-and-hill-gops-big-six-tax-plan on Sept. 27, 2017,

[5] The Tax Policy Center, “A Preliminary Analysis of the Unified Framework,” downloaded from http://www.taxpolicycenter.org/publications/preliminary-analysis-unified-framework on Oct 11, 2017 [6] Institute on Taxation and Economic Policy, “Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State,†downloaded from https://itep.org/trumpgopplan/ on Oct. 18, 2017.Â