LB 432, as amended by AM 774, will be up for debate early this week and would give a sizable tax cut to corporations and their shareholders. While the vast majority of the tax cut would go out of state, the revenue losses would threaten services relied on not only by working Nebraskans, but also by the corporations themselves, including the schools that provide them with an educated workforce and the roads they use to ship their products.

A cut to the top corporate rate and a special exclusion for offshored income

The bill, as amended, would lower the top corporate tax rate from 7.81% to 6.84%, as originally proposed in LB 680. It would also decouple the state from a tax-base-broadening provision of the federal Tax Cuts and Jobs Act of 2017 intended to recapture domestic income held by corporations in overseas tax havens, as originally proposed in LB 347. The corporate tax provisions would reduce state revenues by nearly $147 million over the next two budget cycles.[1]

LB 432 could cause Nebraska to have to return federal relief dollars

Another important factor to keep in mind as senators debate LB 432 and other tax-cut measures this session is that any revenue reductions lawmakers pass could result in a commensurate reduction of federal relief dollars, as per a stipulation in the American Recovery Plan. Guidance from the U.S. treasury regarding the use of state surplus dollars to cut taxes is pending and until it comes any tax reduction passed by Nebraska lawmakers could put the state in position to experience a double fiscal hit as it could end up forgoing revenue from the tax cut and then also have to refund an equal amount of federal dollars.

Lowering the top rate will mostly benefit out-of-state entities at the expense of Nebraskans

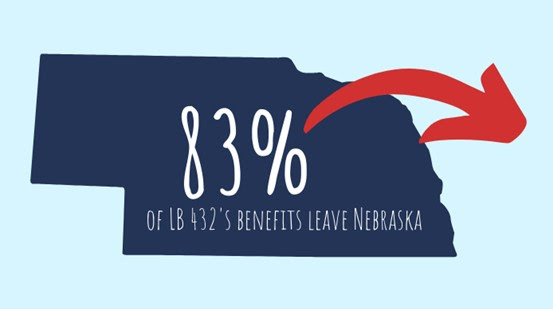

According to the Institute on Taxation and Economic Policy, 83% of

As a result, the state would be narrowing its tax base to benefit non-Nebraska residents, leaving future Legislatures to decide which other taxes to raise or which vital services to cut, many of which are shown to grow economies, like good schools.

Nebraska’s corporate tax is based on sales in the state, not location, so companies can’t reduce their liability by moving

Nebraska has what’s known as “single-sales factor apportionment,” which means that a corporation only pays taxes on their sales in Nebraska, regardless of where they are located. Because most multinational corporations would be making similar amounts of sales in Nebraska regardless of where they are headquartered, their corporate tax liability won’t change even if they move from Nebraska to another state.

Taxing GILTI is a way to ensure multinational corporations are paying their fair share to Nebraska

In a recent interview with OpenSky Executive Director Renee Fry, tax law professor Darien Shanske recommended Nebraska continue taxing this income as a way to make multinational corporations help Nebraska maintain an attractive set of services that bring people into the state and foster economic growth.

Taxing GILTI protects Nebraska’s corporate tax base from increased profit shifting

Shanske believes there are few arguments to decouple from federal taxation of GILTI, explaining that “these profits, shifted to low tax jurisdictions, were earned in the U.S., and a slice of them were earned in Nebraska. There’s no reason for a state not to protect its corporate tax base.” He calls taxing GILTI at the state level a “no brainer,” because if a state “can broaden [its] corporate tax base to include stuff that should have already been there, [it] should do it.”

Conclusion

LB 432 would not only give tax breaks to non-Nebraskans, but also reward corporations that use tax shelters to lower their liability. These breaks aren’t going to help the state accomplish its economic development goals and we would be better served by protecting our tax base and using that revenue to make targeted investments in those areas shown to boost economic growth, such as infrastructure and our educational system.

Download a printable PDF of this analysis.