Property taxes in Nebraska

Overview

In Nebraska, property taxes:

- Are levied by local governments, not the state;

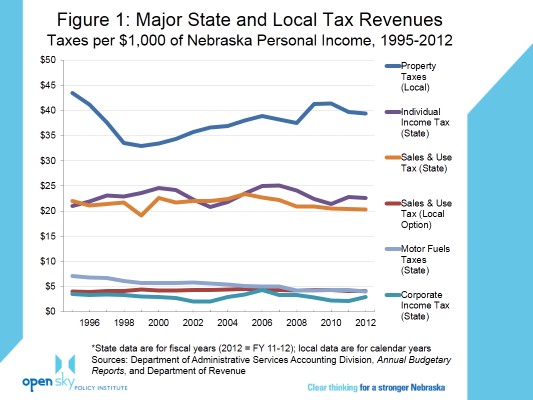

- Generate more revenue than any state tax. (Figure 1)

- Are levied at 75 percent of agricultural land valuations and 100 percent of residential and commercial property valuations.

- Account for 37 percent of all tax revenue generated in Nebraska and 44 percent of revenue generated from the three major taxes – income, sales and property.[i]

- Are “high by every measure looked at” by the Burling Commission,[ii] and continue to rise faster than inflation.

Statewide reliance

In recent years Nebraska has grown increasingly reliant on property taxes as the state:

- Now ranks fourth nationally in terms of reliance on property taxes to fund K-12 education.[iii] The latest school funding bill passed by the Legislature will slightly reduce K-12 dependence on property taxes ;[iv] and

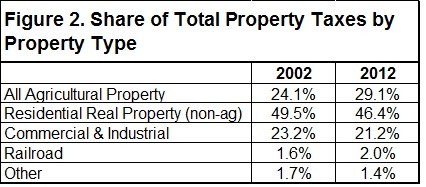

- Residential property taxes account for the greatest share of property tax revenue but in the past decade the state has become more reliant on property taxes from agriculture (Figure 2).

How state policy affects property taxes

While the state doesn’t collect property taxes, its policies have direct effects on property taxes. For example:

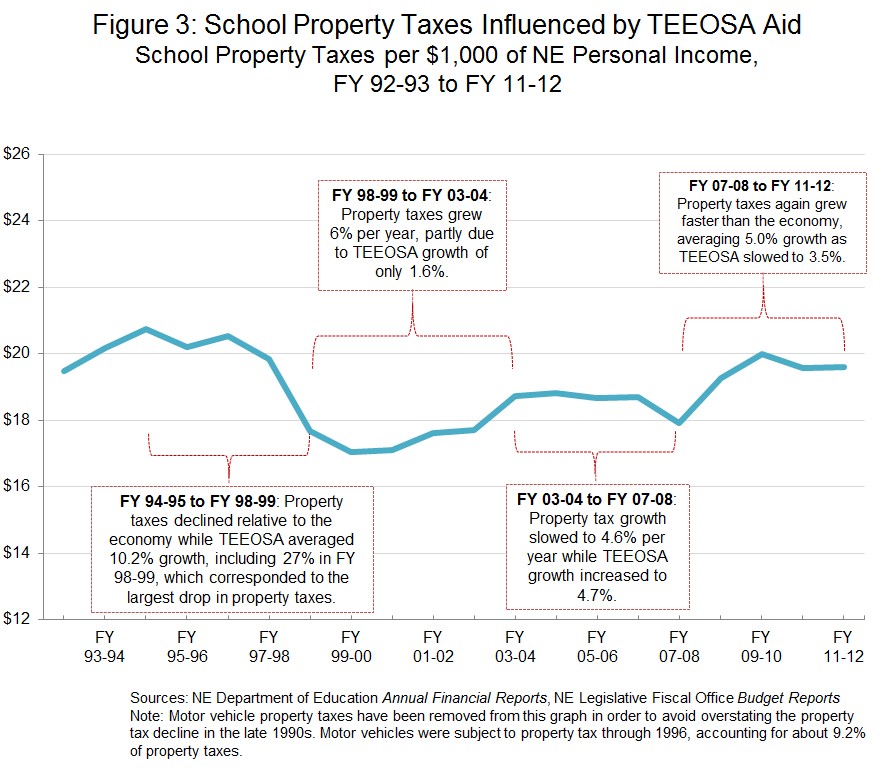

- Decreased state aid to local governments like counties, municipalities and school districts has contributed to higher property tax rates; and

- The Legislature helped lower property tax rates in the 1990s by increasing state aid to K-12 education. This took school funding pressure off local governments and temporarily led to lower property taxes (Figure 3).

[i] US Census Bureau, State and Local Finances, Fiscal Year 2010-2011.

[ii] Nebraska Tax Policy Commission (2007), p. 4-17.

[iii] US Census Bureau, 2011 Annual Survey of School System Finances, Fiscal Year 2010-2011.

[iv]See OpenSky Policy Institute, Policy Brief on LB 407, (April 2013), https://www.openskypolicy.org/wp-content/uploads/2013/04/TEESOSABrief4.21.13.pdf.