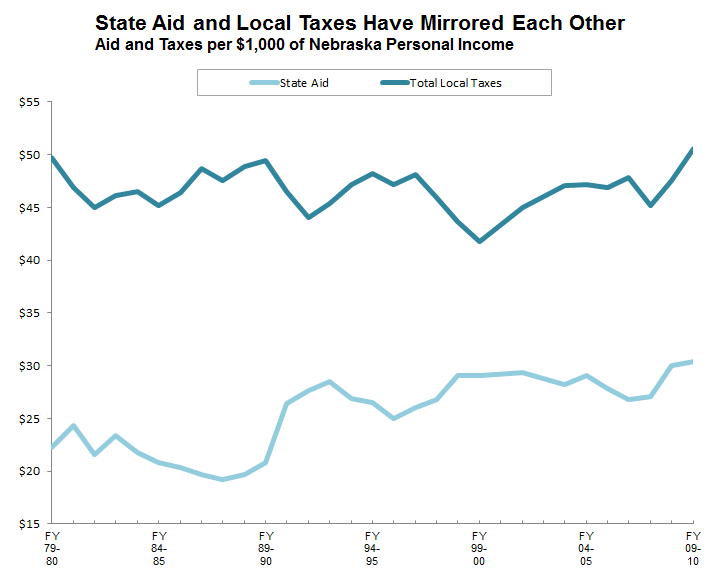

State Aid and Local Tax Trends Have Mirrored Each Other, FY 79-80 to FY 09-10

Though local taxes and spending are not technically part of the state budget, local governments partner with the state to fund and provide many crucial public services. K-12 education, funded through a mix of local taxes, state aid, and federal funding, is a prominent example. As a result, increases in state revenue are often used to help reduce local taxes, and cuts in state aid often lead to local tax increases to make up the difference. The graph below demonstrates this relationship, as state aid increases have often coincided with local tax decreases, and vice versa. Click here to go back to Primer Extras: Chapter 5 – Evaluating Nebraska’s Tax System.

Sources: US Census Bureau and US Bureau of Economic Analysis