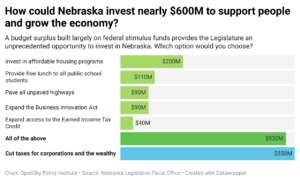

For the same cost as extending personal and corporate income tax cuts, Nebraska lawmakers could make significant investments that would benefit all residents and grow the state’s economy.

Tax cuts outlined in LB 754 would reduce the state’s revenues by $558 million over the next two years. By full implementation in 2027, the income tax cuts under consideration would reduce funds available for key initiatives in Nebraska by over $3 billion.

OpenSky looked at other proposals in this year’s session that could benefit students and families, businesses and workforce development, infrastructure and economic opportunities across the state.

Investments in those programs could touch all Nebraskans, as opposed to income tax cuts proposed in LB 754 that largely benefit wealthy residents and out-of-state corporations. At full implementation, three-quarters of the tax cut benefits proposed in LB 754 would go directly to the top 20% of Nebraska income earners.

The revenue that the state would lose under LB 754 – combined with proposals for significant property tax reductions and a long-term commitment to increase state funding to K-12 schools – could put future Legislatures in a position to have to cut services that Nebraska residents rely on daily. With state tax collections lagging projections, prudent revenue and spending decisions now are critical to keeping Nebraska on sound financial footing and helping all Nebraskans to thrive in the years to come.