The tax package designed to lower property taxes paid to local political subdivisions would increase the tax burden on low- and middle-income working families and make it increasingly difficult for cities, counties and schools to provide the services that Nebraskans expect.

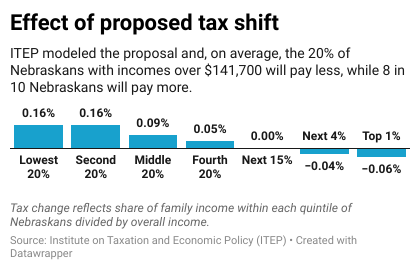

An amendment to LB 388, filed Tuesday, would raise an estimated $650 million through Nebraskans paying more in sales taxes and direct the increase to reduce what property owners pay to fund local services. Modeling indicates that, on average, the top 20% of income earners in Nebraska would pay less as a result of the tax shift while low- and middle-income Nebraskans would pay more.

The tax package is also expected to include changes in how the state funds its public schools and proposes new caps on what cities and counties can bring in from property taxes. These revenue caps are designed to ensure that the package results in a tax shift away from property taxes and onto sales taxes. The proposed tax package therefore does not represent a new state investment in K-12 education or in aiding cities and counties in providing services.

Debate on LB 388 could begin as early as Wednesday, Day 51 of the 60-day legislative session.

Wealthy Nebraskans will benefit from tax shift

-

The Institute on Taxation and Economic Policy modeled the proposed tax shift and, on average, the 20% of Nebraskans with incomes over $141,700 will pay less, while 8 in 10 Nebraskans will pay more in taxes overall (ITEP, 2024).

-

The package aims to reduce what property owners pay in property taxes and shifts responsibility to consumers. For all but Nebraska’s top earners, the sales tax increase will on average be greater than any property tax cut they may receive.

-

The result of the proposed changes would make Nebraska’s tax system more regressive by reducing the tax burden on those with the greatest ability to pay.

-

Even with the inclusion of a sales tax exemption for electricity, natural gas and propane, low- and middle-income residents will still pay more in sales and excise tax than they do currently.

Nebraskans would pay more for necessities like cars, clothes and school supplies

-

Raising the state rate from 5.5% to 6.5% would put Nebraska in a tie for the 9th highest state sales rate in the nation and a tie for the highest rate among our neighbors (Tax Foundation, 2024).

-

The proposal removes existing sales tax exemptions in a piecemeal fashion that deviates from principles of good taxation. The sales tax should be broadened in a comprehensive manner to apply to all final consumer purchases and those additional revenues directed to lowering the sales tax rate (Tax Foundation, 2017). Adding or subtracting one good or service at a time is akin to picking and choosing winners and losers.

-

The proposal would raise taxes on cigarettes and vaping devices. So-called “sin taxes” are typically increased to generate revenue for public health investments, not for tax cuts. Further, tax revenues on these types of products tend to decline with a tax increase, so “sin taxes” are not a sustainable revenue source (Pew, 2018).

Limits on local property taxes could prevent schools, cities and counties from providing the services their constituents want

-

In the wake of property tax caps in other states, local governments shifted to a reliance on revenue sources which disproportionately impact lower-income residents and Black, Indigenous and People of Color communities (CBPP, 2018).

-

If revenues decline – such as in a recession – caps can lead to what’s called a “ratchet down” effect. This effect can hurt local governments’ ability to rebound from a recession, as it holds revenues at artificially low levels even after the economy rebounds (Pew, 2021).

Additional state aid to schools does nothing to address needs of students or student achievement

-

Financing education through foundation aid per student does not recognize that educational costs vary across districts. Some students have greater needs that require greater investments, but they still have a right to a quality education.

-

If the state hopes to improve educational outcomes, state funding should be targeted to school districts with the highest need students, rather than used to reduce property taxes.

-

The most recent model of state aid components included in the tax package shows eight school districts shifting from equalized to unequalized, including large districts (Lincoln, Millard and Papillion-La Vista) and small rural districts (Shelton and Homer) (NDOE, 2024). Outside of growing enrollment, unequalized districts have to rely more on property taxes to fund future needs, although they’d only be able to grow them as set out under the various caps.

References

Center on Budget and Policy Priorities. (2018). “State Limits on Property Taxes Hamstring Local Services and Should Be Relaxed or Replaced.” Accessed at https://www.cbpp.org/sites/

Institute on Taxation and Economic Policy. (2024). “Nebraska: Who Pays?” Accessed at https://sfo2.

Nebraska Department of Education. (2024). “Model of State Aid.” Accessed at https://www.education.ne.gov/

Pew Charitable Trusts. (2018). “Are Sin Taxes Healthy for State Budgets? Taxes on vices are tempting but unreliable source of revenue.” Accessed at https://www.pewtrusts.org/en/

Pew Charitable Trusts. (2021). “Local Tax Limitations Can Hamper Fiscal Stability of Cities and Counties.” Accessed at https://www.pewtrusts.org/-/

Tax Foundation. (2017). “Sales Tax Base Broadening: Right-Sizing a State Sales Tax.” Accessed at https://taxfoundation.org/

Tax Foundation. (2024). “State and Local Sales Tax Rates, 2024.” Accessed at https://taxfoundation.org/