Analysis shows large chunk of income-tax cut would leave Nebraska

Download a printable PDF of this analysis.

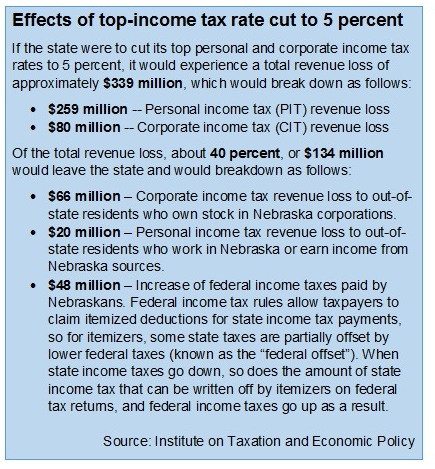

Ahead of Tuesday’s Tax Modernization Committee meeting on the state’s corporate and personal individual income taxes, OpenSky commissioned the Institute on Taxation and Economic Policy (ITEP) to forecast a hypothetical scenario in which the state cuts its top income tax rate to 5 percent. The ITEP analysis showed about 40 percent of such a tax cut would leave the state.

Presently Nebraska’s top personal income tax rate is 6.84 percent and the top corporate income tax rate is 7.81 percent, which rank 25th and 33rd in terms of state income tax rates.

ITEP reported that under such a top-rate cut, the state would lose a total of $339 million in revenue — about $134 million of which would go to the federal government and non-Nebraska residents who are stockholders in Nebraska companies or who earn income from Nebraska sources but don’t live here.

According to the analysis, such a tax-cut plan would cause Nebraska to lose:

- $48 million in revenue to the federal government. Nebraskans can write off our state income taxes in their federal tax returns. Under the tax-rate cut, we would have less to write off, which means the federal government would get money that would otherwise stay here.

- $86 million in personal and corporate income tax revenue to out-of-state shareholders in Nebraska companies and to non-Nebraskans who earn income from Nebraska sources.

This is valuable revenue the state could otherwise use for key investments like education and health care.

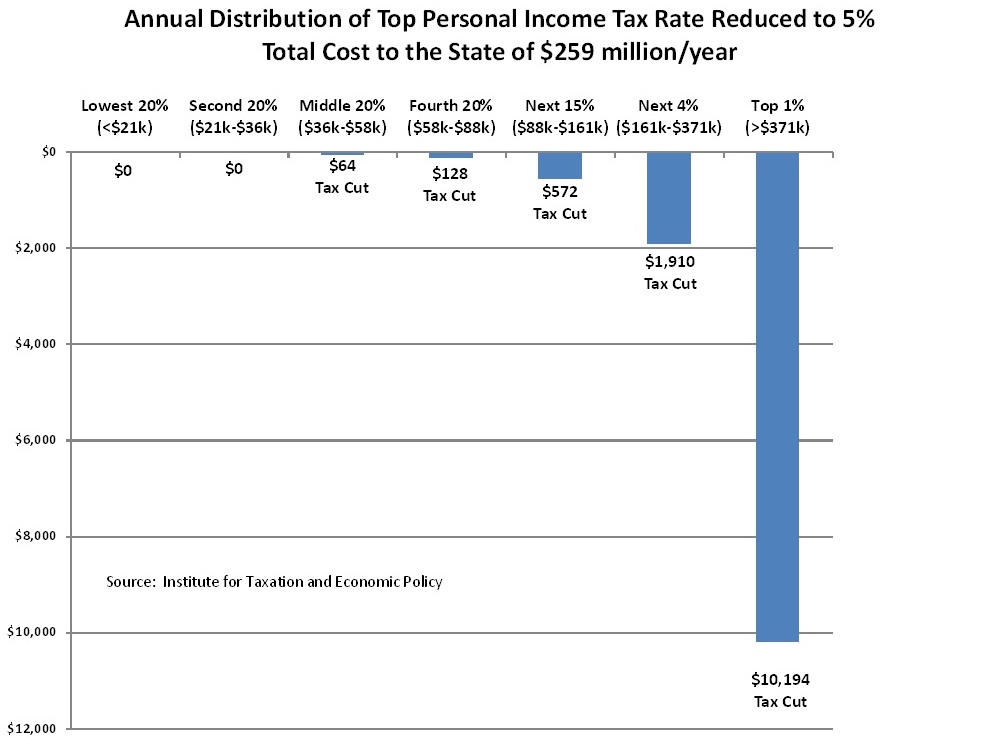

The analysis also showed that under such a plan, middle-class Nebraskans who earn between $36,000 and $58,000 annually would receive a tax cut of $64 a year – or less than $6 a month.

And that savings could be negated completely if the state decided to offset the lost income-tax revenue with increased sales and property taxes, which put more pressure on middle- and lower-income earners. In fact, a tax shift of this nature would likely lead to a tax increase for most Nebraskans. The top 1 percent of Nebraska earners, meanwhile, would experience more than $10,000 in annual tax savings.

Income tax cuts are usually proposed in the name of economic development but the hypothetical plan examined in this analysis would threaten our state’s ability to invest in education, health care and infrastructure, which are key components of our strong economy.

Methodology note: The model used for this analysis is based on a very large stratified sample of tax returns, combined with data from other sources, to estimate the impacts of policy changes on state revenues and people at different income levels. For the personal income tax, the structure of the Nebraska tax code (the rates, brackets, exemptions, credits, deductions, etc.) is combined with information from actual tax returns and other demographic data to determine the effective tax rates for each income group. For the corporate income tax, the structure of the tax code is combined with information about Nebraska businesses – such as who and where the owners and shareholders are, where they sell their products, and to whom – to determine the final incidence of those taxes.