State tax revenue:

- Individual income tax – $1.8 billion

- Sales and use tax – $1.6 billion

- Gas and fuel taxes – $322 million

- Corporate income tax – $235 million

- Other state taxes[1] – $214 million

Major local tax revenue:

- Property tax – $3.2 billion

- Local option sales tax – $340 million

- Inheritance tax – $43 million

National ranking, state/local taxes: 22nd as share of personal income

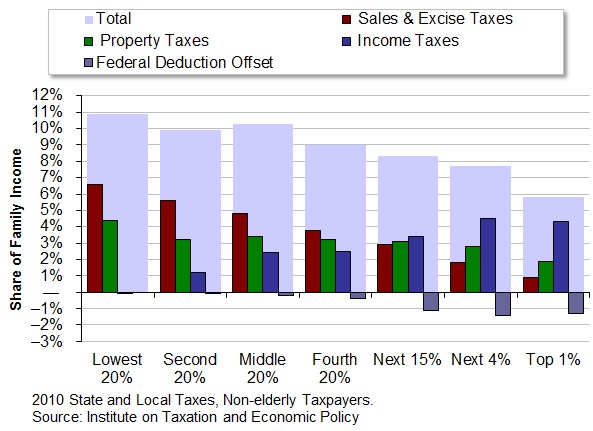

Nebraska’s tax system is regressive

Sales tax

Rate: 5.5% with up to 2% additional local option[1]

National ranking: 28th as share of personal income

What’s taxed: Goods, some services

What’s not: Many services, food

More about the sales tax:

- $4.1 billion in exemptions reported in 2012. Many are business inputs.

- Quarter-cent sales roads diversion started July 1

- $98 million lost yearly in untaxed Internet/catalog sales[2]

- State taxes 77 out of 168 services taxed elsewhere. [3] Loss of $450 million-$500 million in potential revenue[4]

Personal income tax (PIT)

Rates (for married couples filing jointly, beginning 2014):

- 2.46% up to $5,999 income

- 3.51% from $6,000 to $35,999

- 5.01% from $36,000 to $57,999

- 6.84% for income more than $58,000

National ranking: 25th as share of personal income

More about the individual income tax:

- 59% of Social Security benefits exempt[5]

- Standard Deduction – $11,900 for married couple in 2012

- Personal Exemption Credit – $123 per exemption in 2012

- Earned Income Tax Credit (EITC) – 10% of federal EITC

- Itemized deductions for items like mortgage interest and medical expenses

- Special deductions for items like college savings plans, special capital gains

Corporate income tax (CIT)

Rate: 5.58% on first $100,000 of taxable profit, 7.81% on amounts above $100,000

National ranking: 33rd as share of personal income

Who pays: Mostly large, publicly-traded companies

Who doesn’t: S-Corps, partnerships, LLCs. Such businesses pay through the personal income tax

Business incentives: Nebraska Advantage Act, other programs reduce CIT/other taxes for qualifying companies

Property tax

Rate: Varies by locality. Raises more money than any state tax.

National ranking: 17th as share of personal income

Levies:

- Total levy limits – $2.06-$2.19 per $100 of property value

- $1.05 limit for school districts

- 50-cent limit for counties and subdivisions, municipalities

- Other limits for smaller governments like natural resources districts and community colleges

- Levies can be overridden by local voters

Gas tax

Rate: 26.3 cents per gallon for second half of 2013

National ranking: 24th

Inheritance tax

Rates:

- Spouses — exempt

- Close relatives and siblings – first $40,000 exempt, 1% on remainder

- Remote relatives – first $15,000 exempt, 13% on remainder

- Non-relatives – first $10,000 exempt, 18% on remainder

Nationally: Five other states have inheritance taxes. 13 have estate taxes — Nebraska does not

County impact: Ranges from less than 1% to more than 20% of county budgets

[1] Includes excise taxes on alcohol, tobacco, and keno, business and franchise taxes, and insurance premium tax.

[2] National Conference of State Legislatures, Collecting E-Commerce Taxes: An Interactive Map. Based on state and local sales tax collections in 2012, the state’s share is approximately 83 percent, or $98 million of the $118 million total estimated by NCSL.

[3] Federation of Tax Administrators, Sales Taxation of Services, 2007 Survey

[4] Bill Lock, Memo Re: LR161, LR166, & LR 97 (Committee on Revenue: December 2009). Estimates have varied. The 2002 Tax Expenditure Report estimated $791 million, but this included many services, such as medical services, that are not considered feasibly taxable. Another estimate that looked only at a list of 30 services commonly taxed in Nebraska’s border states estimated that expanding the sales tax to those services would generate $60 million per year. Estimates focusing on all feasibly taxable services have come in between $450 million and $500 million.

[5] This percentage is a statewide total. Amount exempted varies from 15% to 100% based on a family’s income. A federal calculation is used to determine the amount of Social Security benefits included/excluded in Adjusted Gross Income. NE Department of Revenue Statistics of Income. Table B4: Individual Income Tax Data by Size of Adjusted Gross Income, all returns, tax year 2011.