Policy Brief: LB 357 would lead to budget cuts, benefits top earners

In spite of its gradual implementation, LB 357 would leave future lawmakers with a budget crisis as they inherit a depleted cash reserve and the need to make continuous cuts to vital services like schools and health care.

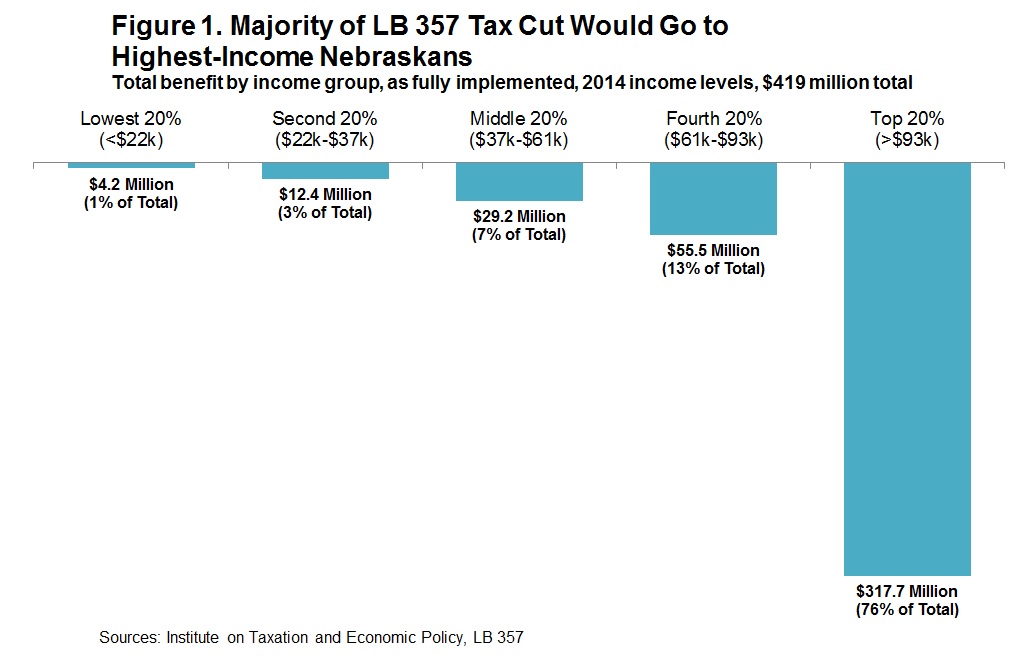

The bill also will largely benefit the highest income Nebraskans (Figure 1) and send about a third of its income tax cuts out of state.Furthermore, property tax increases likely will be needed over time to offset the loss of state support.

LB 357 calls for significant reductions in personal and corporate income tax rates over several years.

It also transfers $160 million out of the cash reserve, $80 million to the Property Tax Credit Program and another $80 million to the General Fund to fill in for the loss of income tax revenue in the first two years.

High-income Nebraskans benefit most

About 76 percent of the income tax cuts in LB 357 would go to the highest-earning 20 percent of Nebraskans with annual incomes greater than $93,000, according to analysis by the Institute on Taxation and Economic Policy. Under LB 357, a top-earning Nebraskan would receive about $12,218 a year; a middle-income earner would receive about $153 annually; and the lowest-earning taxpayer would receive about $22 per year.

Revenue loss would be drastic, cash reserve transfers leave us vulnerable

When fully implemented, ITEP estimates the total annual cost of LB 357 to be $419 million,[1] which is equivalent to the salaries of more than 8,500 teachers or almost half of the appropriation for the state K-12 education funding formula for Fiscal Year 2014-2015 (FY14-15).[2]

LB 357 also transfers $160 million out of the state’s cash reserve, which is meant to help the state in economic downturns. The reserve is projected to reach $769 million at the end of FY 16-17 – which is right at the minimum recommended level of 16.7 percent of the General Fund.[3] LB 357’s transfers would reduce the cash reserve to 13.2 percent.

Property Tax Credit increase unsustainable

By draining the cash reserve and eroding income tax revenue, the $40 million annual increase in the Property Tax Credit in LB 357 is almost certain to be temporary and Nebraska property taxpayers will likely see a tax increase in the third year of the bill’s implementation.

Much of the benefit would leave the state

About 31 percent of the total income tax cuts would leave the state with more than 80 percent of the corporate income tax cuts going to non-residents who own stock in multi-state companies that do business in Nebraska. [4]

LB 357 proposed on shaky premises

LB 357 has been proposed in the name of economic growth, but academic research fails to find a conclusive link between income tax cuts and economic growth.[5] For its part, Nebraska economically outperforms most states with lower or no income taxes.[6] Improving Nebraska’s tax ranking has been mentioned as another reason for LB 357, but Nebraska is not a high-tax or high-spending state by any standard measure, ranking 20th to 26th in the nation, and 3rd to 4th in the seven-state region, in state and local taxes. In terms of spending, Nebraska ranks 25th to 34th in the nation and 3rd to 5th in the region.[7]

Conclusion

LB 357 poses serious budgetary risks with little guarantee of economic reward. The measure, however, would almost certainly lead to major cuts to schools, health care and other key services, which may in turn put additional pressure on local property taxes, as schools and other local entities attempt to fill the budget hole left by LB 357.

Download a printable PDF of this analysis.

_____________

[1] This total differs from the LB 357 fiscal note because the ITEP analysis estimated the effects of the bill as fully implemented, while the fiscal note shows only the first nine years.

[2] State spending data from NE Legislative Fiscal Office. Teacher salary data from National Center for Education Statistics Digest of Education Statistics, Table 211.60.

[3] Government Finance Officers Association, “Determining the Appropriate Level of Unrestricted Fund Balance in the General Fund” (October 2009), http://www.gfoa.org/determining-appropriate-level-unrestricted-fund-balance-general-fund.

[4] Regarding individual income taxes, under LB 357 non-Nebraskans with income from Nebraska sources would get a share of the tax cut and Nebraska residents would have less to write off on federal tax returns, which means the federal government would get money that would otherwise stay in the state.

[5] Dr. McGuire: Research shows no conclusive link between taxes, economic growth,” (January 2014) https://www.openskypolicy.org/dr-mcguire-research-shows-no-conclusive-link-between-taxes-economic-growth

[6] Personal income tax cuts don’t spur economic growth, https://www.openskypolicy.org/personal-income-taxes-dont-affect-economic-growth

[7] US Census Bureau and US Bureau of Economic Analysis data, FY 11-12. The ranges cited in this analysis depend on whether taxes and spending are measured as a share of personal income or per capita.