LB 974, a bill that would significantly change school funding in Nebraska and is the focus of a Revenue Committee hearing today, raises concerns about fiscal sustainability and equity in educational opportunities.

The bill[1] seeks to lower property taxes by reducing the taxable value of all property types for school districts, limiting school spending and increasing state aid. It would, however, be funded by projected revenue surpluses rather than new dedicated revenue streams and would make fundamental changes to the state’s school funding formula that could hinder our ability to provide equitable educational opportunities for all Nebraska students. (EDITOR’S NOTE: See a full list of LB 974’s proposed policy changes at the bottom of this analysis.)

Banking on projected revenues is unsound fiscal policy

Increasing state aid to K-12 education has long been considered the best way to lower property taxes in Nebraska, including being the top recommendation of the 2013 Tax Modernization Committee.[2] LB 974, however, would fund such increases with surplus revenues the state is projected to receive in the next couple years. It’s important to remember that the projected revenue increases are just that — projections — and are often considerably higher or lower than actual revenues.[3] Read more in our recent policy brief about revenue projections.

Counting on one-time revenues also risky

The recent bump in state revenues may be inflated by one-time factors, such as increases in corporate income tax receipts due to companies claiming offshore earnings in response to a 2017 change in federal tax law.[4] Similarly, an influx of market facilitation payments — federal dollars paid to farmers for losses sustained from tariffs — may also be playing a role in the surplus revenue. These payments have totaled nearly $720 million in Nebraska[5] and are subject to income tax. Enacting on-going fiscal policy based on one-time revenues and increased projections is dangerous because it leaves the state with no other option but to cut services or increase other taxes and fees when revenues come in below projections in the future.

LB 974 per-student funding component would turn K-12 aid formula on its head

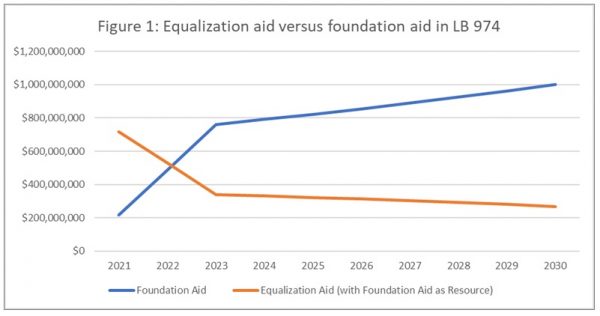

A major piece of LB 974 would change the state school aid formula to provide school districts with per-student funding — also known as foundation aid. To account for the difference in needs and resources among Nebraska school districts, the state currently utilizes an equalization-based formula to fund K-12 education. Districts that receive equalization aid have educational needs that exceed what they are able to raise in local resources — namely, property tax revenue. Equalization aid helps ensure all districts have equitable educational opportunities, regardless of their local resources, and foundation aid does not consider the diverse needs of individual districts. Pulling back from the equalization-based formula and shifting to more foundation aid threatens districts with high amounts of poverty and English language learners. And as LB 974 is structured, foundation aid could rapidly outpace equalization aid growth. LB 974’s foundation aid component is funded by a share of the state’s net income, corporate, and sales and use tax collections, gradually increasing to equal 15% in the third year and beyond.

The chart above compares the projected growth of LB 974’s foundation aid component with projected growth in equalization aid starting in 2021. The chart assumes foundation aid would grow at 4%, which is about the average growth in state sales and income tax revenue in Nebraska over the past decade (2010-2019). It also assumes equalization aid would continue to increase at the 1.64% rate of growth it averaged over the same time period. But because foundation aid is considered a school funding formula resource under the bill, it would reduce equalization aid. While the bill does not indicate at what level equalization would be reduced, for this chart, we assume equalization aid is reduced by 75% of foundation aid. Under these conditions, foundation aid would replace equalization aid as the biggest component of state school aid in the second year of implementation and continuously become a larger share of school aid over time. The actual rate at which equalization aid is reduced may end up higher or lower than 75%, but that wouldn’t change the fact that foundation aid will overtake equalization aid, it only changes the timing. If the rate is lower than 75%, the shift will come later; if the rate is higher than 75%, it will come sooner. This would be particularly detrimental to Nebraska’s largest school districts, which rely heavily on equalization aid, educate the majority of Nebraska’s students and have the greatest educational needs.

Valuing land different for tax purposes adds unpredictability to school funding, creates revenue losses for many schools

LB 974 would reduce the taxable value of real property and shift funding from a stable revenue source, property taxes, to an unpredictable revenue source, state aid. The state has changed the school funding formula regularly, often resulting in less state aid to schools and making state aid unpredictable over time.[6] Also, OpenSky analysis shows that many districts will lose more revenue under the measure than they would be able to recoup from the increased state support because of the decrease in their assessed valuation.

Linking school spending growth to CPI would exacerbate budget uncertainty for schools, ignores spending realities

The proposal also would limit district spending and maximum levies to the Consumer Price Index (CPI), so long as it does not exceed 2.5%. The CPI — a measure of the national average change in the price paid by urban consumers for common household purchases — is a poor metric on which to base school spending because it does not reflect the factors that drive school spending. The bulk of school spending is on salaries — 55% for Nebraska schools in FY 2017-18[7] — but CPI does not factor in income growth. As a result, chaining school spending to CPI would omit a large cost driver in school budgets. Also, limiting school spending to between 0 and 2.5%, would likely squeeze school budgets over time. Public school spending in Nebraska averaged 3.5% growth from FY 2007-17 and CPI during that same timeframe only grew an average of 1.6%.[8] Read more about CPI in our recent policy brief on school spending.

Revenue recoup measures not guaranteed to hold school districts harmless

Transitional aid and the ability to override levies would be available under LB 974 but neither guarantees schools will be held harmless. Transitional aid would only be available for three years and it would not be guaranteed for any school at any amount. Also, the transitional aid:

- Would only replace lost spending ability relative to the prior year and not allow for the growing needs of a district;

- Would only be available to districts with a $1.05 levy and would decline to 75% in year two and 50% in year three; and

- Would require an appropriation, and should the Legislature not appropriate the full amount of transitional aid, it would be prorated among affected schools. As a result, school districts are not guaranteed to be held harmless by LB 947.

The bill’s levy override provision would only allow school districts to recoup 75% of any decrease in certified state aid when compared to the January estimate. Districts would need a 2/3rd vote of their school boards to enact an override.

Schools already subject to tax and spending lids

Nebraska school districts already are subject to limits on how much they can tax and spend and they are governed by elected boards that work hard to keep property taxes as low as possible while still meeting the needs of their students. In recent years, state school aid has been constrained as a share of the economy and this has contributed to increased reliance on property taxes to fund K-12 education. The additional constraints on taxes and spending will likely force schools to make damaging cuts to the services they provide to Nebraska’s students.

Conclusion

It is important that Nebraska address its longstanding struggle with high reliance on property taxes to fund K-12 education, which has been particularly difficult on agricultural landowners. LB 974, however, is likely an unsustainable measure that puts the onus of providing property tax relief on the backs of Nebraska’s public school children, particularly those in school districts with the highest educational needs. Fortunately, there are better options in front of lawmakers in terms of reducing our need to rely on property taxes to fund our state’s vital investment in K-12 education.

______________________________________________________________________________________________

What LB 974 does

LB 974 makes multiple changes to Nebraska’s school finance system, using projected revenue surplus as funding source, to provide property tax relief. LB 974 is estimated to cost more than $535 million over the next three years, exceeding the $405 million projected surplus. The measure would:

- Lower taxable value of agricultural land both in and out of the school funding formula by 20% over two years for purposes of school property taxes;

- Lower taxable value of residential/commercial property both in and out of the school; funding formula by 15% over three years for purposes of school property taxes;

- Provide foundation aid equal to up to 15% of state net sales and income tax revenue;

- 5% in year one; 10% in year two; 15% in year three and beyond;

- Allocates aid on a per-student basis with each school receiving at least 15% of its basic funding;

- Limit school spending growth to the Consumer Price Index (CPI) — so long as CPI is between zero and 2.5% — starting in year one and modifies maximum levy in year four;

- Starting in FY24, it would change the maximum levy to the lesser of $1.06 or the local formula contribution (valuation growth multiplied by the CPI, so long as the CPI is between zero and 2.5%);

- Eliminate the averaging adjustment and allocated income tax;

- Change the calculation of and reduces net option funding;

- Reduce the building fund from 14 to 6 cents; and

- Allow schools to make up 75% of any decrease in certified state aid, as compared to the January estimate, with a vote of at least ⅔ of the school board.

Also under LB 974:

- Schools with unused budget authority — those that haven’t increased their general fund expenditures in line with their ability to do so — would lose any accumulated authority prior to school FY21, restricting school districts with levy authority from spending increased state aid; and

- Districts may receive three years of decreasing transitional aid for schools with levies at $1.05 that lose more than 1% of their budget of disbursements year over year during those three years.

_______________________________________________________________________________________

[1] Nebraska Legislature, “LB 974,” accessed at https://www.nebraskalegislature.gov/bills/view_bill.php?DocumentID=41351 on Jan. 17, 2020.

[2] Nebraska Legislature, “Report to the Legislature: LR155 – Nebraska’s Tax Modernization Committee (2013)” accessed at https://nebraskalegislature.gov/pdf/reports/committee/select_special/taxmod/lr155_taxmod2013.pdf on Nov. 6, 2019.

[3] OpenSky Policy Institute, “Policy brief — Beware of banking on revenue projections,” accessed at https://www.openskypolicy.org/policy-brief-beware-of-banking-on-revenue-projections on Jan. 17, 2020.

[4] Tax Policy Center, “What is the TCJA repatriation tax and how does it work?” accessed at https://www.taxpolicycenter.org/briefing-book/what-tcja-repatriation-tax-and-how-does-it-work on Jan. 20, 2020.

[5] U.S. Department of Agriculture, “Market Facilitation Program Data,” accessed at https://www.farmers.gov/sites/default/files/documents/MFP%20Data%20-%2001062020.pdf on Jan. 17, 2020.

[6] OpenSky Policy Institute, “Investing in Our Future: An Overview of Nebraska’s Education Funding System (P. 7-8),” updated September 2018, accessed at https://www.openskypolicy.org/wp-content/uploads/2018/12/OSPI007-03-2018-EDUCATION-PRIMER-UPDATE_singles-1.pdf on Jan. 21, 2020.

[7] OpenSky Policy Institute, “Policy brief — A look at school spending in Nebraska,” accessed at https://mailchi.mp/openskypolicy.org/policy-brief-a-look-at-school-spending-in-nebraska?e=5ec57c7887 on Jan. 17, 2020.

[8] Federal Reserve Bank of Minneapolis, “Consumer Price Index, 1913-,” accessed at https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1913- on Jan. 17, 2020.