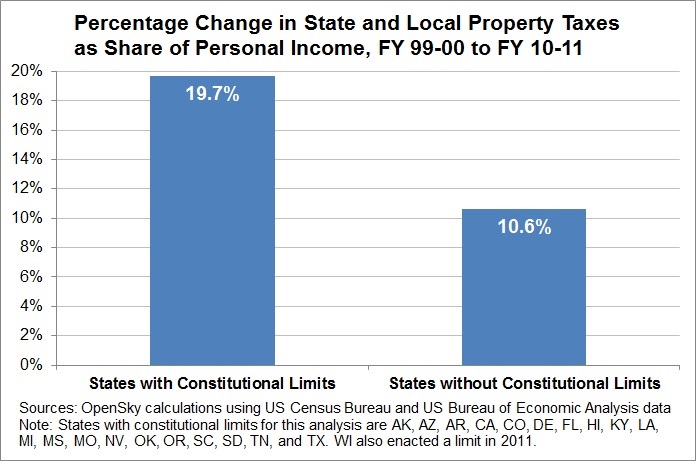

Property taxes have grown faster in states with tax and spending limits

As a follow up to our recent report that found spending growth caps in Nebraska would likely lead to higher property taxes and cuts to education, new analysis shows that states with constitutional limits on taxes and spending have seen property taxes increase significantly faster than states without such limits.

Twenty-one states currently have constitutional limits on taxes and spending, either through strict limits on spending growth, supermajority requirements for tax increases, or a combination of these limits.

Since FY 99-00, property taxes in the states with constitutional limits rose 19.7 percent as a share of their economies. States without such limits saw property taxes climb 10.6 percent.

You can learn more about limits on spending and taxes as well as the effect of state taxes on state economies at our Jan. 8 presentation featuring Northwestern University Professor Therese McGuire.

Dr. McGuire – who will present at 1:30 p.m. in the State Capitol, Room 1023 — has done extensive research into the relationship between state taxes and state economies, spending caps and education finance.

RSVP online or call 402-438-0382 to reserve your seat.