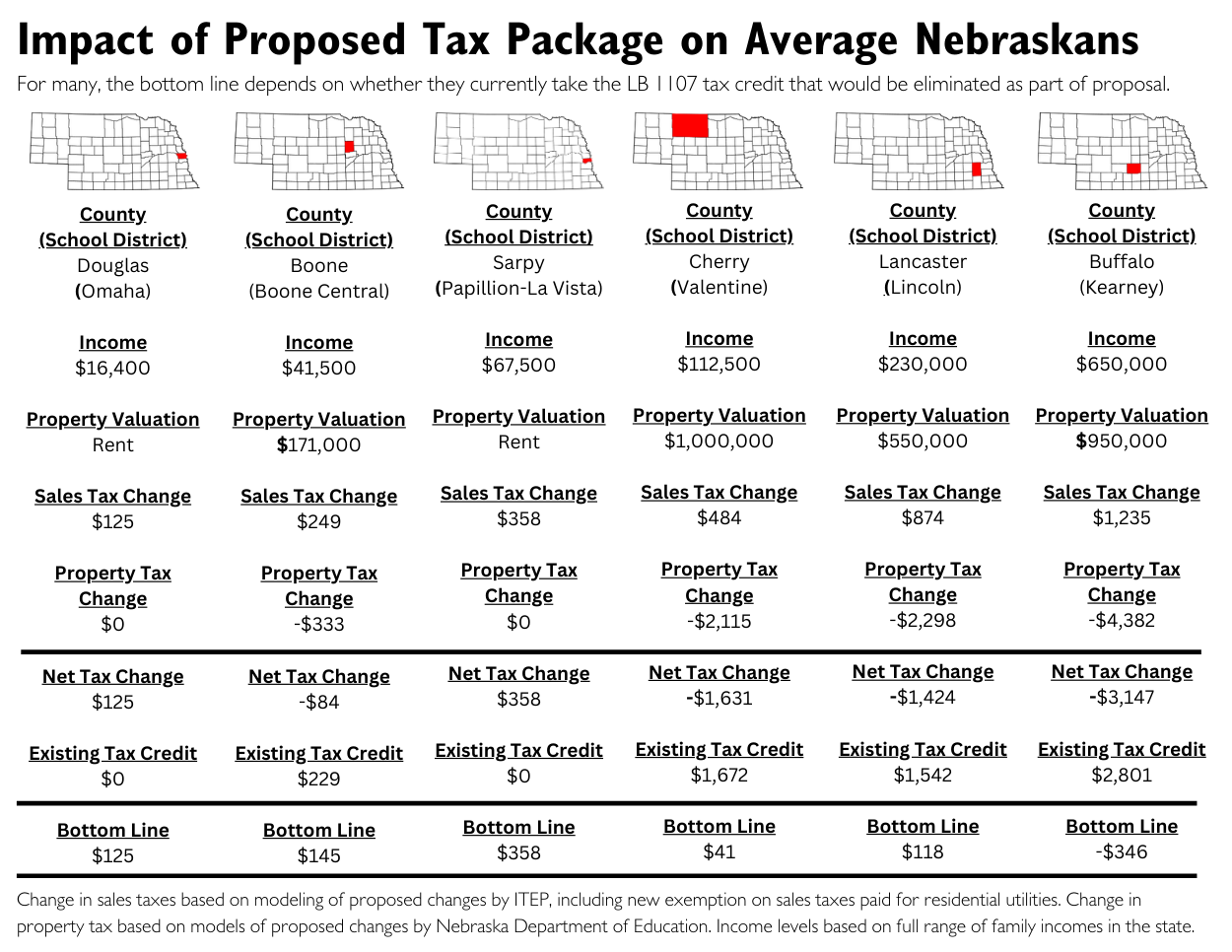

The proposal to lower property taxes paid to fund local government services will reduce property taxes paid by property owners, but it’s important to understand how the package that raises the state sales tax rate impacts all consumers and the effect of plans to “front load” the existing tax credit for taxes paid to public schools.

OpenSky modeled the proposed changes to show how average Nebraskans, including renters, would be impacted by an amendment to LB 388, filed Tuesday, that would raise an estimated $650 million through Nebraskans paying more in sales taxes and directing the increase to reduce what property owners pay to fund local services.

For the average Nebraskans in each example, the change in sales taxes is based on modeling by the Institute on Taxation and Economic Policy, including a new exemption on sales taxes paid for residential utilities. The change in property tax is based on models by the Nebraska Department of Education. Income levels for the different scenarios are based on the full range of family incomes in the state and distributed across Nebraska’s diverse geography of counties and schools.

For most property owners, the change in property taxes and sales taxes results in a tax savings. But the bottom-line impact of that tax savings depends on whether a taxpayer currently claims the state income tax credit on property taxes paid to public schools. The tax package, as reported, would end the state income tax credit, and as shown in OpenSky modeling of average taxpayers, the bottom line for some is a net increase.

The Institute on Taxation and Economic Policy modeled the proposed tax shift and, on average, the 5% of Nebraskans with incomes over $252,600 will pay less, while 8 in 10 Nebraskans will pay more in taxes overall.

Currently, some property taxpayers eligible to claim what’s known as the LB 1107 credit do not claim the deduction when they file their state income taxes. Reportedly, the tax package includes plans to “front load” the tax credit. Under the plan, funding that the state currently distributes through the income tax credit would instead be directed to public schools as state aid to reduce local property tax levies. The additional state funding is reflected in the modeling shared by the Department of Education.

Renters may see savings as a result of the reduction in property taxes, but any adjustments in rent may not be passed along right away and are likely subject to other market factors, including the demand for rental housing in a certain location.

The Legislature opened debate on LB 388 on Wednesday afternoon.