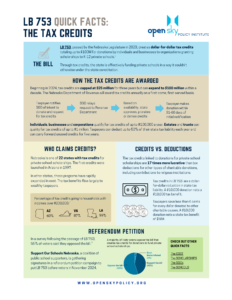

After repeated attempts to pass school privatization measures had failed, Nebraska lawmakers in 2023 approved LB 753, which creates dollar-for-dollar tax credits totaling up to $100 million for donations to organizations granting private school scholarships.

Today’s post explores the tax credits.

Tax benefits more lucrative than tax deductions

Beginning in 2024, taxpayers can annually divert a portion of what they owe in state taxes to SGOs, which in turn will award scholarships to eligible students attending a private school. Nebraska’s constitution forbids sending public dollars to non-state schools, but LB 753 is a workaround similar to programs implemented in other states. As a tax credit, it gives more beneficial tax treatment to private school scholarship donations compared to other charitable giving, such as contributions to cancer charities or religious groups.

Unlike charitable donations to other causes where taxpayers save less than 6 cents in state taxes for every dollar donated, the incentives in LB 753 give private school scholarship donors their full donation back.

If a couple with a state income tax liability of at least $20,000 make a $10,000 donation to an SGO, they would receive a state tax benefit of $10,000. On the other hand, if the same couple made a $10,000 donation to a nonprofit public or private school foundation and pays the state’s top personal income tax rate of 5.84% in 2024, their tax savings would be $584.

Offset of state tax liability

Under LB 753, individuals, businesses and corporations can earn tax credits of up to $100,000 each year. Estates and trusts, and by extension their beneficiaries, can qualify for tax credits of up to $1 million in a single year.

The tax credits are a direct offset of what a taxpayer owes the state of up to 50% of their tax liability. So anyone claiming the LB 753 tax credit can cut in half the amount that they owe the state before subtracting what they’ve paid throughout the year in withholdings. That’s money that otherwise would flow into the state’s bank account to spend on other things.

In a survey conducted this spring, likely voters were asked to prioritize several proposals for spending state tax dollars on K-12 education. Participants ranked expanding career training and vocational education programs and reducing the teacher shortage as their highest priorities. Conversely, providing tax credits for donations to help parents pay for students to attend private schools ranked lowest.

Credits are first come, first served

Under LB 753, the annual tax credits awarded by the state are capped at $25 million for three years but could grow by 25% annually beginning in 2027 until reaching $100 million in 2033.

Each year, the Nebraska Department of Revenue will determine who qualifies for the tax credits on a first-come, first-served basis. Prospective donors must first notify an SGO of their intent to donate and the amount they are seeking in tax credits, information that the SGO then relays to the state.

The Department of Revenue will approve the tax credits until reaching that year’s limit. When requests exceed the limit, tax credits will be prorated among those received on the date the limit is reached.

Based on what’s happened in other states, the tax credits could all be claimed on the first day they are available. That’s what happened this year in Nevada, when all of the available tax credits went to the one SGO that was first to submit donors’ intent. With donors to other SGOs unlikely to follow through with contributions not eligible for a tax credit, state officials said hundreds of students on taxpayer-funded scholarships last year will likely lose them. Nevada’s governor has asked state lawmakers to allocate more funding to the program.

Wealthy taxpayers benefit in other states

The very high caps on the maximum amount of credit that can be claimed per taxpayer and provisions in LB 753 that unused credits can be carried forward for five years are indicative of a program benefitting high-income families, which has been borne out in other states.

In Arizona, Louisiana and Virginia, states with taxpayer-funded private school scholarships where data from tax agencies is available, more than 60% of all voucher tax credits are flowing to families with annual incomes over $200,000.

Nebraska’s median household income is $66,644, and 80% of all households have incomes of less than $138,000.

Signature-gathering effort continues

Support Our Schools Nebraska, a coalition of public school supporters, is gathering signatures in a referendum petition campaign to put LB 753 before voters in November 2024.

More updates on LB 753 to come at openskypolicy.org.