April Tax Receipts Confirm Sluggish Economy

Revenue forecasts only part of the economic picture

An announcement by the Nebraska Department of Revenue that April tax receipts were 7.2 percent below the projection reinforces that Nebraska’s economy — like those of many states — is still sluggish and in a slow recovery from the Great Recession.

While tax receipts so far this year are still on pace to exceed earlier forecasts, the fact remains that both revenues and the broader economy have been underperforming compared to historic averages. And that trend is likely to continue.

Economic indicators show only modest growth

The nine-member Nebraska Economic Forecasting Advisory Board had projected a $99 million increase in revenue for the two-year budget period that ends June 30, 2015.

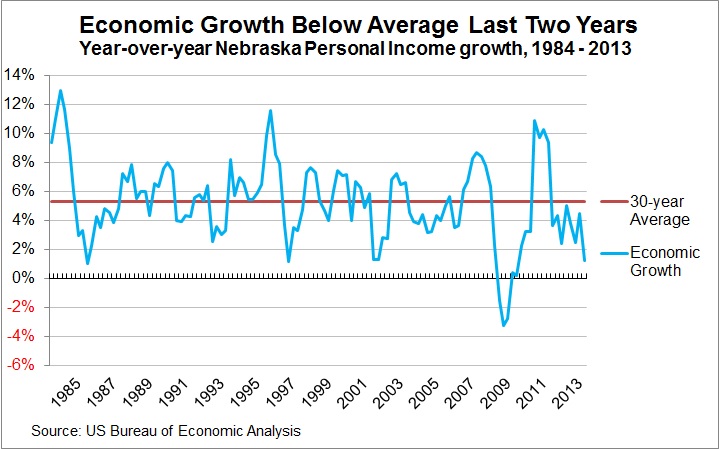

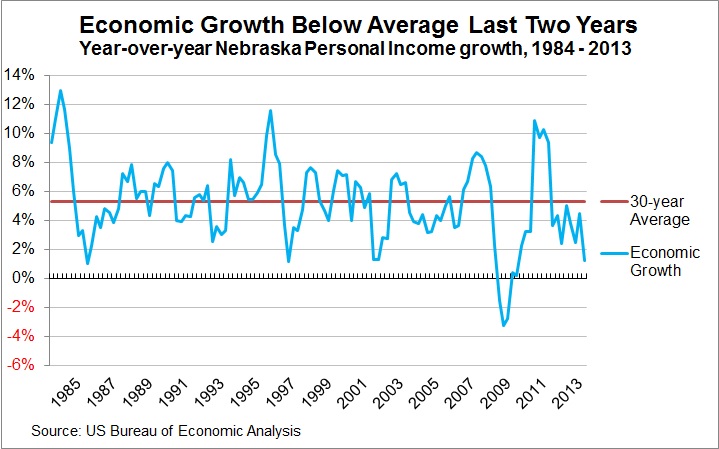

While that extra revenue was welcomed, a look beyond short-term revenue performance to broader measures of economic strength — such as personal income growth — shows that Nebraska’s economy has grown at below-average rates for two straight years (see figure at right).

Other measures of the economy tracked by the University of Nebraska-Lincoln’s Bureau of Business Research[1] and national groups[2] also indicate sluggish growth.

Revenue has come in better than expected, but not particularly strong

The official revenue forecast for Nebraska in FY 13-14 was conservative, projecting revenues to shrink 0.8 percent, before the data are adjusted for rate and base changes. When the forecast was revised in February, that figure changed to a positive 1.4 percent – but still well below the long-term average of 5.7 percent growth.[3]

If revenues continue on the same clip as the first ten months of FY13-14 (2.5 percent above the forecast), Nebraska will see an overall growth rate of 1.7 percent for the year — which again is still significantly below the 5.7 percent long-term average and even below the 2.9 percent average over the last five difficult years.

A recent article in Governing, a magazine that covers state and local government, noted: “Early figures released by the Rockefeller Institute of Government’s State Revenue Report show that tax revenue growth is slowing in 2014. And the nation’s economic growth stalled during the first quarter of the year, creeping along at a mere 0.1 percent growth.”[4]

A recent CNNMoney article said that states possibly face “difficult headwinds heading into fiscal 2015, and reasons for fiscal policymakers to resist feelings of austerity fatigue by either cutting taxes or counting on continually strengthening revenue. The prudent approach, as difficult as it may be, is to consider our current economic expansion to be at a mature stage and to be prepared for the next decline.”[5]

The Governing article also said: “the eight recessions that have occurred since 1961 happen, on average, once every 6.6 years. The U.S. economy has been growing — albeit slowly — since 2009…The 6.6-year reference is by no means a rule.… But trends indicate that budget planners should consider economic cycles in their forecasting.”[6]

Revenue forecasts and growth only part of the economic picture

Defining the strength of an economy based solely on revenue forecasts and short-term performance is unlikely to present an accurate picture of the actual strength of the economy or its ability to adjust to tax cuts and major spending initiatives. This becomes more apparent given the concerns being expressed by experts about possible rough economic seas ahead.

[1] UNL College of Business Administration Department of Economics, “Nebraska Monthly Economic Indicators: April 18, 2014”.

[2] Rockefeller Institute, “Special State Revenue Report,” No. 94, December 19, 2013; The National Conference of State Legislatures, “State Budget Update: Fall 2013,” reports that “although fiscal conditions have improved and revenue collections are meeting projections, the recovery has been painfully slow…Overall, state budgets appear to be stabilizing and settling into a period of modest growth;” and the National Association of State Budget Officers, “Fiscal Survey of the States: Fall 2013,” warned that “revenue growth rates are expected to slow in fiscal 2014, which may result in additional budget gaps later in the fiscal year.”

[3] OpenSky analysis of data from Legislative Fiscal Office Budget Reports. Long-term average is the 30-year average from FY 82-83 to FY 12-13.

[4] Governing, “Is Your State Prepared for the Next Economic Bust?” April 30, 2014.

[5] CNNMoney, “For some U.S. states, budget woes are on the horizon.” April 23, 2014.

[6] Governing, “Is Your State Prepared for the Next Economic Bust?” April 30, 2014.