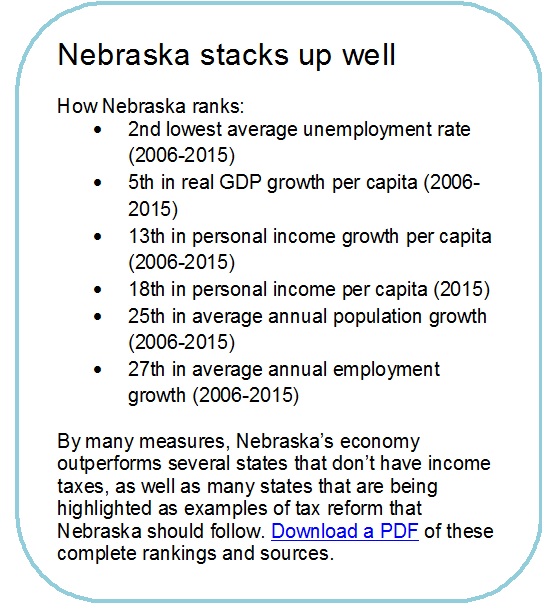

Nebraska’s economy has demonstrated stable growth over the last decade, outperforming most other states in Gross Domestic Product (GDP) growth per capita, personal income growth per capita, and unemployment. (See sidebar box.)

There is, however, room for improvement. Nebraska experiences a shortage of workers in many key areas, and wages are well below the national average.[1] Also, it is important to note that not every community in our state has experienced the strong economic growth that our state has experienced as a whole.

Important conversations have taken place recently around targeted, evidence-based strategies for economic growth and development in Nebraska. One such discussion took place at OpenSky’s Fall Policy Symposium on Sept. 1, during which Dr. Timothy Bartik, Senior Economist of the W.E. Upjohn Institute on Employment Research, discussed what we can do to grow Nebraska’s economy in a cost-effective and targeted way.[2]

Focus should be on increased per-capita income

The economic development goal for Nebraska should be to increase per-capita earnings, Dr. Bartik said. This economic development goal also is recommended in a report on Nebraska’s economy by the independent research firm, SRI International, which was presented at the Governor’s Summit on Economic Development in July.[3] Nebraska’s economy is strong, but moving forward the state’s economic focus should be on “growth that emphasizes high-quality jobs,” SRI noted.

Some point to the fact that we rank near the middle nationally in employment and population growth as a cause for enacting certain fiscal policies. Dr. Bartik, however, said too much emphasis is placed on overall job growth without consideration of the kinds of jobs we grow and increasing per capita earnings. Economic development is most impactful, Dr. Bartik said, if it leads to higher per-capita earnings for residents, preferably in a way that is broadly shared. Dr. Bartik also noted that population growth associated with new jobs comes with public costs, such as the need to accommodate more students in our public schools and new public infrastructure. This new spending would nearly offset the additional government revenue generated by growing our population, he said.

Nebraska’s best economic development plan – strengthen our workforce

In states like Nebraska where unemployment is low, the most effective economic development policies are those that increase the quantity and quality of the local labor pool, Dr. Bartik said. He suggests that Nebraska can get a strong return on investment (ROI) by developing our own workforce through the following evidence-based strategies:

- Increased investment in high quality early childhood education, which has a proven record of improving local labor markets by developing soft and hard skills needed in school and in the workforce. Dr. Bartik said the ROI for public dollars invested in early child education can be 6 to 1;

- Enacting mandatory summer school for elementary school students who are academically behind a grade level. He said the ROI for mandatory summer school can be 13 to 1;

- Creating career academies for high school students in fields that play to Nebraska’s strengths. He said the ROI for career academies can be 13 to 1; and

- Working with local small- and medium-sized export base businesses to design customized job training programs (frequently delivered by community colleges) and manufacturing extension services that meet the needs of such employers. Dr. Bartik said the ROI for such workforce training programs can be 6 to 1.

Business tax cuts not targeted enough

“Across-the-board” business tax cuts are too broad to be effective as an economic development tool, Bartik said, noting that the tax cuts are provided whether or not businesses want to make new business investments or create new jobs. Dr. Bartik noted that even if business tax cuts “are magically financed from outside the state,” they offer only a 51 cent return on each dollar invested. And if they must be financed by lower public spending, the short-run negative effects on demand for goods and services outweigh any short-run simulative effects of general business tax cuts, Dr. Bartik said. For example, he said, a local restaurant’s lower business taxes would be outweighed by lower sales when teachers and other public employees are laid off or take salary cuts and do not go out to eat as often. In the long-run, if lower public spending leads to lower quality infrastructure, or a lower quality labor force, these negative effects can outweigh any positive effects of lower business taxes, he said.

Personal income tax cuts not evidence-based economic development policy

U.S. labor market participation is not particularly sensitive to personal income tax cuts, and state income taxes don’t seem to have large aggregate effects on migration, Dr. Bartik said. As such, personal income tax cuts would not be a particularly cost-effective way to boost the quantity or quality of a state’s labor supply, he said. Dr. Bartik also said no research consensus exists regarding the effect of income tax cuts on per capita earnings in a state, that most of the studies on this topic are not strong methodologically, and that that research results vary widely. Furthermore, any full analysis of how income tax cuts affect economic development would have to consider the effects of how the tax cuts are financed. If they are financed by public service cuts for example, this might reduce a state’s attractiveness to firms, he said.

Targeted incentives can be effective

Similar to recommendations made by SRI at the Governor’s summit, Dr. Bartik suggested the state examine its business incentives and work to make sure they are strategically targeted. Presently, Dr. Bartik noted, Nebraska’s incentives are generous but not targeted. Dr. Bartik’s research shows well-designed, targeted incentives can offer a 3 to 1 return on dollars invested, which is significantly more bang for the buck than across-the-board rate cuts for business taxes and personal income taxes but less than some of the workforce development policies he discussed.

Summary

Nebraska has a lot going for it in terms of economic development, Dr. Bartik said, echoing sentiments expressed by SRI, which called our economy “a job machine.” Based on these findings and recommendations from outside experts (SRI & Bartik), a prudent economic development course for Nebraska would be to build upon our strong foundation and make targeted, evidence-based investments that focus on increasing skills and wages of our local workforce.

Our state should avoid less targeted policies, such as broad business or personal income tax cuts, which have created major fiscal problems in other states. Such polices would be particularly risky at this time, as Nebraska faces a projected budget shortfall of $114 million at the end of FY17 and of at least $353 million at the end of the next biennium, according to the Nebraska Legislative Fiscal Office.[4]

By making targeted investments in proven and cost-effective policies, our state’s leaders can help Nebraska create more of the high-skilled jobs that are needed to truly grow our state’s economy.

Download a printable PDF of this brief.

______________________________________________________________________________________

[1] SRI International, Nebraska’s Next Economy, downloaded from http://neded.org/files/govsummit/Nebraskas_Next_Economy_Analysis_and_Recommendations_web.pdf on Sept. 9, 2016.

[2] Dr. Timothy Bartik, What Works in Economic Development, downloaded from https://www.openskypolicy.org/wp-content/uploads/2016/09/BartikSlides.pdf on Sept. 12, 2016.

[3] SRI International, Nebraska’s Next Economy, downloaded from http://neded.org/files/govsummit/Nebraskas_Next_Economy_Analysis_and_Recommendations_web.pdf on Sept. 9, 2016.

[4] Nebraska Legislative Fiscal Office, General Fund Financial Status, Tax Rate Review Committee July 2016 downloaded from http://nebraskalegislature.gov/FloorDocs/Current/PDF/Budget/status.pdf on Sept. 13, 2016.